On March 24, 2025, DBV Technologies SA (XPAR:DBV, Financial) released its 8-K filing, announcing significant progress in its Viaskin Peanut Patch program and reporting its unaudited financial results for the full year 2024. The company, a clinical-stage biopharmaceutical entity, focuses on developing novel immunotherapy solutions through its proprietary Viaskin technology. This technology aims to treat food allergies by delivering biologically active compounds to the immune system via the skin.

FDA Agreement and Accelerated Timeline

DBV Technologies SA (XPAR:DBV, Financial) has secured an agreement with the U.S. Food and Drug Administration (FDA) regarding the safety exposure data required for a Biologics License Application (BLA) for its Viaskin Peanut Patch in children aged 4 to 7 years. This agreement eliminates the need for the COMFORT Children supplemental safety study, thereby accelerating the BLA submission timeline to the first half of 2026. This development could potentially expedite the product launch by approximately one year, pending FDA approval.

“DBV’s alignment with FDA represents a tremendous achievement for food allergy families, clinicians, researchers, and countless external partners that have been working for many years to advance the Viaskin peanut patch in children living with peanut allergy,” said Daniel Tassé, Chief Executive Officer, DBV Technologies.

Financial Performance and Challenges

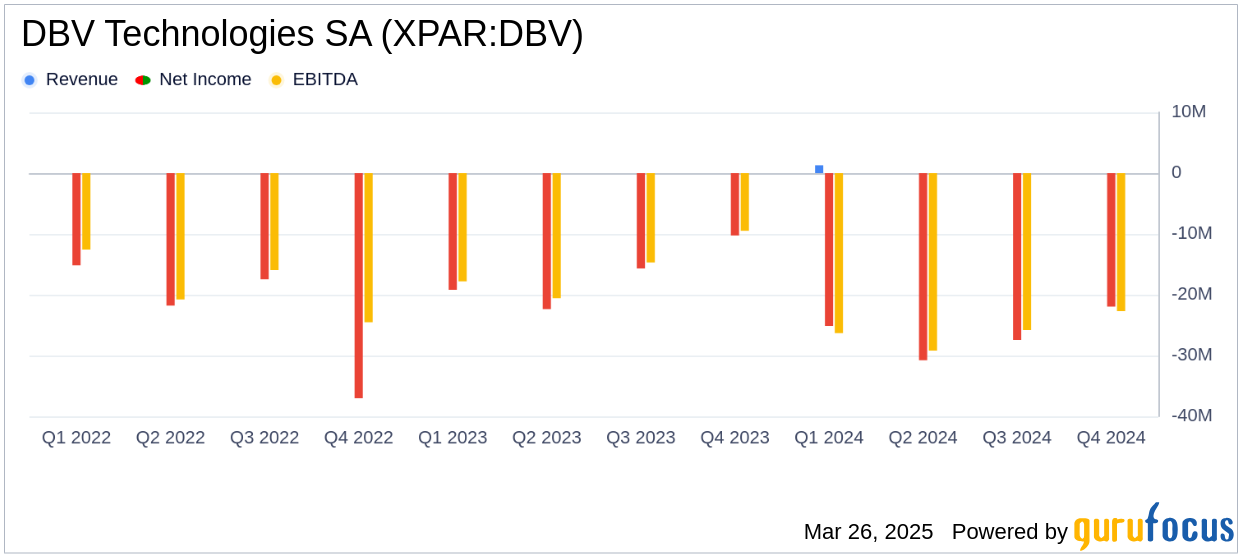

DBV Technologies SA (XPAR:DBV, Financial) reported a net loss of $113.9 million for the year ended December 31, 2024, compared to a net loss of $72.7 million in 2023. The company's operating income decreased to $4.2 million from $15.7 million in the previous year, primarily due to the termination of a collaboration agreement with Societé des Produits Nestlé S.A. and a lower Research Tax Credit.

Operating expenses rose to $120.7 million from $92.2 million in 2023, driven by increased research and development costs associated with the VITESSE Phase 3 clinical trial and preparatory activities for the COMFORT supplemental safety studies. Despite these challenges, the company's efforts to advance its clinical programs remain a priority.

Cash Flow and Financial Position

As of December 31, 2024, DBV Technologies SA (XPAR:DBV, Financial) held cash and cash equivalents totaling $32.5 million, a significant decrease from $141.4 million at the end of 2023. This reduction reflects the company's substantial investment in clinical trials and regulatory activities. The current cash reserves are projected to fund operations only until April 2025, raising concerns about the company's ability to continue as a going concern without additional financing.

“I am extremely pleased to see that FDA agrees that the VITESSE safety exposure data being generated is sufficiently robust to support a BLA in this age group,” said Dr. David Fleischer, Global Principal Investigator, VITESSE.

Conclusion and Outlook

DBV Technologies SA (XPAR:DBV, Financial) faces financial challenges as it continues to invest in its promising Viaskin Peanut Patch program. The recent FDA agreement marks a significant milestone, potentially accelerating the product's market entry. However, the company's financial sustainability hinges on securing additional funding to support its ongoing research and development efforts. Investors and stakeholders will be closely monitoring DBV Technologies SA (XPAR:DBV)'s strategic moves in the coming months as it navigates these challenges.

Explore the complete 8-K earnings release (here) from DBV Technologies SA for further details.