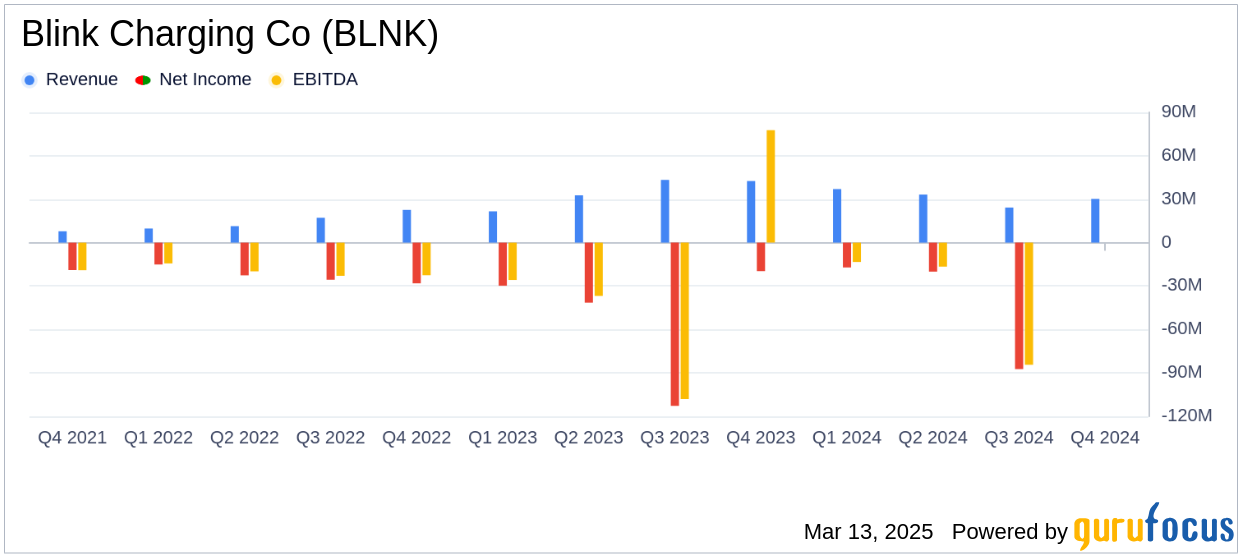

Blink Charging Co (BLNK, Financial) released its 8-K filing on March 13, 2025, detailing its financial performance for the fourth quarter and full year of 2024. The company, a prominent player in the electric vehicle (EV) charging industry, reported total revenues of $30.2 million for the fourth quarter, falling short of the analyst estimate of $30.52 million. For the full year, Blink Charging Co recorded revenues of $126.2 million, slightly below the annual estimate of $126.54 million.

Company Overview

Blink Charging Co is a global leader in providing EV charging services, offering both residential and commercial charging equipment. The company generates revenue through the sale and distribution of EV charging equipment and associated services, primarily in the United States.

Performance and Challenges

Despite a challenging year, Blink Charging Co reported a 24% increase in service revenues for the fourth quarter, reaching $9.8 million compared to $7.9 million in the same period last year. This growth was driven by increased utilization of chargers and expansion of the Blink network. However, the company faced a significant decline in product revenues, which fell by 48.6% to $17.2 million in the fourth quarter, reflecting a decrease from the previous year's strong equipment sales.

Financial Achievements and Industry Importance

The company's gross margin for the full year improved to 32%, up from 29% in 2023, highlighting its efforts to enhance operational efficiency. Blink Charging Co's focus on expanding its charging network and achieving profitability is crucial as the global transition to electric vehicles accelerates, increasing demand for EV charging infrastructure.

Key Financial Metrics

In the fourth quarter, Blink Charging Co reported a net loss of $(73.5) million, or $(0.73) per share, compared to a net loss of $(19.7) million, or $(0.28) per share, in the same period last year. The full-year net loss was $(198.1) million, or $(1.96) per share, an improvement from $(203.7) million, or $(3.21) per share, in 2023. The company's adjusted EBITDA loss for the fourth quarter was $(10.6) million, showing an improvement from the $(13.9) million loss in the previous year.

Commentary and Strategic Outlook

“During 2024, we achieved record charging revenue and significantly grew the total number of Blink-owned chargers. That said, as we expected, product revenues declined in the fourth quarter and for the full year in comparison to exceptionally strong equipment sales in 2023. In addition, we reduced operating expenses and cash burn across the Company,” commented Mike Battaglia, President and Chief Executive Officer of Blink Charging.

Analysis and Future Prospects

Blink Charging Co's strategic focus on increasing service revenues and reducing operating expenses is evident in its financial results. The company's ability to adapt to the evolving EV market and expand its charging network positions it well for future growth. However, the decline in product revenues and the substantial net loss highlight the challenges it faces in achieving profitability. As the company continues to navigate these challenges, its performance in the coming quarters will be critical in determining its long-term success in the competitive EV charging industry.

Explore the complete 8-K earnings release (here) from Blink Charging Co for further details.