On March 13, 2025, Tourmaline Bio Inc (TRML, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year 2024. Tourmaline Bio Inc is a late-stage clinical biotechnology company focused on developing transformative medicines for immune diseases, with its lead product candidate, TOUR006, targeting autoimmune and inflammatory disorders.

Financial Performance and Challenges

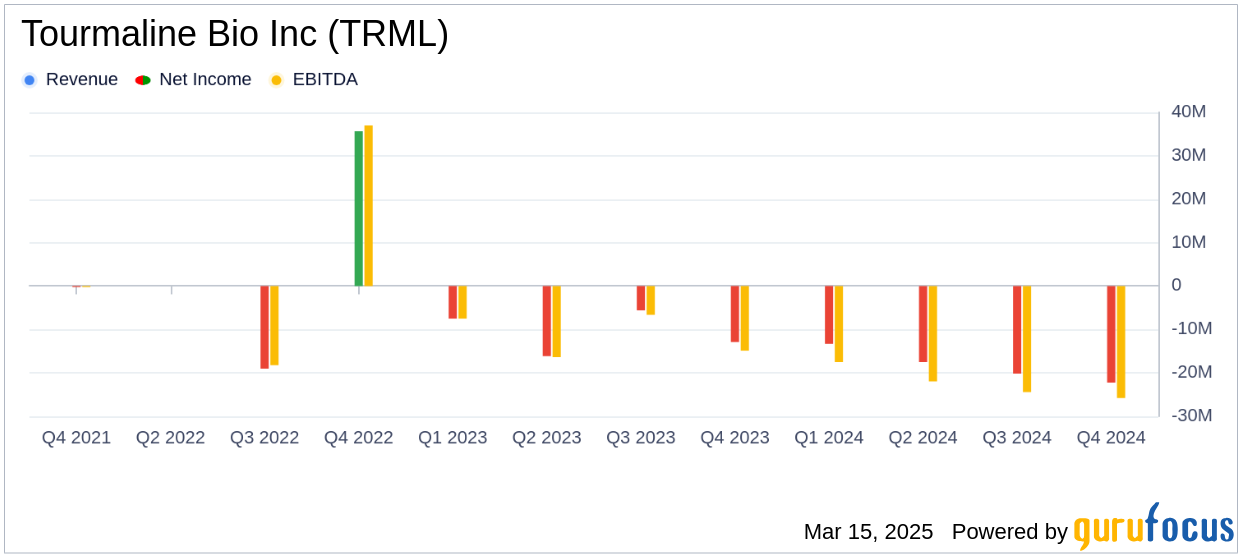

Tourmaline Bio Inc reported a net loss of $22.2 million for Q4 2024, translating to a net loss per share of $0.86, which is slightly better than the analyst estimate of -$0.88. For the full year 2024, the net loss was $73.2 million, with a net loss per share of $2.89, also outperforming the annual estimate of -$3.58. The company's financial performance is crucial as it reflects the ongoing investment in research and development, which is vital for advancing its clinical programs.

Key Financial Achievements

Tourmaline Bio Inc's cash, cash equivalents, and investments stood at $294.9 million as of December 31, 2024, up from $203.0 million at the end of 2023. This robust financial position provides the company with a cash runway into the second half of 2027, supporting its operations and clinical trials. The increase in cash reserves is significant for a biotechnology company, as it ensures the continuation of critical research and development activities.

Income Statement and Balance Sheet Highlights

| Metric | Q4 2024 | Q4 2023 | Full Year 2024 | Full Year 2023 |

|---|---|---|---|---|

| Research and Development Expenses | $20.5 million | $8.0 million | $67.0 million | $32.4 million |

| General and Administrative Expenses | $5.3 million | $6.9 million | $22.7 million | $13.0 million |

| Net Loss | $22.2 million | $12.9 million | $73.2 million | $42.1 million |

| Net Loss Per Share | $0.86 | $0.81 | $2.89 | $8.87 |

Research and development expenses increased significantly, reflecting the company's intensified efforts in clinical trials, particularly the TRANQUILITY and spiriTED trials. The rise in expenses is attributed to increased headcount, clinical trial costs, and drug manufacturing expenses. General and administrative expenses decreased in Q4 2024 compared to Q4 2023 due to reduced stock-based compensation but increased annually due to higher employee compensation and professional fees.

Clinical and Corporate Developments

Tourmaline Bio Inc's clinical progress includes the over-enrollment of its Phase 2 TRANQUILITY trial, which is crucial for advancing its cardiovascular inflammation program. The company also strengthened its Cardiovascular Scientific Advisory Board with notable appointments, enhancing its strategic guidance. These developments are pivotal as they position Tourmaline Bio Inc for potential Phase 3 readiness and expansion into new indications.

“2024 was an important year of execution as it relates to our clinical development programs in cardiovascular inflammation and thyroid eye disease,” said Sandeep Kulkarni, MD, Co-Founder and Chief Executive Officer of Tourmaline.

Analysis and Outlook

Tourmaline Bio Inc's financial results and clinical advancements underscore its commitment to developing innovative treatments for immune diseases. The company's strong cash position and strategic clinical progress provide a solid foundation for future growth. However, the increased operating expenses and net loss highlight the challenges of sustaining long-term development in the biotechnology sector. Investors will be keenly watching the upcoming data readouts from the TRANQUILITY trial, which could significantly impact the company's trajectory.

Explore the complete 8-K earnings release (here) from Tourmaline Bio Inc for further details.