On December 31, 2024, LSV Asset Management executed a notable transaction involving El Pollo Loco Holdings Inc (NASDAQ: LOCO). The firm added 332,708 shares to its holdings, bringing its total position in the company to 1,599,200 shares. This strategic move highlights LSV Asset Management's continued interest in the fast-casual restaurant chain, reflecting confidence in the company's potential for growth and value creation.

About LSV Asset Management

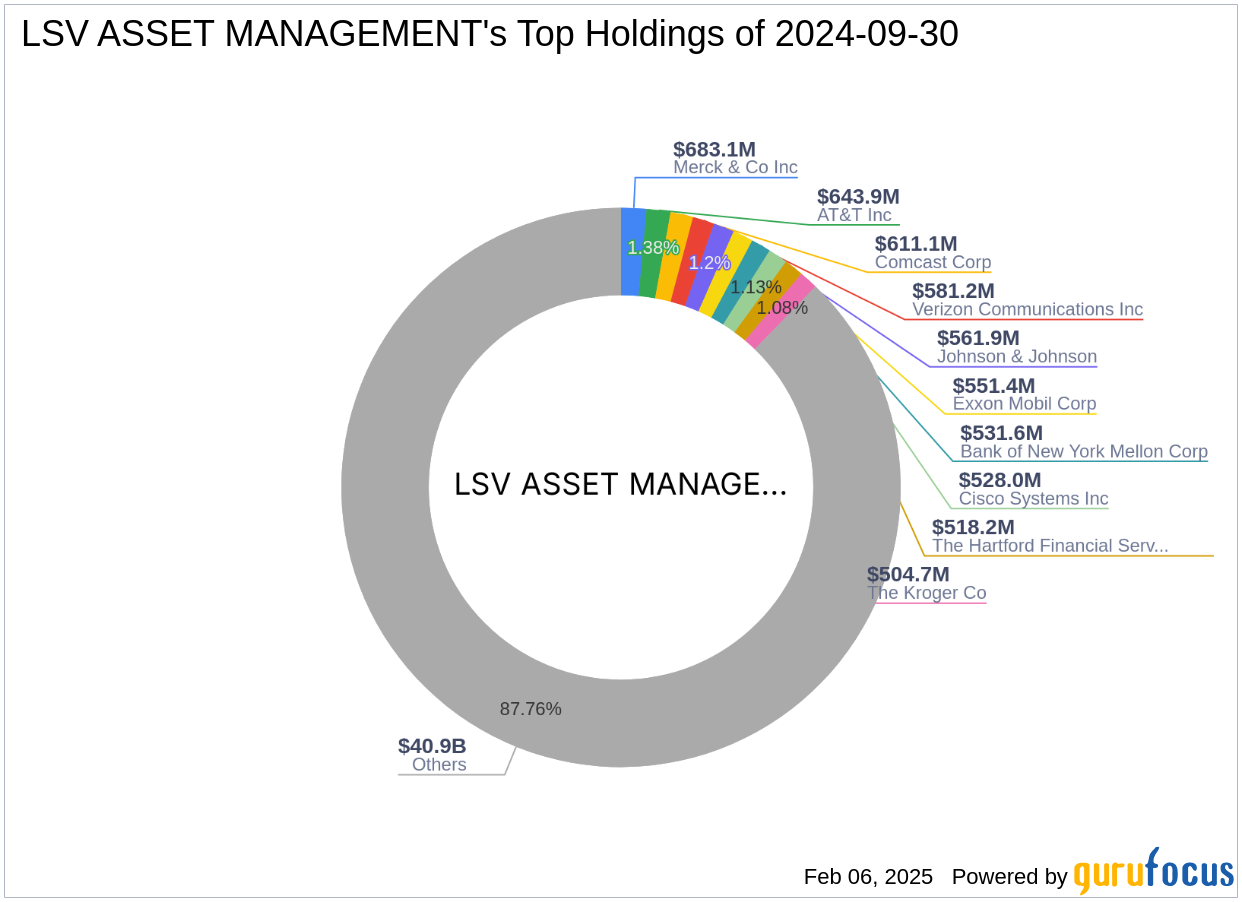

Founded in 1994, LSV Asset Management is a quantitative value manager that primarily serves institutional investors. The firm is renowned for its investment philosophy rooted in behavioral finance, which aims to exploit judgmental biases and behavioral weaknesses in the market. LSV Asset Management was established by Josef Lakonishok, Andrei Shleifer, and Robert Vishny, with Lakonishok still actively leading the company. The firm manages approximately $90 billion in value equity portfolios and is known for its deep value orientation and proprietary investment models.

Details of the Transaction

The shares of El Pollo Loco were acquired at a price of $11.54, with the transaction impacting 0.01% of LSV's portfolio. This addition represents a 26.27% increase in LSV's holdings of El Pollo Loco, now constituting 5.30% of the firm's total holdings in the stock. This significant increase in shares indicates LSV Asset Management's strategic positioning within the restaurant industry, particularly in a company that offers potential for value appreciation.

El Pollo Loco Holdings Inc: Company Overview

El Pollo Loco Holdings Inc operates and franchises fast-casual chicken restaurants across the United States, focusing on low-priced menu options. The company has a market capitalization of $367.056 million and is categorized under the restaurant industry. El Pollo Loco's business model includes company-operated restaurant revenue, franchise advertising fee revenue, and franchise revenue. The company manages its largest food cost, poultry, by using multiple suppliers and entering supply contracts of varying lengths.

Financial Metrics and Valuation

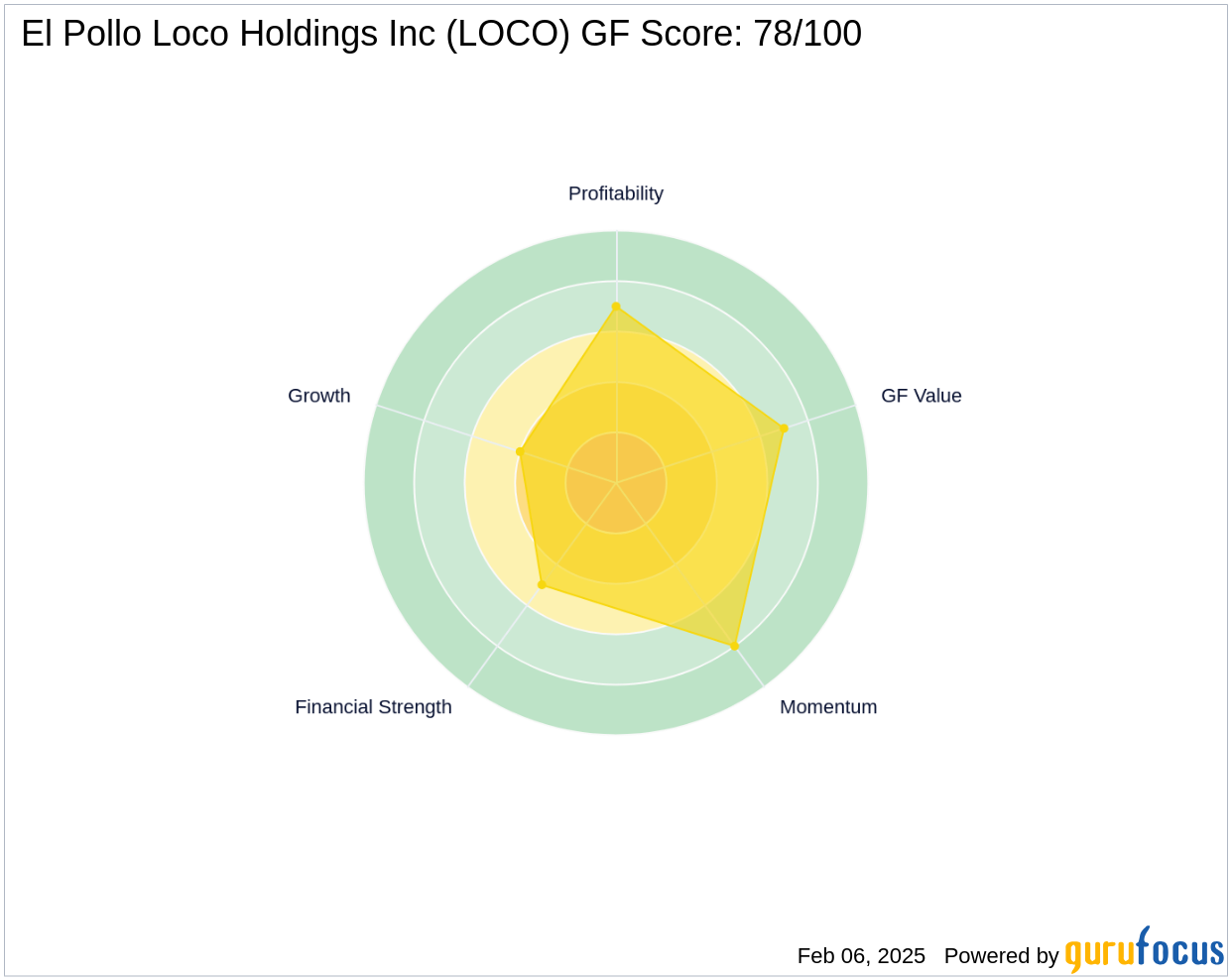

Currently, El Pollo Loco's stock is priced at $12.26, with a price-to-earnings ratio of 15.52, and is considered fairly valued according to GuruFocus. The company has a GF Score of 78/100, indicating likely average performance. The balance sheet ranks at 5/10, while the profitability rank is 7/10. These metrics suggest a stable financial position with moderate growth potential.

Market Performance and Growth

Since the transaction, El Pollo Loco's stock has gained 6.24%, with a year-to-date increase of 7.45%. The company has shown a 3-year revenue growth of 4.60%, although earnings growth has declined by 7.60%. These figures reflect a mixed performance, with revenue growth indicating potential, but challenges in earnings growth that may need to be addressed for sustained profitability.

Other Notable Investors

In addition to LSV Asset Management, other prominent investors in El Pollo Loco include First Eagle Investment (Trades, Portfolio) and Keeley-Teton Advisors, LLC (Trades, Portfolio). Hotchkis & Wiley Capital Management LLC holds the largest share percentage of the stock among gurus, indicating a shared interest in the company's potential within the investment community.

Transaction Analysis

This transaction by LSV Asset Management underscores the firm's strategic approach to identifying undervalued stocks with potential for near-term appreciation. By increasing its stake in El Pollo Loco, LSV Asset Management is positioning itself to benefit from any future growth in the company's market value. The transaction's impact on the firm's portfolio is minimal at 0.01%, yet it significantly boosts its holdings in El Pollo Loco, reflecting a calculated risk in pursuit of value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.