On March 28, 2025, Leatt Corp (LEAT, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year ending December 31, 2024. Leatt Corp, known for its innovative personal protective equipment for motorsports and leisure activities, operates primarily through its Leatt-Brace brand, offering a patented neck protection system. The company functions geographically through the U.S. market.

Performance Overview

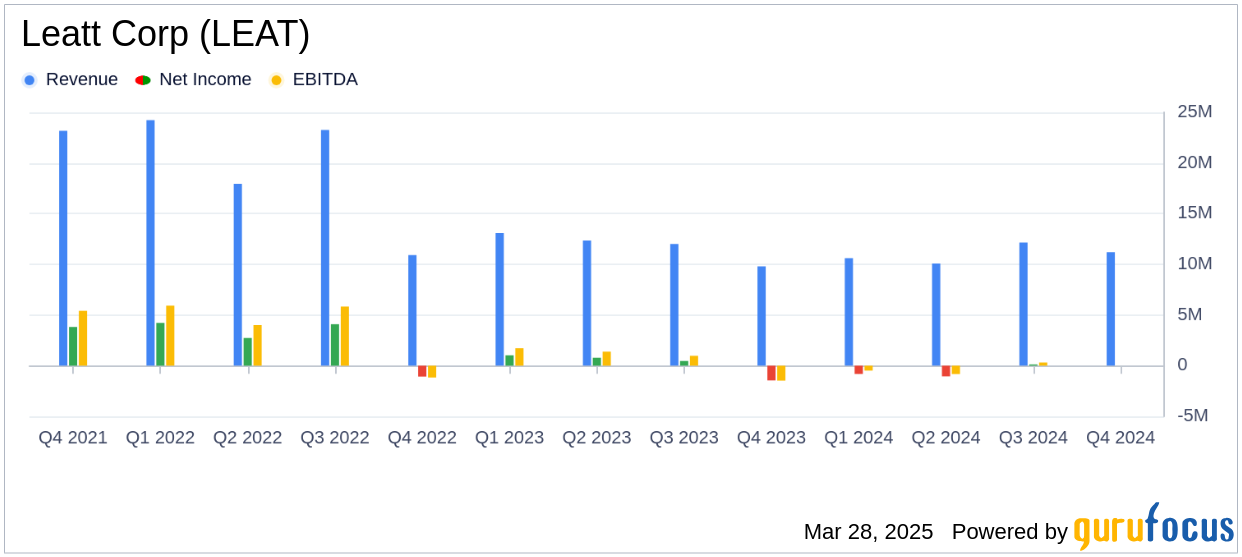

Leatt Corp (LEAT, Financial) reported a 14% increase in fourth-quarter revenues, reaching $11.20 million compared to $9.80 million in the same period of 2023. However, the company faced a net loss of $(446,459) for the quarter, a significant improvement from the $(1.46) million loss in the previous year. Despite the quarterly growth, total revenues for 2024 declined by 7% to $44.03 million from $47.24 million in 2023, primarily due to decreased sales in helmets, neck braces, and other products.

Financial Achievements and Challenges

Leatt Corp's cash and cash equivalents increased by 9% to $12.37 million by the end of 2024, supported by $2.80 million in cash flow generated from operations. The company also achieved a gross profit margin improvement, rising from 36% to 41% in the fourth quarter, indicating better domestic trading conditions and stabilized inventory levels.

Chief Executive Officer Sean Macdonald commented, "Our team is very encouraged by our return to double-digit revenue growth in the 2024 fourth quarter. Total global revenues increased by 14%, compared to the fourth quarter of 2023, fueled by international sell-through, re-stocking dynamics, and the addition of strong distribution partners in key areas."

Income Statement and Balance Sheet Insights

For the full year 2024, Leatt Corp (LEAT, Financial) reported a net loss of $(2.20) million, a stark contrast to the net income of $803,159 in 2023. The company's basic and diluted loss per share stood at $(0.35) and $(0.34), respectively. Despite the annual revenue decline, the company maintained a strong current ratio of 5.2:1, reflecting solid liquidity and efficient working capital management.

| Financial Metric | 2024 | 2023 |

|---|---|---|

| Total Revenues | $44.03 million | $47.24 million |

| Net Income (Loss) | $(2.20) million | $803,159 |

| Cash and Cash Equivalents | $12.37 million | $11.35 million |

Analysis and Outlook

Leatt Corp (LEAT, Financial) demonstrated resilience in the fourth quarter of 2024, with a notable recovery in revenue growth driven by international sales and improved inventory management. The company's strategic focus on innovative product development and expanding distribution partnerships is expected to support future growth. However, challenges such as decreased annual revenues and net losses highlight the need for continued adaptation to market dynamics.

Founder and Research and Development lead, Dr. Christopher Leatt remarked, "We continue to build out a strong pipeline of innovative protective gear for the riding community. We are very proud of the work of our design and engineering team which has received yet another honor from their peers and experts in the industry."

Leatt Corp's commitment to innovation and strategic investments in talent and product development positions it well for capturing opportunities in the growing Adventure (ADV) market segment. The company's robust balance sheet and liquidity provide a solid foundation for navigating industry challenges and pursuing long-term growth objectives.

Explore the complete 8-K earnings release (here) from Leatt Corp for further details.