On March 31, 2025, Local Bounti Corp (LOCL, Financial) released its 8-K filing detailing its financial performance for the year ending December 31, 2024. Local Bounti Corp, a controlled environment agriculture company, focuses on delivering fresh produce with a limited carbon footprint through its innovative smart greenhouse technology.

Performance Overview and Challenges

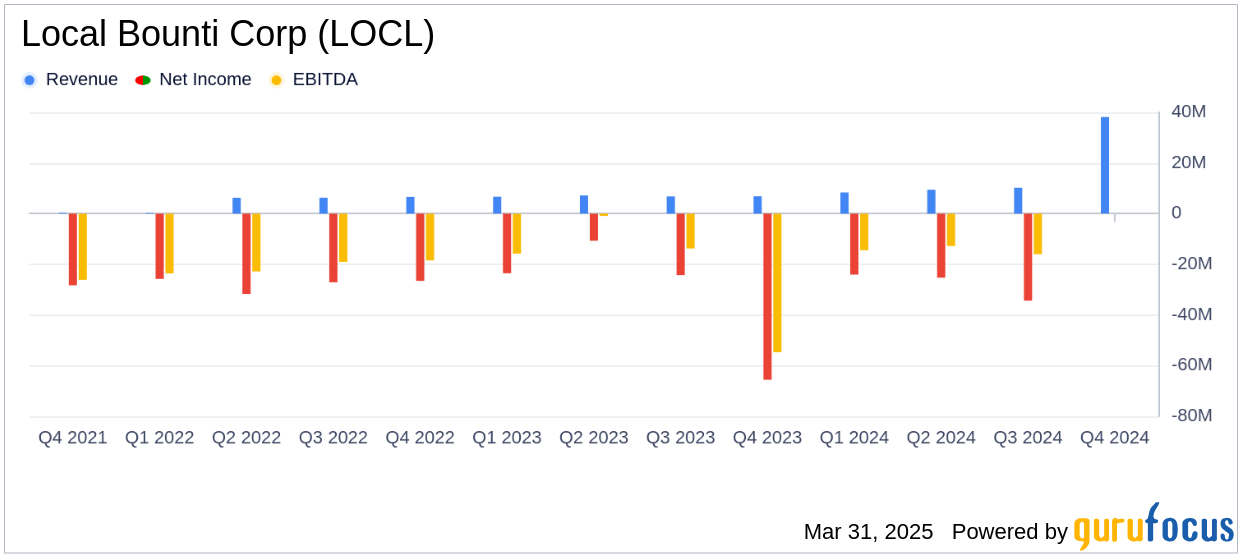

Local Bounti Corp reported a 38% increase in sales, reaching $38.1 million in 2024, slightly below the annual revenue estimate of $39.00 million. This growth was driven by increased production and new facilities in Texas and Washington. However, the company faced a net loss of $119.9 million, slightly improving from a $124.0 million loss in the previous year. The estimated annual earnings per share (EPS) was -13.81, indicating ongoing challenges in achieving profitability.

Financial Achievements and Industry Importance

Local Bounti Corp secured $27.5 million in new funding, including $25 million in equity proceeds and $2.5 million in capex financing. The company also restructured its existing credit facility, reducing debt by approximately 40% and extending repayment terms to 2035. These financial maneuvers are crucial for the Consumer Packaged Goods industry, as they provide the necessary capital to support growth and operational improvements.

Key Financial Metrics and Statements

The company's gross profit for 2024 was $4.1 million, with an adjusted gross margin of approximately 27%. Selling, general, and administrative expenses decreased significantly by $23.8 million to $40.8 million, reflecting cost-saving measures. Research and development expenses increased to $22.3 million, driven by non-cash depreciation and stock compensation expenses.

| Financial Metric | 2024 | 2023 |

|---|---|---|

| Sales | $38.1 million | $27.6 million |

| Net Loss | $119.9 million | $124.0 million |

| Adjusted EBITDA Loss | $32.1 million | $34.1 million |

Analysis of Company Performance

Local Bounti Corp's revenue growth and debt restructuring are positive indicators of its potential to achieve profitability. The company's strategic focus on expanding its product mix and optimizing production costs is expected to enhance its adjusted gross margin over time. However, the ongoing net losses and increased research and development expenses highlight the challenges in reaching positive adjusted EBITDA.

Kathleen Valiasek, President, CEO, and CFO of Local Bounti, stated, “Our successful financing transaction has resulted in new equity infusion and a significant restructuring of our debt... This restructuring and equity infusion, combined with our focused efforts to improve our operational efficiency, have significantly strengthened our financial foundation.”

Local Bounti Corp's strategic initiatives, including leadership succession and expanded distribution with major retailers like Walmart, position the company for sustainable growth. The company's commitment to innovation and customer-centric operations is evident in its product development and facility expansion plans.

Explore the complete 8-K earnings release (here) from Local Bounti Corp for further details.