On March 13, 2025, D-Wave Quantum Inc (QBTS, Financial) released its 8-K filing detailing its financial performance for the fourth quarter and full year of 2024. The company, a pioneer in quantum computing systems, software, and services, reported significant growth in bookings but faced challenges in meeting revenue expectations.

Company Overview

D-Wave Quantum Inc is at the forefront of quantum computing, providing both annealing and gate-model quantum computers. The company's mission is to harness quantum computing to solve complex problems across various sectors, including logistics, artificial intelligence, and financial modeling. D-Wave's quantum systems are accessible via its LeapTM cloud service, offering practical applications for diverse industries.

Performance and Challenges

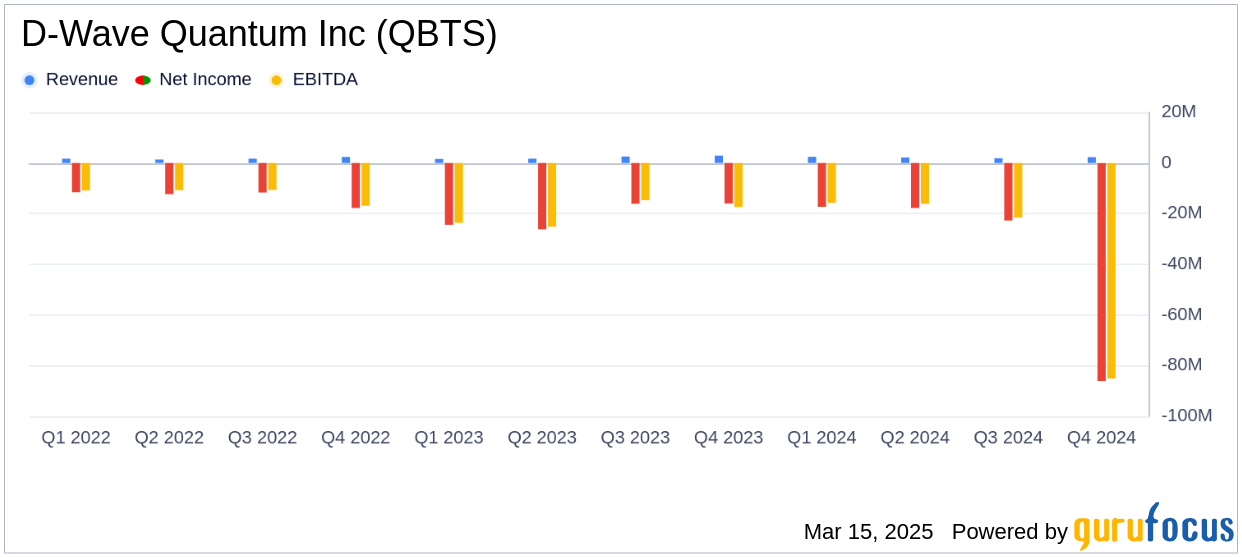

For the fiscal year 2024, D-Wave reported revenue of $8.8 million, which remained flat compared to the previous year and fell short of the annual estimate of $14.77 million. The fourth quarter revenue was $2.3 million, a 21% decrease from the same period in 2023, missing the quarterly estimate of $2.61 million. This revenue shortfall highlights the challenges D-Wave faces in converting its technological advancements into financial gains.

Financial Achievements

Despite revenue challenges, D-Wave achieved a remarkable 128% increase in bookings for the year, reaching $23.9 million. The fourth quarter alone saw a 502% surge in bookings to $18.3 million. These figures underscore strong customer demand and potential future revenue streams, crucial for a company in the hardware industry where upfront investments are significant.

Key Financial Metrics

| Metric | 2024 | 2023 |

|---|---|---|

| Revenue | $8.8 million | $8.8 million |

| Bookings | $23.9 million | $10.5 million |

| Net Loss | $143.9 million | $82.7 million |

| Cash Position | $178.0 million | $41.3 million |

Income Statement and Balance Sheet Insights

D-Wave's GAAP gross profit for 2024 was $5.6 million, a 20% increase from the previous year, driven by higher-margin QCaaS revenue. The GAAP gross margin improved to 63.0% from 52.8%. However, the net loss widened to $143.9 million, primarily due to a $68.3 million non-cash charge related to warrant liabilities. The company's cash position improved significantly, exceeding $300 million as of the filing date, providing a buffer for future investments and operations.

Commentary and Analysis

“Every day D-Wave’s quantum technology is helping customers gain competitive advantages, discover new scientific breakthroughs, and fuel innovations that were previously unimaginable,” said Dr. Alan Baratz, CEO of D-Wave.

This statement reflects the company's commitment to advancing quantum computing technology and its potential impact on various industries. However, the challenge remains in translating technological advancements into consistent revenue growth.

Conclusion

D-Wave Quantum Inc's latest earnings report presents a mixed picture. While the company has made significant strides in bookings and technological advancements, it faces challenges in meeting revenue expectations. The strong cash position and increased bookings indicate potential for future growth, but the company must address its revenue generation strategies to capitalize on its technological leadership in the quantum computing space.

Explore the complete 8-K earnings release (here) from D-Wave Quantum Inc for further details.