On March 19, 2025, TWFG Inc (TWFG, Financial), a high-growth insurance distribution company, released its 8-K filing detailing the financial results for the fourth quarter and full year ended December 31, 2024. The company, known for its independent distribution platform for personal and commercial insurance in the United States, reported substantial growth in revenue and strategic expansion across multiple states.

Fourth Quarter 2024 Financial Highlights

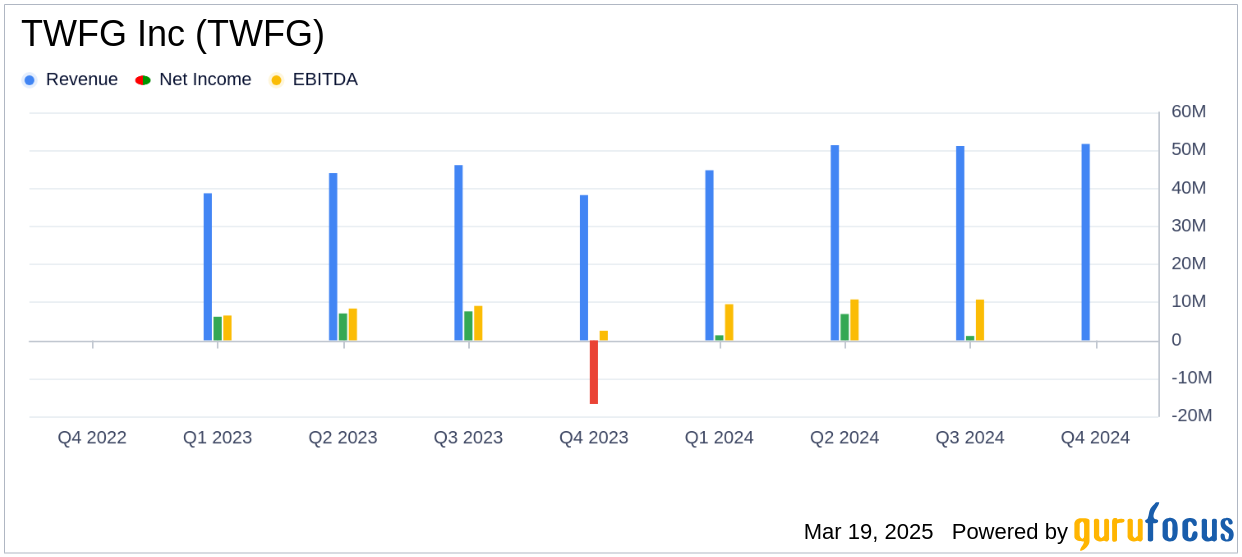

TWFG Inc (TWFG, Financial) reported a 30.8% increase in total revenues for the fourth quarter, reaching $51.7 million compared to $39.6 million in the same period the previous year. The company's net income for the quarter was $8.2 million, up from $5.2 million in the prior year period. Commission income rose by 20.7% to $43.7 million, while contingent income saw a remarkable increase of 371.4% to $5.0 million.

Full Year 2024 Performance

For the full year 2024, TWFG Inc (TWFG, Financial) achieved an 18.4% increase in total revenues, amounting to $203.8 million. Net income for the year was $28.6 million, compared to $26.1 million in the previous year. The company also reported a 15.4% rise in commission income to $183.2 million and a 113.5% increase in contingent income to $8.7 million.

Strategic Expansion and Challenges

TWFG Inc (TWFG, Financial) continued its expansion throughout the United States, driven by recruitment of start-up agencies and strategic acquisitions in states such as Colorado, Connecticut, and Texas. The company's growth strategy is supported by its proprietary technology and premium financing, which offer lower operational costs and enhanced services.

Gordy Bunch, Founder, Chairman, and CEO, stated, "Our fourth quarter results demonstrate the continued success of our agents, carriers, employees, and business model with total revenues increasing by 30.8% over the prior year period and Adjusted EBITDA increasing by 91.7%."

Financial Achievements and Metrics

TWFG Inc (TWFG, Financial) reported an Adjusted EBITDA increase of 91.7% for the fourth quarter, reaching $13.8 million, with an Adjusted EBITDA Margin of 26.8%. For the full year, Adjusted EBITDA rose by 44.7% to $45.3 million, with a margin of 22.3%. These metrics are crucial for assessing the company's operational efficiency and profitability.

| Metric | Q4 2024 | Q4 2023 | FY 2024 | FY 2023 |

|---|---|---|---|---|

| Total Revenues | $51.7M | $39.6M | $203.8M | $172.0M |

| Net Income | $8.2M | $5.2M | $28.6M | $26.1M |

| Adjusted EBITDA | $13.8M | $7.2M | $45.3M | $31.3M |

Analysis and Outlook

TWFG Inc (TWFG, Financial)'s strong financial performance underscores its effective growth strategy and robust business model. The company's focus on expanding its distribution network and leveraging proprietary technology positions it well for future growth. However, the integration of new branches and the time required for new agents to become productive may pose short-term challenges.

Overall, TWFG Inc (TWFG, Financial) has demonstrated significant progress in enhancing its market position and financial performance, making it an attractive prospect for value investors seeking exposure to the insurance distribution sector.

Explore the complete 8-K earnings release (here) from TWFG Inc for further details.