On March 26, 2025, Oxbridge Re Holdings Ltd (OXBR, Financial) released its 8-K filing, detailing the financial results for the fiscal year ending December 31, 2024. Oxbridge Re Holdings Ltd, a specialty property and casualty reinsurer, provides reinsurance solutions through its subsidiary, focusing on underwriting fully collateralized reinsurance contracts primarily for property and casualty insurance companies in the Gulf Coast region of the United States, with an emphasis on Florida.

Performance and Challenges

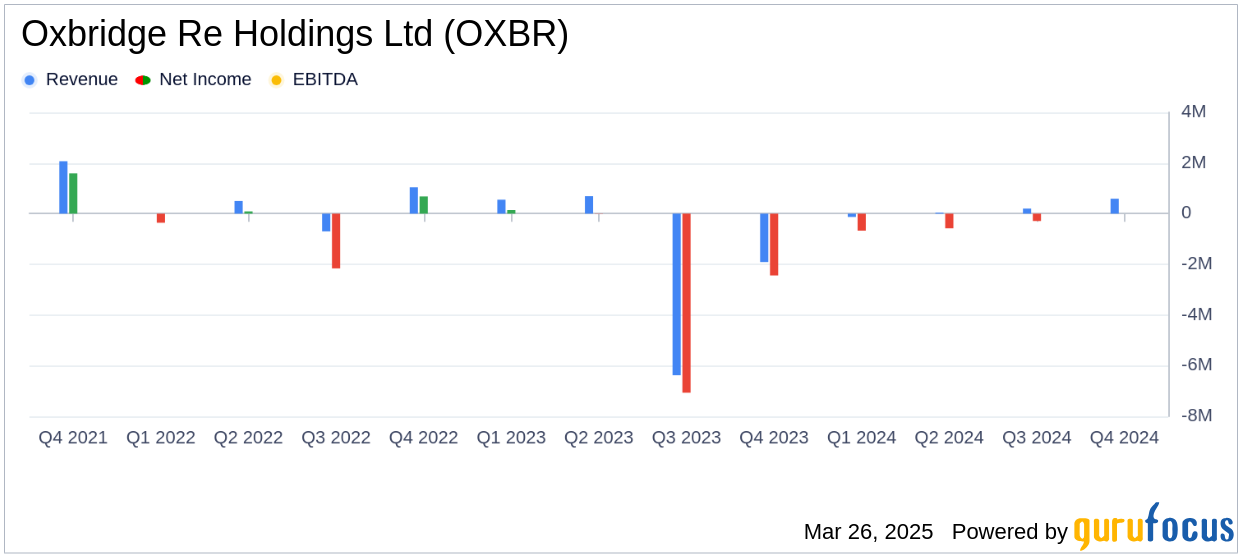

Oxbridge Re Holdings Ltd reported a net loss of $2.7 million for the year ended December 31, 2024, a significant improvement from the $9.9 million net loss in the previous year. The company's performance was bolstered by an increase in net premiums earned, which rose to $2.3 million from $1.3 million in the prior year. This increase is attributed to higher rates on contracts and a full twelve months of premium recognition in 2024 compared to only seven months in the prior year.

Despite the improved financial performance, the company faced challenges, including a decrease in the negative change in the fair value of its investment in Jet.AI, which was sold after the year-end. This factor, along with accounting for non-controlling interests, impacted the overall financial results.

Financial Achievements

Oxbridge Re Holdings Ltd's strategic focus on tokenized Real-World Assets (RWAs) through its subsidiary SurancePlus Inc. has positioned the company as a pioneer in the reinsurance industry. The company became the first public entity to issue a security token in reinsurance, significantly lowering the barrier to entry for investors. This innovation is crucial as it democratizes access to reinsurance, traditionally an asset class requiring substantial capital.

Key Financial Metrics

For the year ended December 31, 2024, Oxbridge Re Holdings Ltd reported total expenses of $2.1 million, down from $2.3 million in the prior year. The decrease is attributed to efficiencies associated with SurancePlus offerings and lower general and administrative expenses. The company's cash and cash equivalents, including restricted cash, increased to $5.8 million from $3.7 million at the end of 2023, primarily due to new collateral deposits.

| Metric | 2024 | 2023 |

|---|---|---|

| Net Premiums Earned | $2.3 million | $1.3 million |

| Net Loss | $2.7 million | $9.9 million |

| Total Expenses | $2.1 million | $2.3 million |

| Cash and Cash Equivalents | $5.8 million | $3.7 million |

Analysis of Financial Ratios

The company's loss ratio remained at 0% for both 2024 and 2023, indicating stable underwriting profitability. The acquisition cost ratio slightly decreased to 11.0% from 11.2%, reflecting improved operational efficiency. Notably, the expense ratio dropped significantly to 94.3% from 185.2%, driven by higher premium levels and reduced general administrative expenses. Consequently, the combined ratio also improved to 94.3% from 185.2%, highlighting enhanced underwriting performance.

SurancePlus is entering its third year in the Real World Asset (RWA) space, leveraging blockchain technology to tokenize targeted reinsurance contracts. As a Nasdaq-listed company, Oxbridge Re, through its subsidiary SurancePlus Inc., became the first public company to issue a security token in reinsurance—bridging the gap between the SEC, blockchain, and tokenization." - Jay Madhu, Chairman and CEO of Oxbridge Re Holdings Ltd.

Conclusion

Oxbridge Re Holdings Ltd's fiscal 2024 results reflect a year of strategic growth and financial improvement. The company's innovative approach to tokenized reinsurance and its focus on operational efficiency have positioned it well for future growth. As the market for real-world asset tokenization continues to expand, Oxbridge Re Holdings Ltd is poised to capitalize on emerging opportunities, reinforcing its commitment to democratizing access to reinsurance.

Explore the complete 8-K earnings release (here) from Oxbridge Re Holdings Ltd for further details.