- XPeng Inc. (XPEV, Financial) delivered a remarkable 268% surge in March, achieving record-breaking quarterly figures.

- Wall Street analysts maintain an optimistic stance on XPeng, projecting a notable upside.

- GuruFocus forecasts a significant increase in XPeng's fair value, highlighting its growth potential.

Chinese electric vehicle manufacturer XPeng (XPEV) recently reported a staggering 268% leap in March deliveries, marking a profound achievement with 33,205 units. This milestone propelled XPeng to surpass its first-quarter target, culminating in an impressive 94,008 vehicles—a 331% year-on-year surge. In parallel, peers Nio (NIO) and Li Auto (LI) also enjoyed robust double-digit growth in their March deliveries. These promising developments in the Chinese EV market contrast sharply with Tesla's (TSLA) projections, which anticipate below-expectation deliveries, especially in key markets like China and Europe.

Analyst Expectations for XPeng

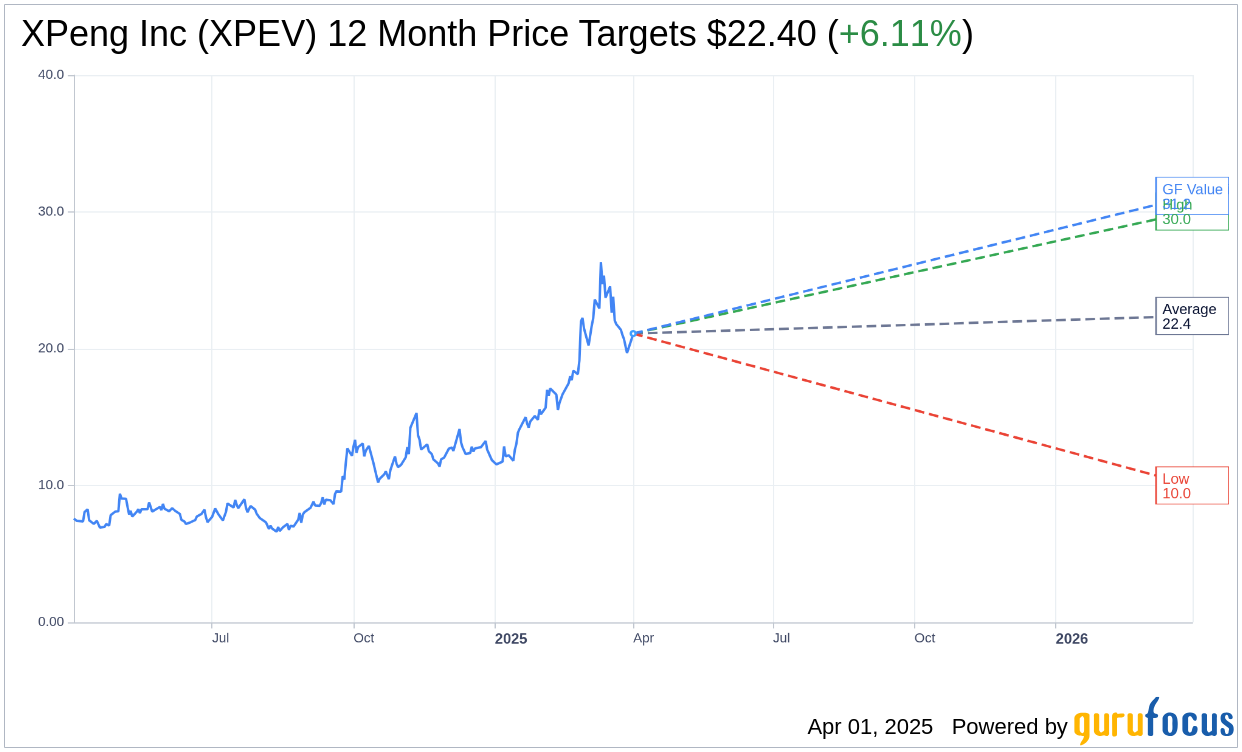

Looking ahead, 25 analysts offer their one-year price targets for XPeng Inc (XPEV) with an average target of $22.40. Estimates range from a high of $30.04 to a low of $10.01, representing a potential upside of 6.17% from the current price of $21.10. For more in-depth analysis, visit the XPeng Inc (XPEV, Financial) Forecast page.

The consensus from 24 brokerage firms rates XPeng Inc's (XPEV) average recommendation as 2.3, translating to an "Outperform" status. The recommendation scale spans from 1, indicating a Strong Buy, to 5, signifying a Sell.

Evaluating XPeng's Fair Value

In terms of valuation, GuruFocus projects the GF Value for XPeng Inc (XPEV) at $31.18 within the coming year. This projection suggests a potential upside of 47.77% from the current price of $21.0998, offering considerable growth opportunities for investors. The GF Value is GuruFocus' proprietary measure of a stock’s fair value, derived from historical trading multiples, past business performance, and future growth projections. For further details, explore the XPeng Inc (XPEV, Financial) Summary page.