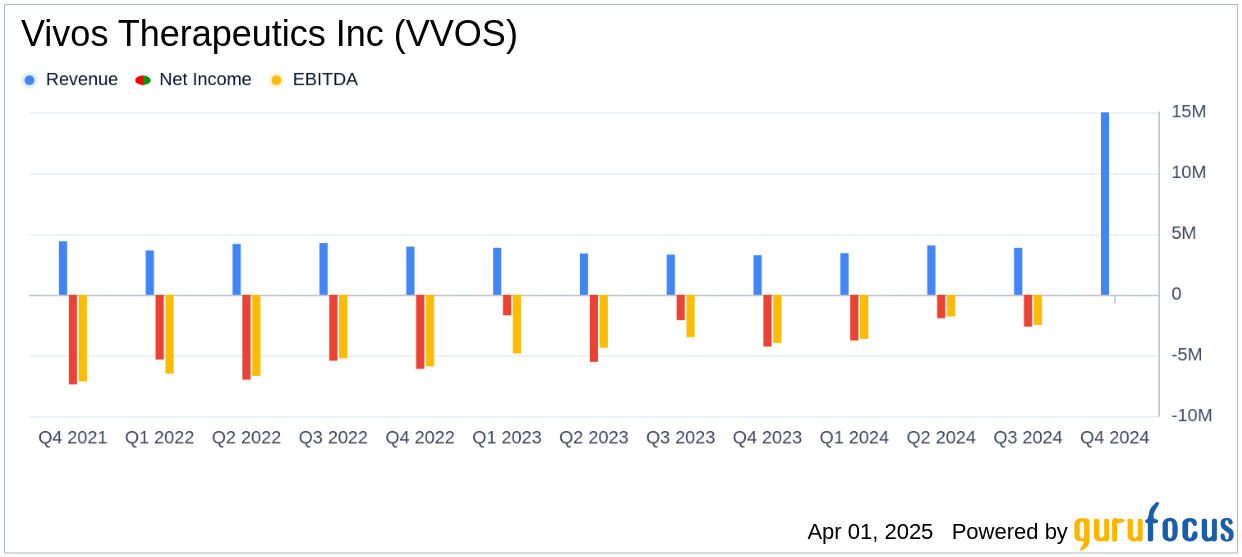

On March 31, 2025, Vivos Therapeutics Inc (VVOS, Financial) released its 8-K filing detailing its financial performance for the year ended December 31, 2024. The company, a medical technology firm specializing in non-surgical treatments for sleep-disordered breathing, reported a 9% increase in revenue to $15.0 million, slightly below the annual estimate of $15.20 million. However, the company reported a net loss per share of $2.22, which is better than the estimated annual loss of $2.25 per share.

Company Overview

Vivos Therapeutics Inc is focused on developing and commercializing innovative solutions for sleep-disordered breathing, including obstructive sleep apnea (OSA). The company's Vivos System offers a non-invasive, cost-effective treatment protocol involving customized oral appliances and clinical treatments prescribed by trained dentists.

Performance and Challenges

Vivos Therapeutics Inc reported a 26% increase in product revenue year-over-year, contributing to the overall revenue growth. However, the company faced challenges with decreased revenue from Vivos Integrated Practice (VIP) enrollments due to a strategic shift towards provider-based alliances. This shift is crucial as it aims to enhance long-term revenue growth by focusing on contractual alliances with sleep healthcare providers.

Financial Achievements

The company achieved a significant reduction in operating expenses by 21%, amounting to $20.2 million, and decreased its operating loss by 35% to $11.2 million. These achievements are vital for a company in the Medical Devices & Instruments industry, as they indicate improved operational efficiency and a stronger financial position.

Key Financial Metrics

Vivos Therapeutics Inc's gross profit increased to $9.0 million, with a stable gross margin of 60%. The company's cash and cash equivalents rose to $6.3 million, supported by $17.9 million raised through equity transactions. These metrics highlight the company's efforts to strengthen its financial foundation and liquidity.

| Metric | 2024 | 2023 |

|---|---|---|

| Total Revenue | $15.0 million | $13.8 million |

| Operating Expenses | $20.2 million | $25.6 million |

| Net Loss | $(11.1) million | $(13.6) million |

| Cash and Cash Equivalents | $6.3 million | $1.6 million |

Strategic Developments

In 2024, Vivos Therapeutics Inc received FDA clearance for its DNA appliance to treat moderate to severe OSA in children, complementing its previous clearance for adults. This regulatory milestone enhances the company's credibility and market potential.

Kirk Huntsman, Vivos’ Chairman and CEO, stated, “In 2024, we increased revenue while continuing to lower our cost structure. We continued to receive FDA approvals on our products and position ourselves for long-term revenue growth.”

Analysis and Outlook

Vivos Therapeutics Inc's strategic pivot towards alliances with sleep healthcare providers is expected to drive future growth. The company's ability to reduce costs and secure FDA approvals positions it well for continued improvements in 2025. However, the challenge remains to convert these strategic initiatives into sustained profitability.

For more detailed financial information, interested parties can access Vivos Therapeutics Inc's full 10-K report on the SEC Filings section of the company's Investor Relations website.

Explore the complete 8-K earnings release (here) from Vivos Therapeutics Inc for further details.