On March 14, 2025, GAN Ltd (GAN, Financial) released its 8-K filing detailing its financial results for the fourth quarter and full year of 2024. The company, a prominent provider of Software-as-a-Service solutions for online casino gaming and sports betting, operates through its B2B and B2C segments. The B2B segment focuses on technology solutions for casino operators, while the B2C segment, including Coolbet, offers online sports betting and casino platforms in various international markets.

Performance Overview and Challenges

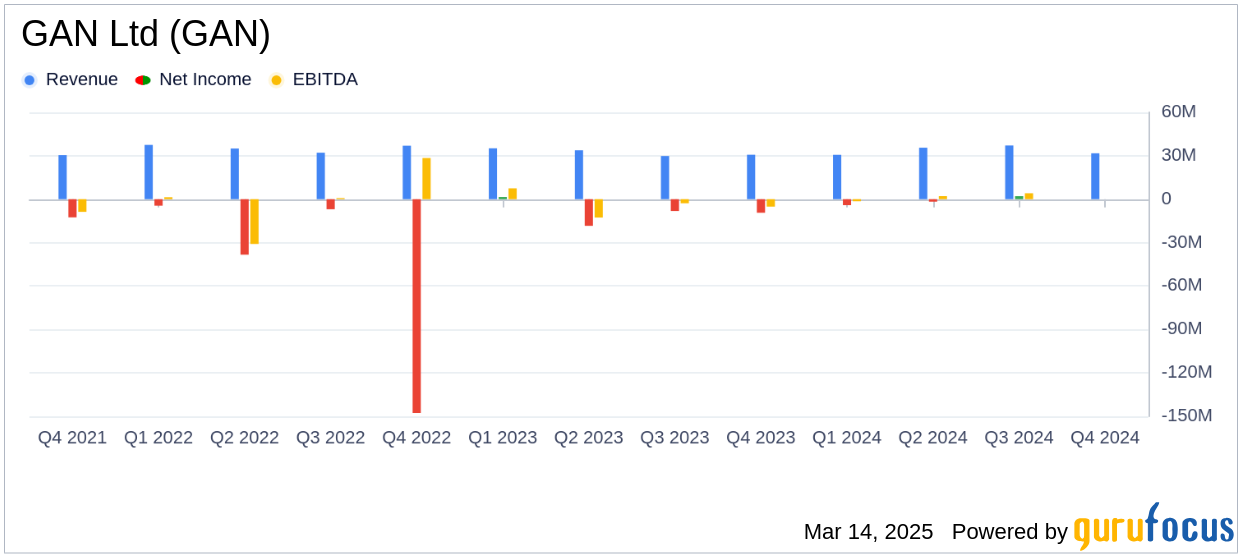

GAN Ltd (GAN, Financial) reported a total revenue of $31.7 million for Q4 2024, marking a 3% increase compared to the same period in 2023. This growth was primarily driven by the B2C segment, which saw revenue rise to $22.7 million from $18.9 million, despite challenges such as reduced player activity and unfavorable exchange rates in Latin America. Conversely, the B2B segment experienced a decline in revenue to $9.0 million from $11.8 million, attributed to a partner exit.

Operating expenses decreased significantly to $23.4 million from $29.5 million, thanks to cost-saving initiatives, including reduced compensation costs and headcount. The net loss improved to $4.2 million from $9.4 million, reflecting increased revenues and decreased operating expenses. However, the decline in B2C active customers, primarily in Latin America, poses a challenge for future growth.

Financial Achievements and Industry Impact

GAN Ltd (GAN, Financial) achieved a notable improvement in its adjusted EBITDA, which was slightly better than breakeven, compared to a loss of $3.9 million in the previous year. This improvement underscores the company's successful cost management and revenue growth strategies. The B2B segment's gross operator revenue surged by 69% to $651.2 million, driven by organic growth in key markets such as Pennsylvania, New Jersey, Ontario, and Connecticut.

For the full year 2024, GAN Ltd (GAN, Financial) reported a total revenue of $135.0 million, a 4% increase from 2023. The B2B segment contributed significantly to this growth, with revenue rising to $50.7 million from $43.2 million, thanks to expanded offerings in Nevada and revenue recognition from a partner exit in Michigan. The company's net loss for the year improved to $8.0 million from $34.4 million, highlighting the positive impact of increased revenues and reduced operating expenses.

Key Financial Metrics and Analysis

GAN Ltd (GAN, Financial) reported a B2B segment contribution margin of 67.9% for Q4 2024, down from 80.6% in the previous year, while the B2C segment contribution margin improved to 64.5% from 60.3%. The company's cash position increased to $38.7 million as of December 31, 2024, up from $36.5 million at the end of Q3 2024, driven by a payment related to a partner exit.

The company's adjusted EBITDA for the full year 2024 was $8.6 million, a significant turnaround from a loss of $8.4 million in 2023. This metric is crucial for assessing GAN Ltd (GAN, Financial)'s core business performance, as it excludes non-operational factors and provides a clearer picture of the company's financial health.

Seamus McGill, GAN’s Chief Executive Officer, stated, “I’d like to thank our entire global team for continuing to execute and grow our business on a streamlined cost structure. This led to stronger financial performance in 2024 with growth in both the top and bottom line.”

Conclusion

GAN Ltd (GAN, Financial)'s financial results for Q4 and the full year 2024 demonstrate the company's ability to navigate challenges and achieve growth through strategic cost management and revenue expansion. The planned merger with SEGA SAMMY, expected to close in Q2 2025, could further enhance GAN Ltd (GAN)'s market position and growth prospects. Investors and stakeholders will be keenly watching how the company leverages these developments to drive future performance.

Explore the complete 8-K earnings release (here) from GAN Ltd for further details.