Logan Ridge Finance Corp (LRFC, Financial) released its 8-K filing on March 13, 2025, announcing its financial results for the fourth quarter and full year ended December 31, 2024. The company, an externally managed non-diversified closed-end management investment company, aims to generate both current income and capital appreciation through debt and equity investments.

Performance Overview

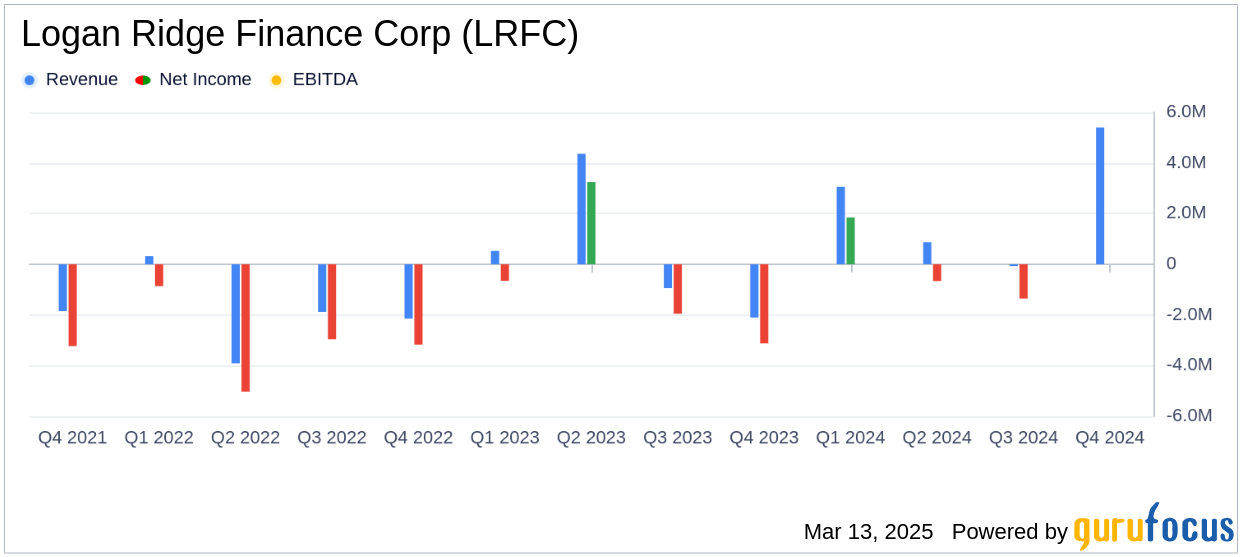

Logan Ridge Finance Corp (LRFC, Financial) reported a total investment income of $5.4 million for the fourth quarter of 2024, surpassing the analyst estimate of $5.00 million. This marks an increase from $5.1 million in the previous quarter and $4.4 million in the same quarter of the previous year. The net investment income (NII) also showed significant growth, reaching $1.5 million, or $0.56 per share, exceeding the estimated earnings per share of $0.37. This is a notable improvement from $1.0 million, or $0.37 per share, in the third quarter of 2024, and $0.6 million, or $0.22 per share, in the fourth quarter of 2023.

Financial Achievements and Strategic Moves

The company's net asset value (NAV) stood at $32.04 per share as of December 31, 2024, slightly down from $32.31 per share at the end of the previous quarter and $33.34 per share a year ago. Logan Ridge Finance Corp (LRFC, Financial) made approximately $26.1 million in investments and had $29.5 million in repayments and sales, resulting in net repayments and sales of $3.4 million during the quarter. Additionally, the company repurchased 16,598 shares of its common stock, resulting in $0.04 per share of NAV accretion.

Key Metrics and Financial Statements

For the full year 2024, Logan Ridge Finance Corp (LRFC, Financial) achieved record levels of total investment income at $20.9 million and net investment income of $4.2 million, or $1.56 per share. The company also successfully exited its largest equity position, Nth Degree, above its prior quarter fair value, and its second-largest non-yielding equity investment in GA Communications, Inc. These strategic exits are part of the company's long-term strategy to rotate out of its legacy equity portfolio.

Ted Goldthorpe, Chief Executive Officer and President of Logan Ridge, stated, “2024 was a profoundly transformative year for Logan Ridge, as we continued to build upon the record results seen in full year 2023 and made significant strides in the rotation out of the legacy equity portfolio.”

Analysis and Future Outlook

The company's strong financial performance and strategic moves, such as the merger agreement with Portman Ridge Finance Corporation, are expected to create meaningful shareholder value through greater scale, enhanced liquidity, and improved operational efficiencies. The Board of Directors has approved a dividend of $0.36 per share for the first quarter of 2025, maintaining the same level as the fourth quarter of 2024 and representing a 13% increase compared to the first quarter of 2024.

Logan Ridge Finance Corp (LRFC, Financial)'s achievements in 2024 highlight its ability to generate income and manage its investment portfolio effectively, positioning it well for future growth and value creation in the asset management industry.

Explore the complete 8-K earnings release (here) from Logan Ridge Finance Corp for further details.