- Enterprise Products Partners (EPD, Financial) and NNN REIT boast attractive dividend yields of over 5.5%, significantly higher than the S&P 500 average.

- EPD supports its 6.3% yield through robust cash flow and substantial expansion projects worth $7.6 billion.

- NNN REIT maintains a 35-year track record of consistent dividend growth thanks to its stable retail property investments.

Enterprise Products Partners (EPD) and NNN REIT are currently shining in the investment world, offering dividend yields that exceed 5.5%, a figure that significantly outperforms the average yield of the S&P 500. With EPD's 6.3% yield, investors are tapping into a steady cash flow stemming from its critical energy infrastructure projects, with $7.6 billion earmarked for expansions. In contrast, NNN REIT's 5.5% yield is underpinned by its reliable single-tenant retail properties and prudent financial strategies, contributing to an impressive 35-year streak in dividend growth.

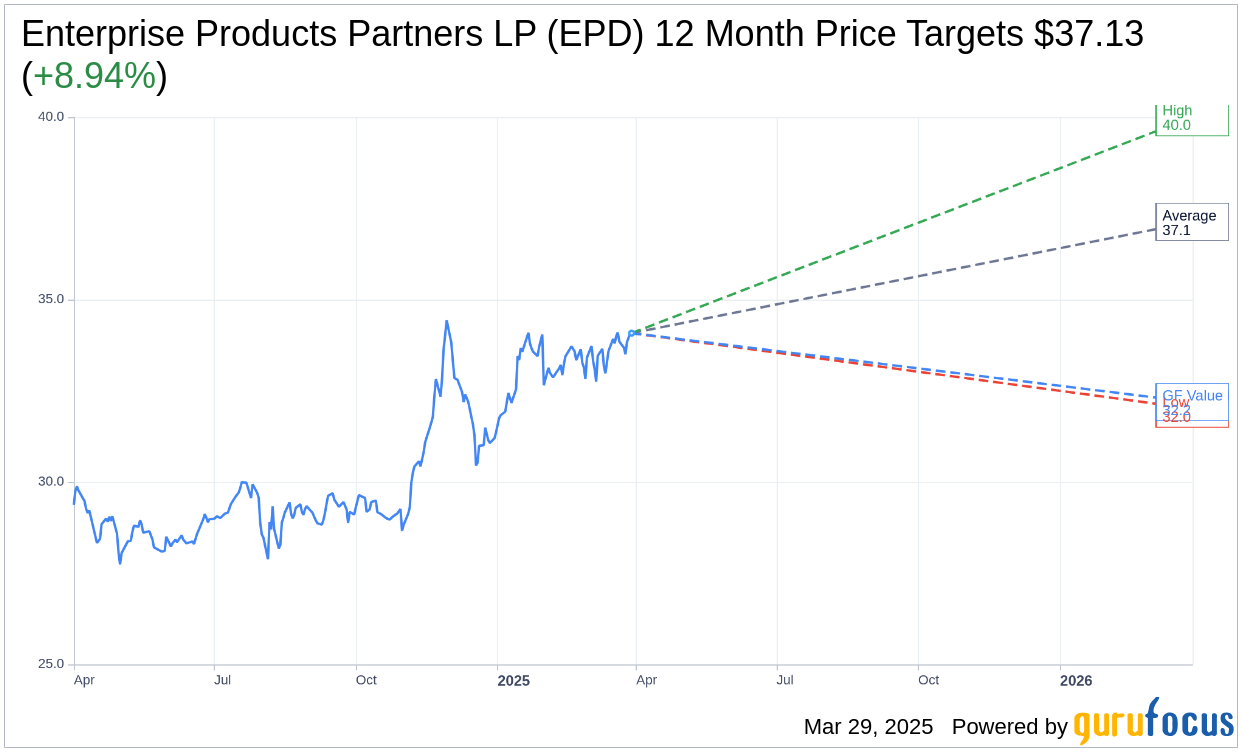

Wall Street Analysts Forecast

According to the insights of 16 analysts, Enterprise Products Partners LP (EPD, Financial) is expected to reach an average target price of $37.13 in the next year. With high estimates reaching $40.00 and low estimates at $32.01, this average target presents an anticipated upside of 8.94% from its current trading price of $34.08. For more detailed forecasts, visit the Enterprise Products Partners LP (EPD) Forecast page.

In terms of brokerage recommendations, EPD enjoys a status of "Outperform" with an average recommendation score of 1.9, based on judgments from 20 brokerage firms. This score is part of a scale ranging from 1, which stands for Strong Buy, to 5, representing a Sell recommendation.

According to GuruFocus' estimates, the projected GF Value for EPD in the upcoming year is pegged at $32.19, indicating a potential downside of 5.55% from its current price of $34.08. The GF Value is GuruFocus' calculated fair value for the stock, derived from historical trading multiples, past growth records, and future performance projections. For an in-depth analysis, consult the Enterprise Products Partners LP (EPD, Financial) Summary page.

Also check out: (Free Trial)