On December 31, 2024, BlackRock, Inc. (Trades, Portfolio) significantly increased its investment in Algonquin Power & Utilities Corp (AQN, Financial) by acquiring an additional 35,489,412 shares. This transaction brings BlackRock's total holdings in AQN to 39,975,062 shares. The shares were acquired at a trade price of $4.45, reflecting BlackRock's strategic interest in the utility sector. This move positions AQN as a notable component of BlackRock's portfolio, representing 5.20% of the firm's total holdings. The acquisition underscores BlackRock's confidence in AQN's potential within the renewable energy space.

BlackRock, Inc. (Trades, Portfolio): A Leading Investment Firm

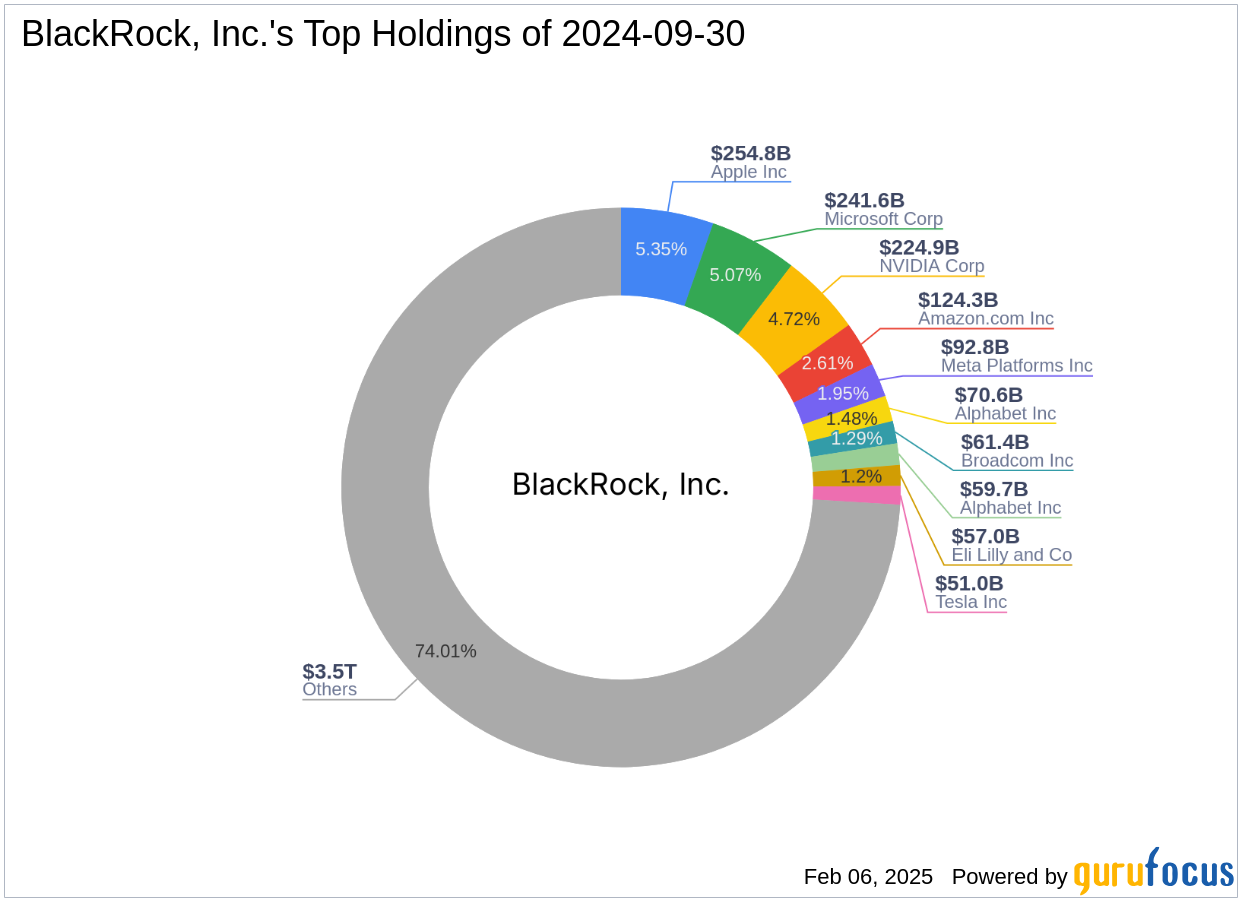

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, is one of the world's largest investment management firms. Known for its comprehensive investment philosophy, BlackRock focuses on long-term value creation and risk management. The firm's top holdings include major technology and financial services companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial). With a diverse portfolio and a strong presence in the technology sector, BlackRock continues to influence global financial markets. The firm's equity stands at an impressive $4,761.16 trillion, highlighting its substantial market influence.

Algonquin Power & Utilities Corp: A Diversified Utility Leader

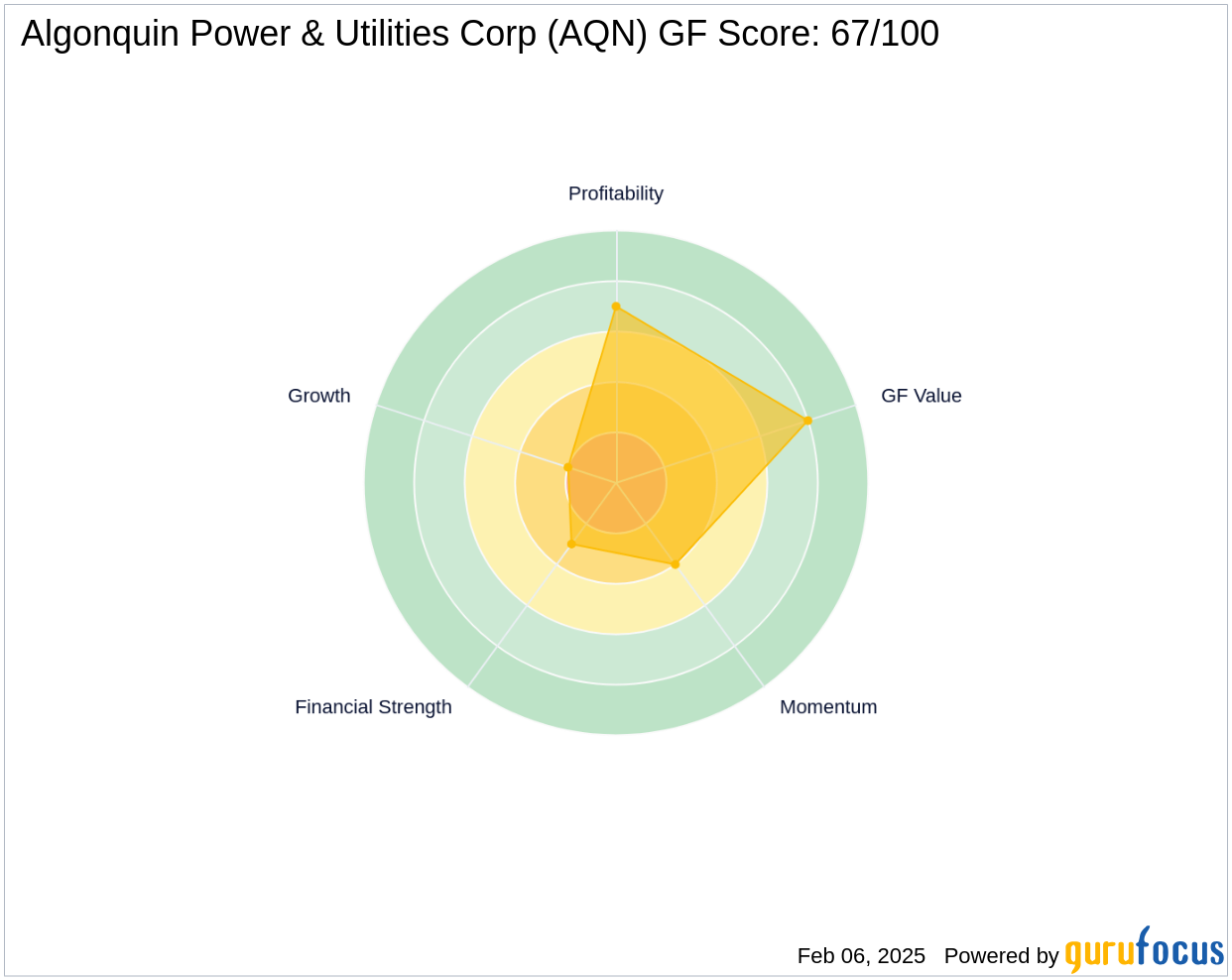

Algonquin Power & Utilities Corp is a diversified international utility company with a strong focus on renewable energy. The company operates through its Regulated Services Group and Renewable Energy Group, providing sustainable energy solutions to over one million customer connections in the United States and Canada. With a market capitalization of $3.44 billion and a current stock price of $4.50, AQN is positioned as a key player in the utilities sector. The company's GF Score of 67/100 indicates a moderate potential for future performance.

Impact of the Transaction on BlackRock's Portfolio

The acquisition of AQN shares at $4.45 per share reflects BlackRock's strategic decision to enhance its exposure to the utility sector. This transaction has increased AQN's representation in BlackRock's portfolio to 5.20%, indicating a significant commitment to the company's growth prospects. The trade price closely aligns with AQN's current market price of $4.50, suggesting a stable valuation. However, with a Price to GF Value ratio of 0.65, AQN is considered a "Possible Value Trap," warranting cautious consideration by investors.

Financial Performance and Valuation of AQN

AQN's financial health presents a mixed picture. The company has a Balance Sheet Rank of 3/10, indicating potential financial challenges. Despite this, AQN's Profitability Rank of 7/10 suggests a solid ability to generate profits. The company's Operating Margin growth has been negative, reflecting operational challenges. Investors should be aware of AQN's Altman Z score of 0.25, which indicates financial distress risk.

Utilities Industry Context and AQN's Role

The utilities industry is characterized by stable demand and regulatory oversight, providing a reliable revenue stream for companies like AQN. AQN's 3-year revenue growth of 11.20% highlights its ability to expand within this sector. Despite a Growth Rank of 2/10, AQN's focus on renewable energy positions it well for future growth. The company's interest coverage ratio of 1.06 suggests limited ability to cover interest expenses, a factor investors should monitor closely.

Other Notable Investors in AQN

In addition to BlackRock, other investment firms have shown interest in AQN. Keeley-Teton Advisors, LLC (Trades, Portfolio) is among the notable investors holding shares in the company. GAMCO Investors is identified as the largest holder of AQN shares among investment firms, further emphasizing the stock's appeal within the investment community. These holdings reflect a broader confidence in AQN's strategic direction and potential for growth in the renewable energy sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: