On March 17, 2025, Harte-Hanks Inc (HHS, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year of 2024. Harte-Hanks Inc, a global customer experience company, operates through three segments: Marketing Services, Customer Care, and Fulfillment & Logistics Services, with a significant presence in the United States.

Revenue and Earnings Overview

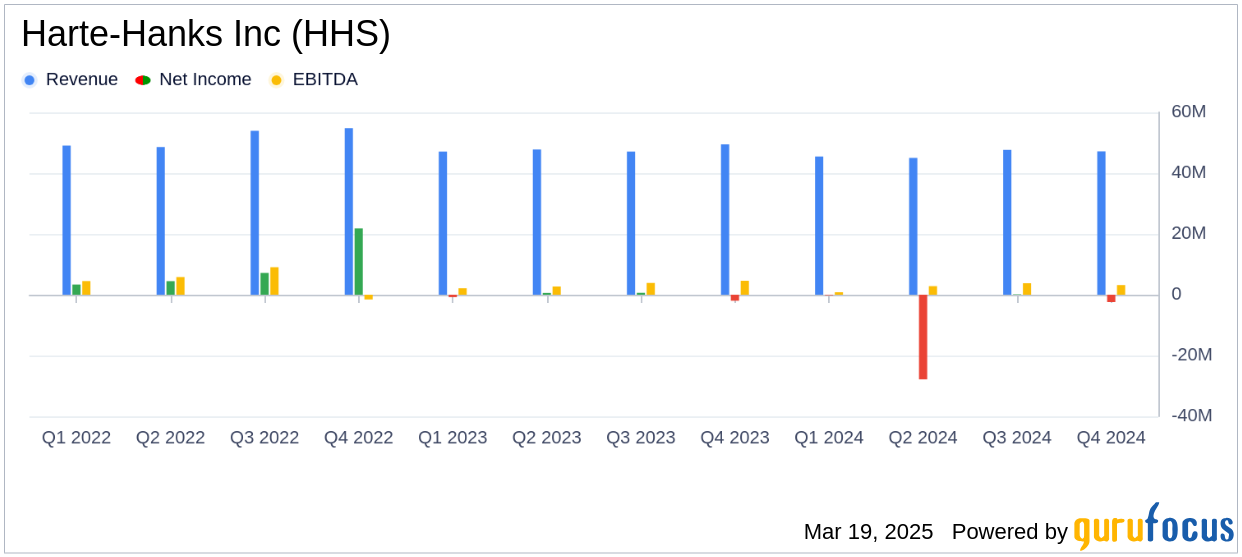

For the fourth quarter of 2024, Harte-Hanks Inc reported revenue of $47.1 million, slightly below the analyst estimate of $47.30 million, and a decrease of 4.8% from $49.5 million in the same quarter of 2023. The full-year revenue was $185.2 million, below the annual estimate of $195.40 million, down 3.3% from $191.5 million in 2023. The company reported a net loss of $2.4 million, or $0.33 per share, for the fourth quarter, compared to a net loss of $2.0 million, or $0.27 per share, in the prior-year quarter.

Segment Performance and Challenges

The Customer Care segment generated $15.0 million in revenue, representing 32% of total revenue, with a slight decrease of 1.5% year-over-year. The Fulfillment & Logistics Services segment, contributing 44% of total revenue, saw a 2.7% decline in revenue to $20.8 million. The Marketing Services segment experienced a 12.1% drop in revenue to $11.3 million, accounting for 24% of total revenue. The decline in revenue across all segments highlights the challenges faced by the company in maintaining growth amidst increased operational costs and market pressures.

Financial Achievements and Strategic Initiatives

Despite the challenges, Harte-Hanks Inc achieved a positive EBITDA of $6.5 million for the full year, although this was a decrease from $7.6 million in 2023. The company ended the year with $9.9 million in cash and no debt, positioning it well for future growth. The strategic initiative, Project Elevate, aimed at optimizing cost structure and streamlining operations, is expected to drive innovation and operational excellence.

David Fisher, Interim Chief Operating Officer, stated, "We continue to execute on Project Elevate to optimize our cost structure and streamline our organization. These initiatives have eliminated cost consistent with our expectations in 2024 and will continue to address business-critical initiatives in 2025."

Key Financial Metrics and Analysis

Operating loss for the fourth quarter was $1.6 million, an improvement from a loss of $2.3 million in the prior-year quarter. The company's balance sheet remains strong with zero debt and a fully terminated Pension Plan I. However, the net loss for the full year was significantly impacted by a $37.5 million charge related to pension plan termination.

| Metric | Q4 2024 | Q4 2023 |

|---|---|---|

| Revenue | $47.1 million | $49.5 million |

| Net Loss | $2.4 million | $2.0 million |

| EBITDA | -$0.3 million | -$1.1 million |

Conclusion

Harte-Hanks Inc's financial results for the fourth quarter and full year of 2024 reflect the challenges of declining revenues and increased operational costs. However, the company's strategic initiatives and strong balance sheet position it for potential growth in the coming years. Investors will be keen to see how the company navigates these challenges and capitalizes on its strategic initiatives to drive future performance.

Explore the complete 8-K earnings release (here) from Harte-Hanks Inc for further details.