On March 31, 2025, Li-Cycle Holdings Corp (LICYF, Financial) released its 8-K filing detailing its financial results for the fiscal year ended December 31, 2024. Li-Cycle Holdings Corp is a prominent player in the lithium-ion battery resource recovery and recycling industry, utilizing its proprietary Spoke and Hub recycling process to recover valuable materials such as lithium carbonate, cobalt sulphate, and nickel sulphate.

Performance Overview and Challenges

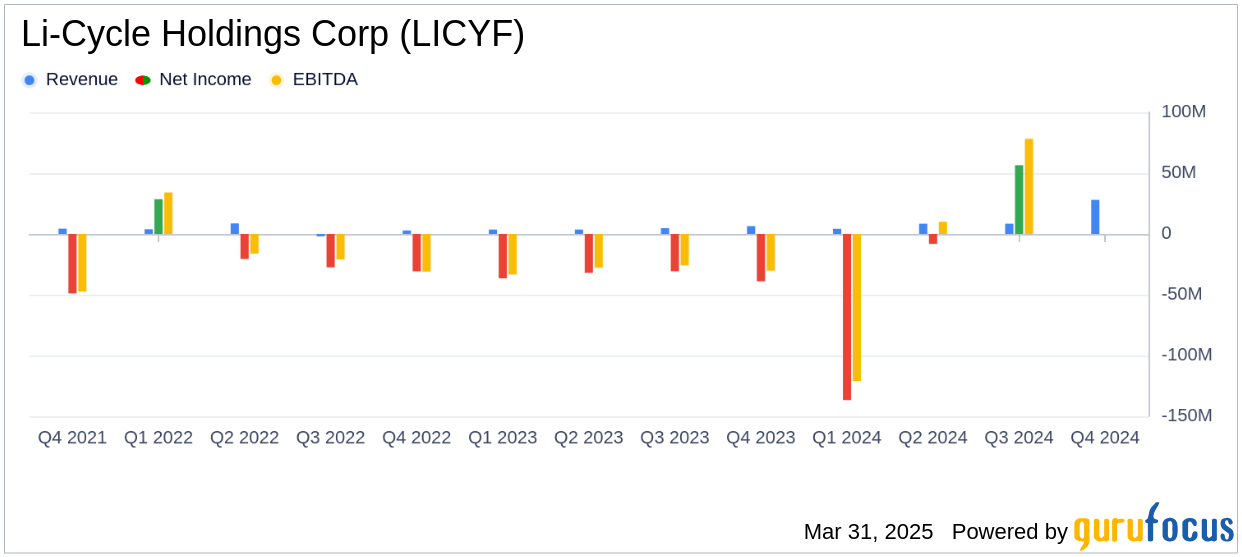

Li-Cycle Holdings Corp reported a total revenue of $28.0 million for 2024, marking a 53% increase from the previous year. This figure, however, fell slightly short of the annual revenue estimate of $29.00 million. The company's net loss was approximately $137.7 million, closely aligning with the previous year's net loss of $138.0 million. Despite the revenue growth, the company faces significant challenges, including the need for additional financing to meet its obligations and the ongoing evaluation of strategic alternatives, including a potential transaction with Glencore.

Financial Achievements and Industry Impact

Li-Cycle's revenue from product sales and recycling services increased to $27.3 million, a 16% rise from 2023, driven by new service contracts and higher volumes sold. The company's efforts to reduce expenses were evident, with a 13% decrease in total expenses, primarily due to cash preservation initiatives. These achievements are crucial for the waste management industry, as they highlight the company's ability to enhance operational efficiency and adapt to market demands.

Key Financial Metrics

Li-Cycle's cost of sales decreased to $76.6 million from $81.8 million in 2023, reflecting lower material costs and inventory adjustments. Selling, general, and administrative expenses were reduced by 19% to $75.3 million, attributed to restructuring activities and decreased personnel costs. The company's adjusted EBITDA loss improved to $90.5 million from $156.4 million in 2023, indicating progress in operational efficiency.

| Financial Highlights | 2024 | 2023 | Change |

|---|---|---|---|

| Revenue | $28.0 million | $18.3 million | $9.7 million |

| Cost of Sales | $(76.6) million | $(81.8) million | $5.2 million |

| SG&A Expenses | $(75.3) million | $(93.4) million | $18.1 million |

| Net Loss | $(137.7) million | $(138.0) million | $0.3 million |

| Adjusted EBITDA Loss | $(90.5) million | $(156.4) million | $65.9 million |

Analysis and Strategic Considerations

Li-Cycle's financial performance in 2024 demonstrates its ability to increase revenue and reduce costs, which are critical for sustaining operations in the competitive waste management sector. However, the company's ongoing need for additional financing and strategic alternatives poses a significant challenge. The potential transaction with Glencore could provide a strategic boost, but the outcome remains uncertain.

Ajay Kochhar, Li-Cycle’s President & CEO, commented: “In 2024, we advanced key priorities for the Company, including closing our $475 million loan facility with the U.S. Department of Energy to help finance our Rochester Hub project and advancing optimization initiatives at our Spoke business. We believe we are well-positioned to support, and are aligned with, the energy priorities of the U.S. government as they look to bolster and onshore the energy supply chain through the domestic production of critical minerals. Looking ahead, we are focused on managing our cash position while considering our financial and strategic alternatives.”

Li-Cycle's strategic focus on aligning with U.S. energy priorities and optimizing its operations positions it well for future growth. However, the company's ability to secure additional financing and navigate strategic alternatives will be crucial in determining its long-term success.

Explore the complete 8-K earnings release (here) from Li-Cycle Holdings Corp for further details.