On March 20, 2025, TELA Bio Inc (TELA, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year ending December 31, 2024. TELA Bio Inc, a U.S.-based medical technology company, specializes in developing and marketing tissue reinforcement materials for soft tissue reconstruction. Their flagship products, OviTex and OviTex PRS Reinforced Tissue Matrix, are designed to improve clinical outcomes and reduce costs in hernia repair and reconstructive surgery.

Performance Overview and Challenges

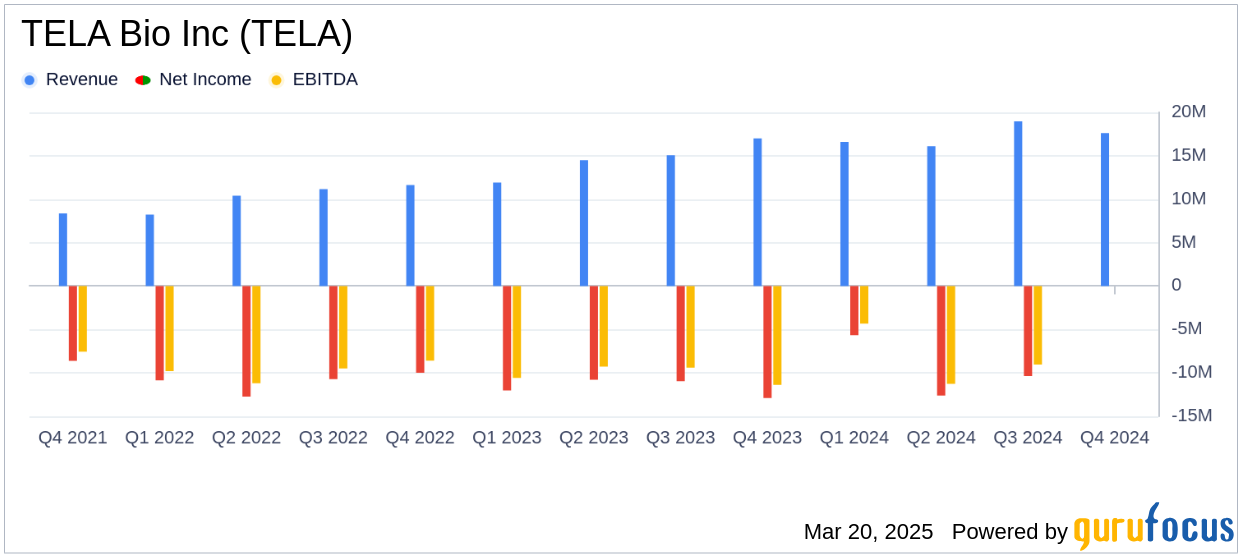

TELA Bio Inc reported a revenue of $17.6 million for Q4 2024, marking a 4% increase compared to the same period in 2023. However, this figure fell short of the analyst estimate of $23.17 million. The full-year revenue reached $69.3 million, a 19% increase from 2023, yet it did not meet the annual estimate of $74.72 million. The growth was driven by increased demand for OviTex and OviTex PRS products, with unit sales volumes rising by approximately 33% and 31%, respectively.

Despite the revenue growth, TELA Bio faced challenges, including a decrease in average selling prices due to a shift in product mix towards smaller-sized units. This was compounded by disruptions that affected Q4 results, although the company believes these issues are either transient or have been addressed.

Financial Achievements and Industry Context

In the medical devices and instruments industry, TELA Bio's achievements in expanding product adoption and increasing sales volumes are significant. The launch of the OviTex IHR Reinforced Tissue Matrix for laparoscopic and robotic-assisted hernia repair contributed to this growth, with over 1,200 units sold since its mid-April 2024 launch.

Key Financial Metrics

Gross profit for Q4 2024 was $11.2 million, representing 64% of revenue, a decline from 68% in Q4 2023. This decrease was attributed to higher expenses for excess and obsolete inventory adjustments. Operating expenses decreased to $19.6 million from $23.9 million in Q4 2023, reflecting cost reduction efforts. The net loss for Q4 2024 was $9.2 million, an improvement from a $12.9 million loss in the same period of 2023.

| Metric | Q4 2024 | Q4 2023 |

|---|---|---|

| Revenue | $17.6 million | - |

| Gross Profit | $11.2 million | $11.6 million |

| Operating Expenses | $19.6 million | $23.9 million |

| Net Loss | $9.2 million | $12.9 million |

Analysis and Outlook

TELA Bio's financial performance in 2024 highlights both growth and challenges. The company's ability to increase sales volumes and expand product adoption is promising, yet the decrease in average selling prices and operational disruptions pose challenges. The company's strategic focus on cost reduction and market share expansion is crucial for future growth.

“Our team delivered 19% revenue growth in 2024, and we saw multiple record-high sales months throughout the year. Despite these challenges, the overall opportunity for substantial value creation from current levels remains intact,” said Antony Koblish, co-founder, President, and CEO of TELA Bio.

Looking ahead, TELA Bio projects 2025 revenue to range from $85.0 million to $88.0 million, indicating a 23% to 27% growth over 2024. This guidance reflects the company's confidence in its strategic initiatives and market potential.

Explore the complete 8-K earnings release (here) from TELA Bio Inc for further details.