Barfresh Food Group Inc (BRFH, Financial) released its 8-K filing on March 27, 2025, announcing its financial results for the fourth quarter and full year of 2024. The company, known for its ready-to-blend frozen beverages, reported a record annual revenue of $10.7 million, marking a significant milestone in its history. Despite facing operational challenges, Barfresh continues to expand its market presence, particularly in the education sector.

Company Overview

Barfresh Food Group Inc develops, manufactures, and distributes ready-to-blend frozen beverages, including smoothies, shakes, and frappes, primarily for restaurant chains and the foodservice industry. The company's proprietary system uses portion-controlled pre-packaged beverage ingredients, offering a quick, cost-efficient, and waste-free solution. Barfresh provides both single-serve and bulk format solutions, catering to high-volume locations with a variety of flavors.

Performance and Challenges

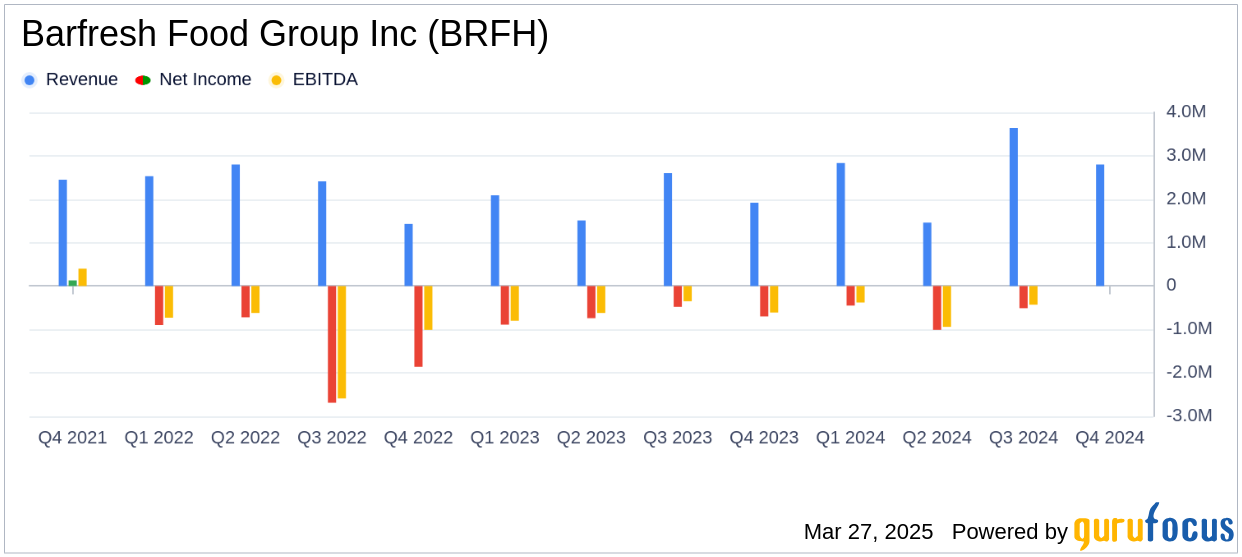

For the fourth quarter of 2024, Barfresh reported revenue of $2.8 million, a notable increase from $1.9 million in the same period of 2023. However, the company faced a net loss of $852,000, compared to a loss of $701,000 in the previous year. The gross margin for the quarter decreased to 26% from 33% in 2023, primarily due to temporary production inefficiencies and increased logistics costs. These challenges are expected to be resolved by mid-2025 as new equipment installations are completed.

Financial Achievements

Barfresh's revenue for the full year 2024 reached $10.7 million, falling short of the analyst estimate of $12.09 million. The company's gross margin for the year was 34%, with an adjusted gross margin of 37%, reflecting improvements in product mix and pricing strategies. Despite a net loss of $2.8 million, consistent with the previous year, the company improved its adjusted EBITDA to a loss of $1.3 million from $1.7 million in 2023.

Key Financial Metrics

| Metric | Q4 2024 | Q4 2023 | FY 2024 | FY 2023 |

|---|---|---|---|---|

| Revenue | $2.8M | $1.9M | $10.7M | $8.1M |

| Gross Margin | 26% | 33% | 34% | 35% |

| Adjusted Gross Margin | 30% | 33% | 37% | 35% |

| Net Loss | ($852K) | ($701K) | ($2.8M) | ($2.8M) |

| Adjusted EBITDA | ($561K) | ($427K) | ($1.3M) | ($1.7M) |

Analysis and Outlook

Barfresh's performance in 2024 highlights its ability to grow revenue despite operational hurdles. The company's strategic focus on expanding its production capacity and enhancing its product portfolio positions it well for future growth. The recent $3 million financing will support these efforts, particularly in the education market. Looking ahead, Barfresh anticipates record revenue for fiscal year 2025, projected between $14.5 million and $16.6 million, as it continues to capitalize on market opportunities.

Riccardo Delle Coste, the Company’s Chief Executive Officer, stated, “Our team delivered record annual revenue of $10.7 million in 2024, and we began generating initial revenue from Pop & Go™ 100% Juice Freeze Pops in the fourth quarter. We’ve secured an impressive string of new customer wins in the education channel as our product portfolio continues to resonate strongly with both school administrators and students alike.”

Barfresh's strategic initiatives and financial achievements underscore its potential to deliver long-term value to shareholders, making it a company to watch in the non-alcoholic beverage industry.

Explore the complete 8-K earnings release (here) from Barfresh Food Group Inc for further details.