Key Takeaways:

- VICI Properties Inc. is strategically positioned for growth in the gaming and hospitality real estate market.

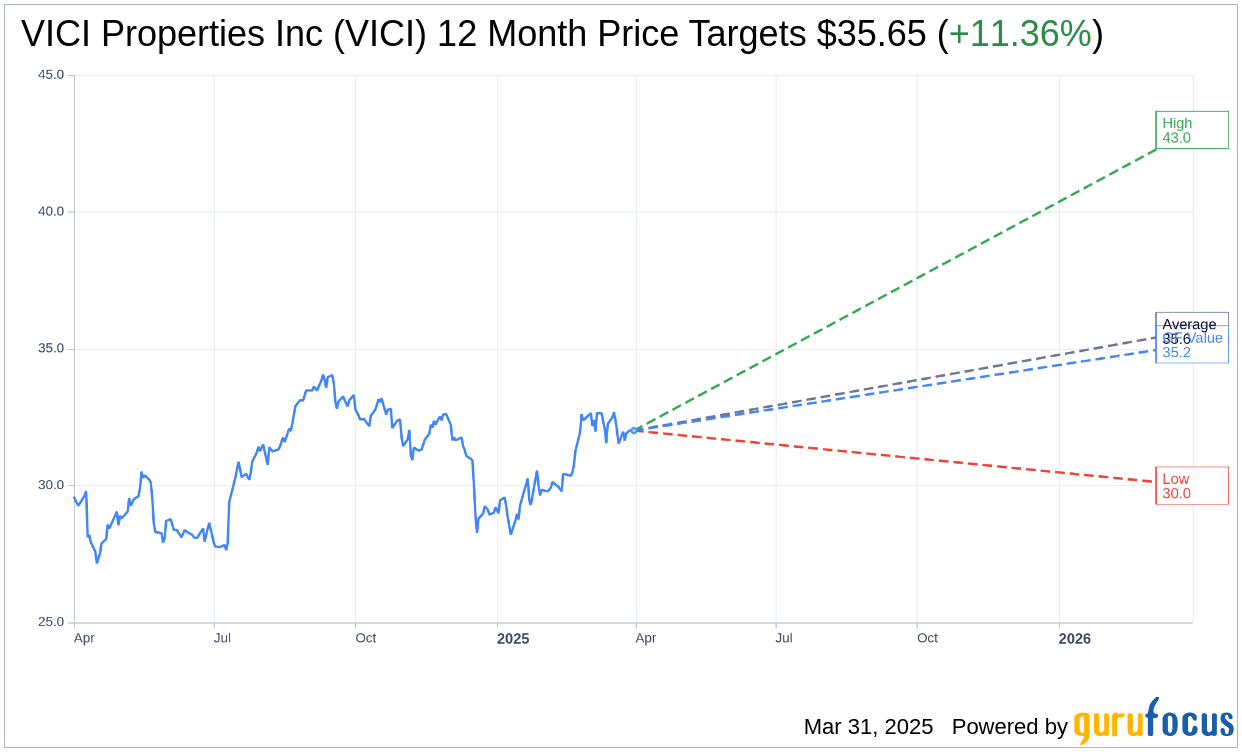

- Analysts project a potential upside of 11.36% with a robust "Outperform" rating.

- Significant investments, such as the $300 million Beverly Hills project, highlight VICI's growth ambitions.

In the dynamic landscape of real estate investment trusts (REITs), VICI Properties Inc. (NYSE: VICI) emerges as a standout performer. Specializing in gaming and hospitality venues, VICI combines strategic investments with robust asset management, positioning itself as a lucrative non-tech stock for 2025. Its portfolio boasts 93 prime assets, including the iconic Caesars Palace, demonstrating its extensive reach and influence in the sector. A notable $300 million investment into a luxury Beverly Hills project underscores VICI's forward-thinking growth strategy, backed by stable interest rates and deepening partnerships.

Wall Street Analysts' Outlook

Delving into analyst predictions, we find that 22 experts have set a one-year price target for VICI Properties Inc., averaging at $35.65. With projections ranging from a high of $43.00 to a low of $30.00, this suggests a potential upside of 11.36% from the current stock price of $32.01. For a comprehensive analysis, additional data is accessible on the VICI Properties Inc. (VICI, Financial) Forecast page.

The consensus recommendation from 25 brokerage firms pegs VICI Properties Inc. with an average rating of 1.8, categorizing it as "Outperform." This recommendation scale, where 1 signifies Strong Buy and 5 denotes Sell, highlights the confidence analysts have in VICI's strategic positioning and future potential.

Understanding VICI's GF Value

According to GuruFocus metrics, the estimated GF Value for VICI Properties Inc. in one year's time is projected at $35.16. This presents an anticipated upside of 9.84% from its current trading price of $32.01. The GF Value is a crucial indicator, reflecting what the stock should ideally be worth based on historical trading multiples, previous business growth, and forecasted performance metrics. Investors can explore further details on the VICI Properties Inc. (VICI, Financial) Summary page.