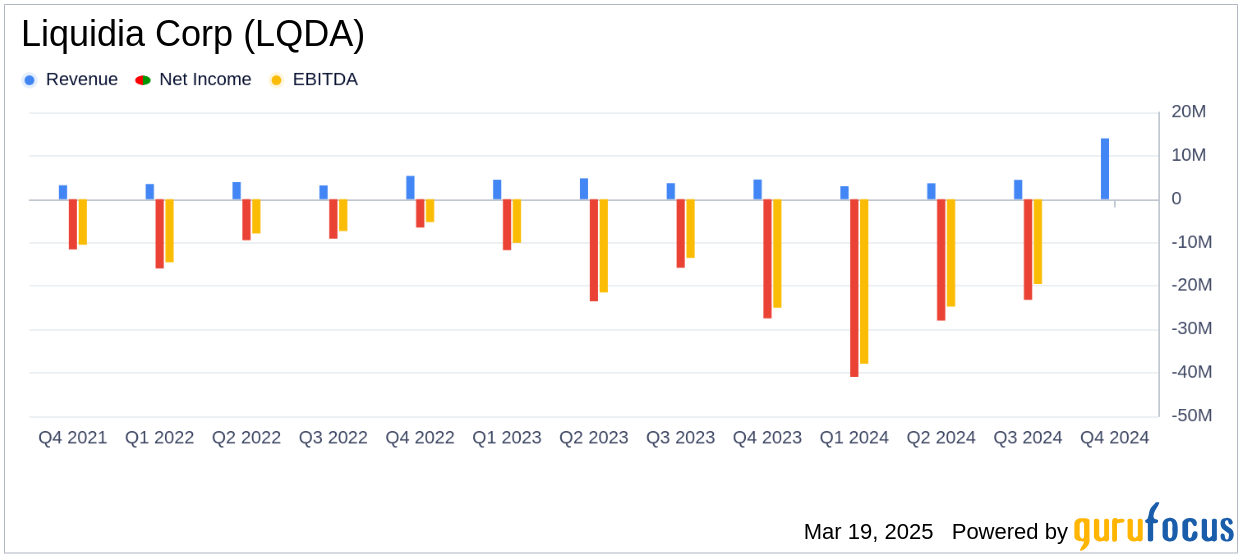

Liquidia Corp (LQDA, Financial) released its 8-K filing on March 19, 2025, detailing its financial performance for the full year ended December 31, 2024. The biopharmaceutical company, which focuses on developing therapies for rare cardiopulmonary diseases, reported a net loss of $130.4 million, or $1.66 per share, missing the annual estimated earnings per share of -$1.56. Revenue for the year was $14.0 million, falling short of the estimated $15.88 million.

Company Overview

Liquidia Corp is a U.S.-based biopharmaceutical company dedicated to addressing unmet patient needs, particularly in the treatment of pulmonary hypertension (PH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD). The company utilizes its proprietary PRINT technology to develop precise drug particles, with its lead product being YUTREPIA (treprostinil) inhalation powder. Liquidia also generates revenue from the sale of Treprostinil Injection through a partnership with Sandoz.

Performance and Challenges

Liquidia's financial performance in 2024 was marked by a decrease in revenue to $14.0 million from $17.5 million in 2023, primarily due to lower sales quantities of Treprostinil Injection. This decline was attributed to limitations on the availability of pumps used for administration, a challenge that may persist until alternative solutions are found. The company's net loss widened significantly to $130.4 million from $78.5 million in the previous year, reflecting increased operational costs.

Financial Achievements and Strategic Moves

Despite the financial setbacks, Liquidia strengthened its financial position by amending its agreement with HealthCare Royalty Partners (HCRx) to secure up to an additional $100 million in financing. This strategic move is crucial as the company prepares for the potential FDA approval and commercialization of YUTREPIA after the expiration of regulatory exclusivity on May 23, 2025. The amendment provides Liquidia with $25 million immediately, with the potential for further funding contingent on achieving specific milestones.

Key Financial Metrics

Liquidia's cash and cash equivalents increased significantly to $176.5 million as of December 31, 2024, from $83.7 million at the end of 2023. Total assets rose to $230.3 million, while total liabilities increased to $153.0 million. The company's accumulated deficit widened to $559.5 million, highlighting the ongoing financial challenges.

| Metric | 2024 | 2023 |

|---|---|---|

| Revenue | $14.0 million | $17.5 million |

| Net Loss | $130.4 million | $78.5 million |

| Cash and Cash Equivalents | $176.5 million | $83.7 million |

Analysis of Financial Performance

The increase in research and development expenses to $47.8 million, up from $43.2 million in 2023, underscores Liquidia's commitment to advancing its pipeline, particularly the L606 program and YUTREPIA research activities. However, the substantial rise in general and administrative expenses to $81.6 million, driven by personnel costs and legal fees, highlights the financial strain of preparing for potential product commercialization and ongoing litigation.

Dr. Roger Jeffs, Liquidia’s Chief Executive Officer, stated, “Building on our progress this past year, Liquidia has strengthened its financial position, with up to an additional $100 million available pursuant to an amendment to its existing financing agreement with HCRx, while remaining poised for the potential approval and commercialization of YUTREPIA after the expiration on May 23, 2025, of the regulatory exclusivity that is currently preventing final approval.”

Overall, Liquidia's financial results reflect both the challenges and strategic efforts in navigating the competitive biotechnology landscape. The company's focus on securing additional financing and advancing its product pipeline positions it for potential growth, contingent on regulatory approvals and successful commercialization efforts.

Explore the complete 8-K earnings release (here) from Liquidia Corp for further details.