On December 31, 2024, LSV Asset Management executed a strategic transaction involving The ODP Corp, reducing its holdings by 74,400 shares. This adjustment represents a 4.64% change in the firm's position in the company. The transaction was carried out at a price of $22.74 per share, leaving LSV Asset Management with a total of 1,527,988 shares in The ODP Corp. This move reflects the firm's ongoing strategy to optimize its investment portfolio, with The ODP Corp now constituting 0.07% of the firm's overall portfolio and 5.10% of its holdings in the company.

About LSV Asset Management

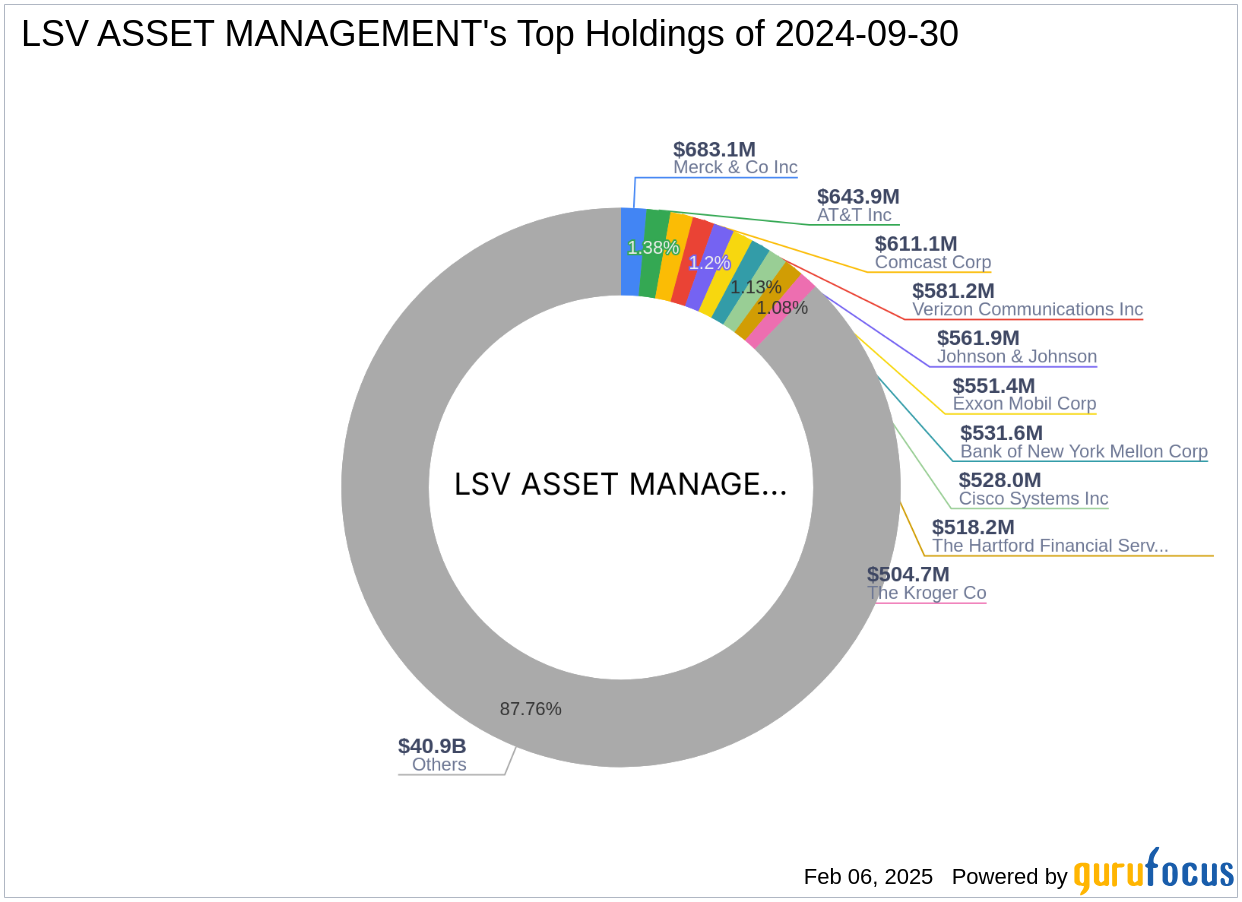

Founded in 1994, LSV Asset Management is a quantitative value manager that provides active management services for institutional investors. The firm was established by Josef Lakonishok, Andrei Shleifer, and Robert Vishny, who are renowned for their contributions to financial research. LSV Asset Management's investment philosophy is deeply rooted in behavioral finance, aiming to exploit judgmental biases and behavioral weaknesses in the market. The firm employs proprietary investment models to identify undervalued stocks with potential for near-term appreciation. With approximately $90 billion in value equity portfolios, LSV Asset Management is a significant player in the financial services and technology sectors.

Overview of The ODP Corp

The ODP Corp operates an integrated B2B distribution platform with several divisions, including ODP Business Solutions, Office Depot Division, Veyer Division, and Varis Division. The company primarily generates revenue from the Veyer division, which focuses on supply chain, distribution, and procurement services. With a market capitalization of $650.252 million, The ODP Corp is a key player in the Retail - Cyclical industry. Despite its diverse operations, the company faces challenges, as indicated by its current stock price of $21.59 and a GF Valuation status of "Possible Value Trap, Think Twice."

Financial Metrics and Valuation

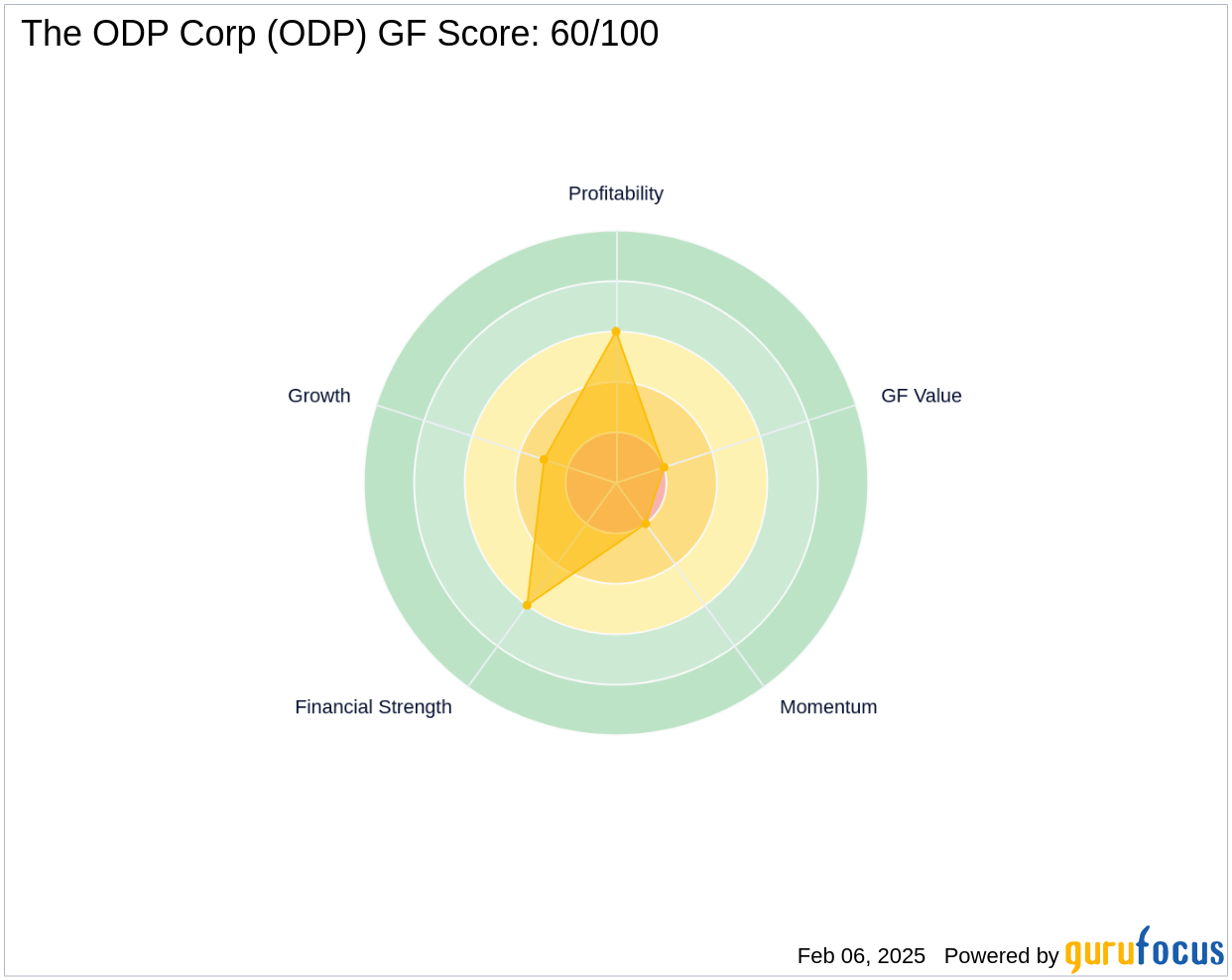

The ODP Corp's financial metrics reveal a mixed performance. The company's current stock price is $21.59, with a [GF-Score](https://www.gurufocus.com/term/gf-score/ODP) of 60/100, suggesting poor future performance potential. The Price to GF Value ratio stands at 0.41, indicating that the stock may be undervalued. Over the past three years, The ODP Corp has achieved a revenue growth of 5.40%, an EBITDA growth of 40.20%, and an earnings growth of 20.50%. However, its [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/ODP) and [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/ODP) are both rated at 6/10, while its [Growth Rank](https://www.gurufocus.com/term/rank-growth/ODP) is 3/10.

Market and Industry Context

Operating within the Retail - Cyclical industry, The ODP Corp faces several challenges. The company's cash to debt ratio is 0.17, and its [interest coverage](https://www.gurufocus.com/term/interest-coverage/ODP) is 5.75, indicating potential financial constraints. The stock's momentum and RSI indicators suggest a downward trend, with a 5-day RSI of 29.13 and a 14-day RSI of 37.66. These metrics highlight the company's current struggles in maintaining a positive market trajectory.

Other Notable Investors

In addition to LSV Asset Management, other notable investors in The ODP Corp include HOTCHKIS & WILEY, Joel Greenblatt (Trades, Portfolio), and Barrow, Hanley, Mewhinney & Strauss. These investors' involvement underscores the company's potential appeal despite its current challenges.

Transaction Analysis

The recent transaction by LSV Asset Management reflects a strategic decision to adjust its holdings in The ODP Corp. By reducing its stake, the firm may be responding to the company's current valuation and market conditions. The transaction's impact on LSV Asset Management's portfolio is relatively minor, given the stock's 0.07% position in the overall portfolio. However, the decision to maintain a significant holding in The ODP Corp suggests that LSV Asset Management still sees potential value in the company, despite its current challenges.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: