Summary:

- XPeng Inc (XPEV, Financial) saw a remarkable 268% growth in Smart EV deliveries in March 2025.

- The company's stock has soared by 167% over the last year, driven by strong sales performance.

- Analysts predict an average target price of $22.40 for XPEV, suggesting potential upside for investors.

Chinese electric vehicle manufacturer XPeng Inc (XPEV) has captured investor attention with its impressive growth trajectory. In March 2025, the company delivered a staggering 33,205 Smart EVs, marking a substantial 268% increase from previous figures. Throughout the first quarter, XPeng achieved deliveries totaling 94,008 vehicles, reflecting a 331% surge year-over-year. This remarkable performance has fueled a 167% rise in XPeng's stock over the past year, aided by fourth-quarter revenues of 16.11 billion Chinese Yuan, which surpassed market expectations. A robust and expanding sales network has been pivotal to this success.

Wall Street Analysts' Forecast

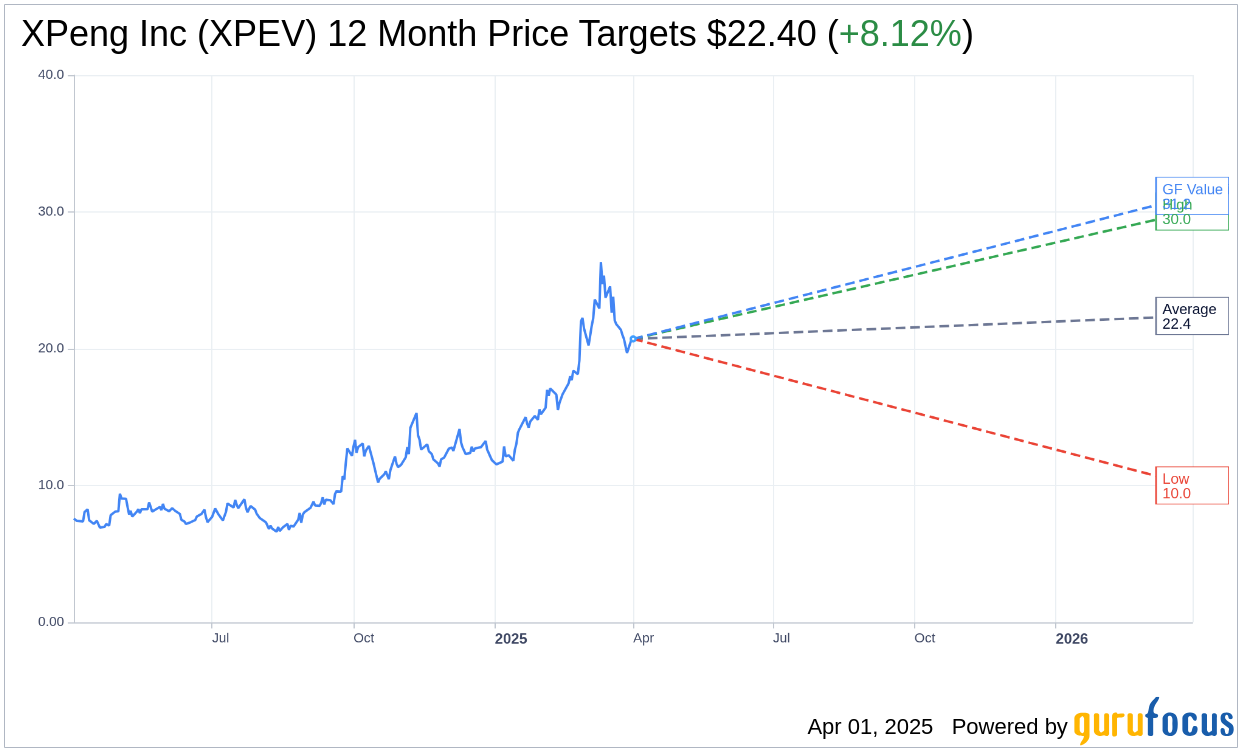

Wall Street analysts are optimistic about XPeng Inc's future. According to price targets from 25 analysts, the average target price for XPeng Inc (XPEV, Financial) is projected to be $22.40. Estimates vary, with a high of $30.04 and a low of $10.01. This average target suggests a potential upside of 8.12% from the current trading price of $20.72. Investors can access more detailed projections on the XPeng Inc (XPEV) Forecast page.

Furthermore, consensus from 24 brokerage firms places XPeng Inc's (XPEV, Financial) average brokerage recommendation at 2.3, indicating an "Outperform" status. This rating scale ranges from 1 (Strong Buy) to 5 (Sell), positioning XPeng attractively for investors seeking robust growth prospects.

In terms of valuation, GF Value estimates for XPeng Inc (XPEV, Financial) over the next year predict a fair value of $31.18. This suggests a potential upside of 50.48% from the current price of $20.72. The GF Value metric, proprietary to GuruFocus, evaluates what the stock should ideally be traded at, factoring in historical trading multiples, past business growth, and future performance forecasts. More detailed insights are available on the XPeng Inc (XPEV) Summary page.