On March 20, 2025, Barinthus Biotherapeutics PLC (BRNS, Financial) released its 8-K filing, detailing its financial performance for the year ended December 31, 2024. The clinical-stage biopharmaceutical company, known for developing novel T cell immunotherapeutics, reported significant developments in its strategic transformation and financial results.

Company Overview and Strategic Developments

Barinthus Biotherapeutics PLC is focused on creating therapies that guide the immune system to combat chronic infectious diseases, autoimmunity, and cancer. The company is undergoing a strategic transformation to position itself as a leader in immunology and inflammatory diseases. Key developments include the advancement of VTP-1000, a potentially curative immunotherapy for celiac disease, and the proprietary SNAP-TI platform, which is expected to drive future pipeline and partnership opportunities.

Financial Performance and Challenges

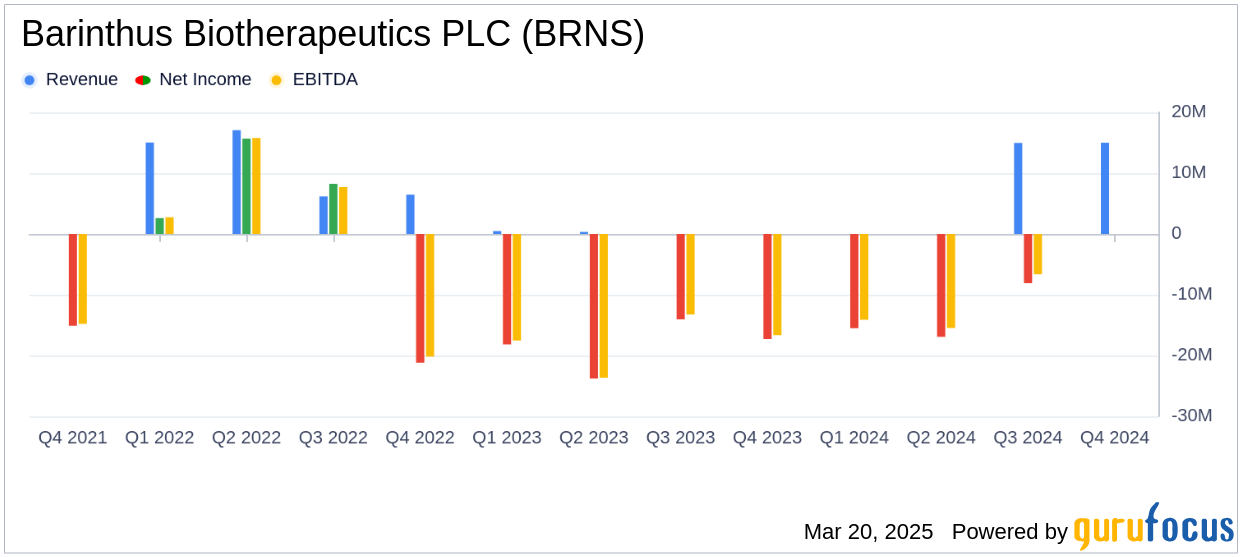

Barinthus Biotherapeutics PLC reported a revenue of $15.0 million for 2024, significantly surpassing the estimated revenue of $0.00 million. This revenue was primarily derived from royalties related to the commercial sales of Vaxzevria® by AstraZeneca. Despite this achievement, the company faced a net loss of $61.1 million, or $(1.55) per share, which was better than the estimated earnings per share of $(1.67). This was an improvement from the previous year's net loss of $73.3 million, or $(1.91) per share. The company's financial performance highlights the challenges of high research and development expenses, which totaled $42.2 million, and a goodwill impairment expense of $12.2 million.

Key Financial Metrics and Achievements

Barinthus Biotherapeutics PLC's cash position was $112.4 million as of December 31, 2024, down from $142.1 million the previous year. The company expects its available resources to fund operations into 2027, reflecting strategic prioritization of resources. The reduction in research and development expenses from $44.9 million in 2023 to $42.2 million in 2024 was mainly due to the completion of certain clinical trials.

| Metric | 2024 | 2023 | Change |

|---|---|---|---|

| Revenue | $15.0 million | $0.8 million | + $14.2 million |

| Net Loss | $(61.1) million | $(73.3) million | + $12.2 million |

| R&D Expenses | $42.2 million | $44.9 million | - $2.7 million |

Analysis and Future Outlook

The company's strategic focus on immunology and inflammatory diseases, coupled with its innovative SNAP-TI platform, positions it well for future growth. The anticipated data from ongoing clinical trials, such as the Phase 1 AVALON trial for VTP-1000, could further enhance its market position. However, the company must navigate the challenges of high R&D expenses and the need for strategic partnerships to fully leverage its pipeline.

“We’ve entered 2025 with a refreshed strategic focus on immunological and inflammatory diseases. Following our restructuring, we are strongly positioned to advance our highly differentiated lead asset, VTP-1000, in patients with celiac disease,” said Bill Enright, Chief Executive Officer of Barinthus Bio.

Barinthus Biotherapeutics PLC's financial results and strategic initiatives underscore its commitment to advancing its pipeline and achieving long-term growth in the biotechnology sector. For more detailed insights, visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from Barinthus Biotherapeutics PLC for further details.