Plains All American Pipeline LP (PAA, Financial) released its 8-K filing on February 7, 2025, detailing its financial performance for the fourth quarter and full year of 2024. The company, which provides transportation, storage, processing, fractionation, and marketing services for crude oil and related products, operates extensively across the United States and Alberta, Canada, with a significant focus on the Permian Basin.

Performance Overview

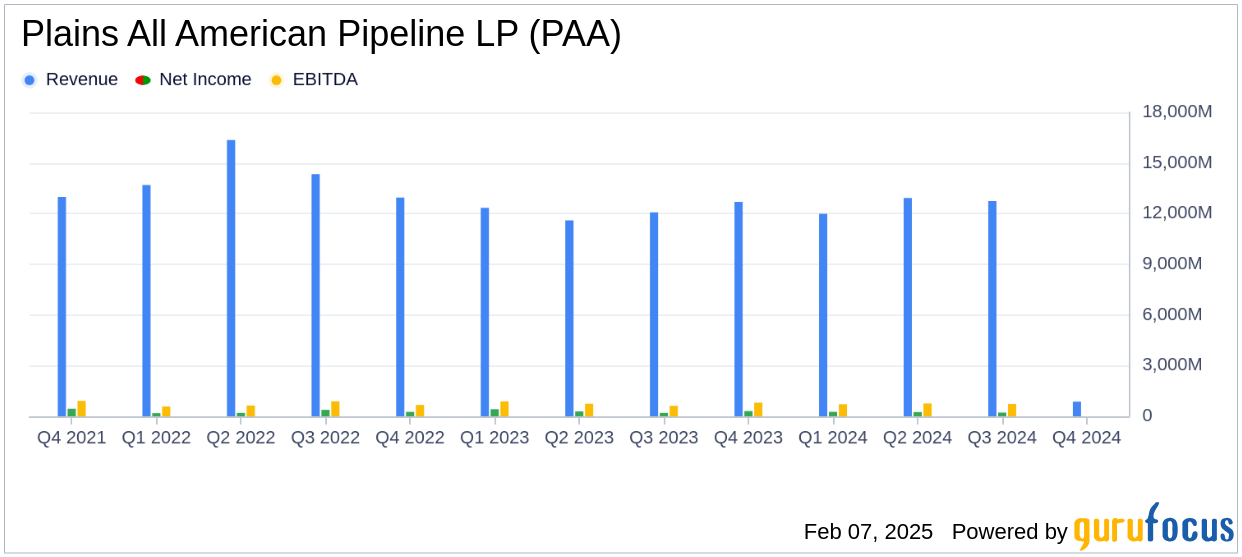

Plains All American Pipeline LP reported a net income attributable to PAA of $36 million for the fourth quarter and $772 million for the full year of 2024. The company achieved an adjusted EBITDA of $729 million for the fourth quarter and $2.78 billion for the full year, exceeding the top-end of its guidance. These results are crucial as they reflect the company's ability to generate stable cash flows and maintain financial health despite industry challenges.

Financial Achievements and Industry Significance

Plains All American Pipeline LP's financial achievements are significant in the oil and gas industry, where maintaining robust cash flows and managing leverage are critical. The company generated an adjusted free cash flow of $1.17 billion for 2024, exiting the year with a leverage ratio of 3.0x. This financial discipline is vital for sustaining operations and funding growth initiatives.

Income Statement and Key Metrics

The company's net income for the fourth quarter was impacted by a $225 million charge due to the write-off of a receivable for Line 901 insurance proceeds and $140 million in non-cash charges related to the write-down of two U.S. NGL terminals. Despite these challenges, Plains All American Pipeline LP's adjusted net income per common unit was $0.42 for the quarter, which is below the estimated earnings per share of $0.48.

| Metric | Q4 2024 | Q4 2023 | % Change |

|---|---|---|---|

| Net Income Attributable to PAA | $36 million | $312 million | (88)% |

| Adjusted EBITDA | $867 million | $875 million | (1)% |

| Adjusted Free Cash Flow | $365 million | $710 million | ** |

Analysis and Strategic Outlook

Plains All American Pipeline LP's strategic focus on efficient growth initiatives is evident from its recent acquisitions, including the Ironwood Midstream Energy acquisition. The company closed three bolt-on acquisitions for approximately $670 million, enhancing its asset base and operational capabilities. Looking ahead, Plains All American Pipeline LP expects to generate an adjusted EBITDA of $2.80 to $2.95 billion in 2025, with a continued focus on disciplined capital investments.

We continue delivering strong financial and operating results and increasing return of capital to unitholders. Our strong performance and positive outlook combined with the contribution from recent bolt-on acquisitions continues driving meaningful cash flow and underpins increasing returns to unitholders all while maintaining capital discipline and financial flexibility," said Plains Chairman and CEO Willie Chiang.

Plains All American Pipeline LP's performance underscores its resilience and strategic positioning in the oil and gas sector, making it a company to watch for value investors seeking stable returns in a volatile market.

Explore the complete 8-K earnings release (here) from Plains All American Pipeline LP for further details.