On March 20, 2025, Macrogenics Inc (MGNX, Financial) released its 8-K filing, providing an update on its corporate progress and financial results for the year ended December 31, 2024. Macrogenics Inc is a biotechnology company focused on discovering and developing antibody-based therapeutics for cancer treatment. Its product portfolio includes MARGENZA for metastatic HER2-positive breast cancer and a pipeline of candidates targeting tumor-associated antigens and immune checkpoint molecules.

Performance and Challenges

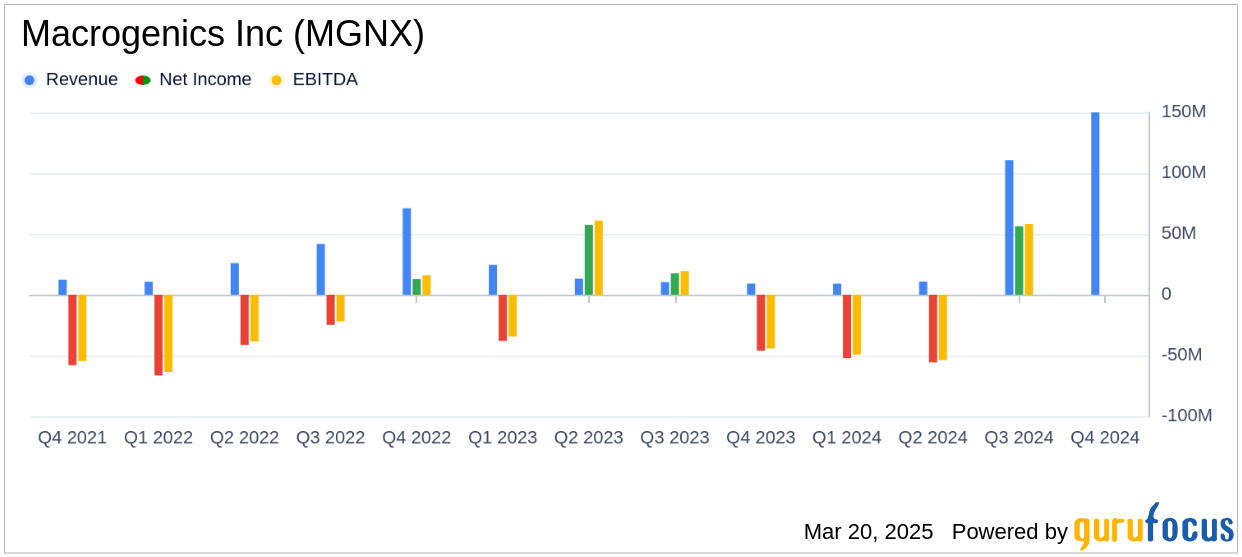

Macrogenics Inc reported a total revenue of $150.0 million for 2024, which fell short of the annual estimated revenue of $163.41 million. The company's net loss for the year was $67.0 million, a significant increase from the $9.1 million net loss in 2023. This performance highlights the challenges faced by the company in achieving profitability amidst its strategic shifts and ongoing clinical developments.

Financial Achievements and Industry Importance

Despite the challenges, Macrogenics Inc achieved several financial milestones. The company recognized a net increase of $85.0 million in revenue from milestones under the Incyte License Agreement. This achievement underscores the importance of strategic partnerships in the biotechnology industry, where collaboration can significantly impact financial outcomes.

Key Financial Metrics

Macrogenics Inc's cash, cash equivalents, and marketable securities stood at $201.7 million as of December 31, 2024, down from $229.8 million in 2023. The company's research and development expenses increased to $177.2 million, reflecting its commitment to advancing its pipeline, including MGC028 and lorigerlimab. Selling, general, and administrative expenses also rose to $71.0 million, partly due to an amendment fee related to the sale of MARGENZA.

| Metric | 2024 | 2023 |

|---|---|---|

| Revenue | $150.0 million | $58.7 million |

| Net Loss | $67.0 million | $9.1 million |

| Cash and Equivalents | $201.7 million | $229.8 million |

Analysis of Company Performance

The increase in research and development expenses highlights Macrogenics Inc's focus on expanding its pipeline, which is crucial for long-term growth in the biotechnology sector. However, the company's inability to meet revenue estimates and the increased net loss indicate the challenges of balancing innovation with financial stability. The decision to discontinue internal development of vobra duo and explore partnering options reflects a strategic shift to optimize resources and focus on promising candidates like lorigerlimab and MGC026.

We concluded 2024 with the achievement of multiple clinical development milestones, including the completion of enrollment in the LORIKEET Phase 2 study evaluating lorigerlimab in combination with docetaxel in patients with mCRPC. We look forward to building upon this momentum in 2025," said Scott Koenig, M.D., Ph.D., President and CEO of MacroGenics.

Macrogenics Inc's strategic focus on advancing its novel pipeline and leveraging partnerships will be critical in navigating the competitive biotechnology landscape and achieving sustainable growth.

Explore the complete 8-K earnings release (here) from Macrogenics Inc for further details.