Rio Tinto (RIO, Financial) has engaged in discussions with the Democratic Republic of Congo to potentially develop one of the largest hard rock lithium deposits globally. These talks aim to transform the Roche Dure resource into a lithium mine, marking Rio's (RIO) strategic expansion into challenging regions. Such a partnership would be significant for Congo, aligning with their discussions with the U.S. about a minerals-for-security agreement. Meanwhile, AVZ Minerals (OTCPK:AZZVF) is pursuing arbitration to regain rights over the project, which it initially explored before the government revoked its license in 2023.

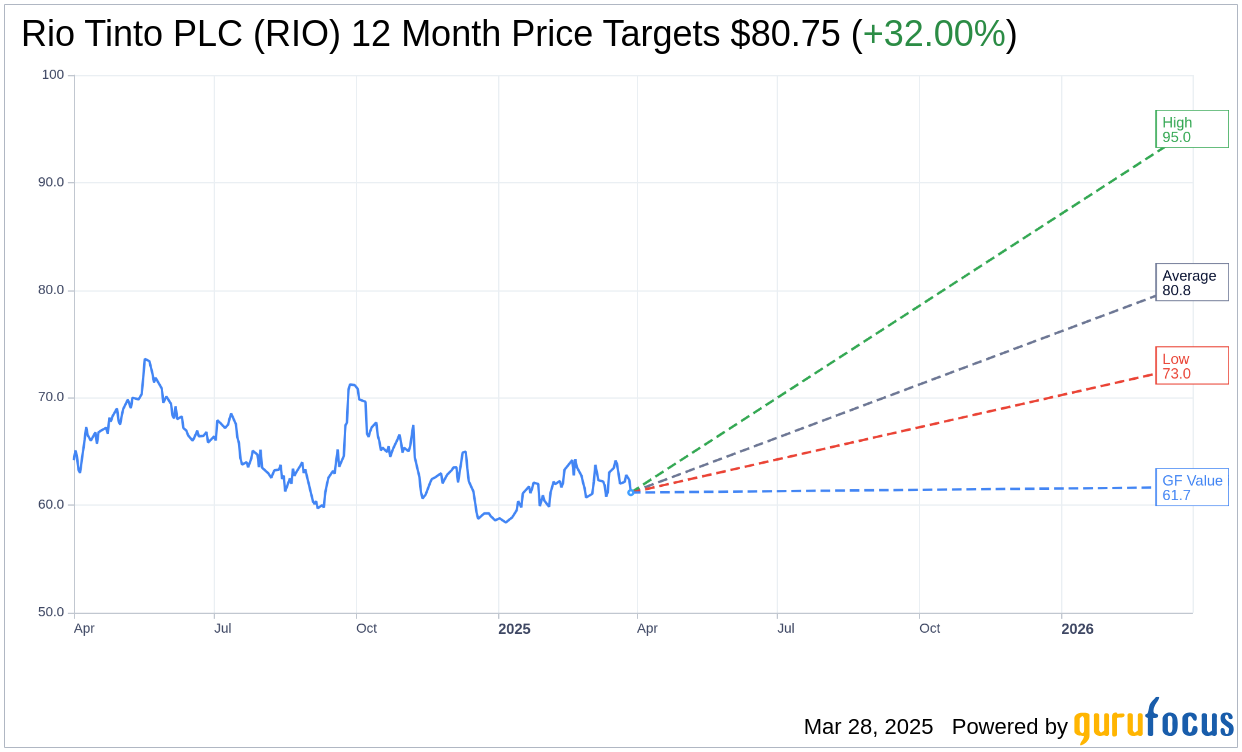

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Rio Tinto PLC (RIO, Financial) is $80.75 with a high estimate of $95.00 and a low estimate of $73.00. The average target implies an upside of 32.00% from the current price of $61.18. More detailed estimate data can be found on the Rio Tinto PLC (RIO) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Rio Tinto PLC's (RIO, Financial) average brokerage recommendation is currently 1.3, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Rio Tinto PLC (RIO, Financial) in one year is $61.67, suggesting a upside of 0.81% from the current price of $61.175. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Rio Tinto PLC (RIO) Summary page.