- Sands Capital's Select Growth Fund outperformed with an 8.8% Q4 return, eclipsing the Russell 1000 Growth Index.

- Roblox Corporation (RBLX, Financial) experienced a notable 32% revenue surge, hitting $988 million, surpassing market expectations.

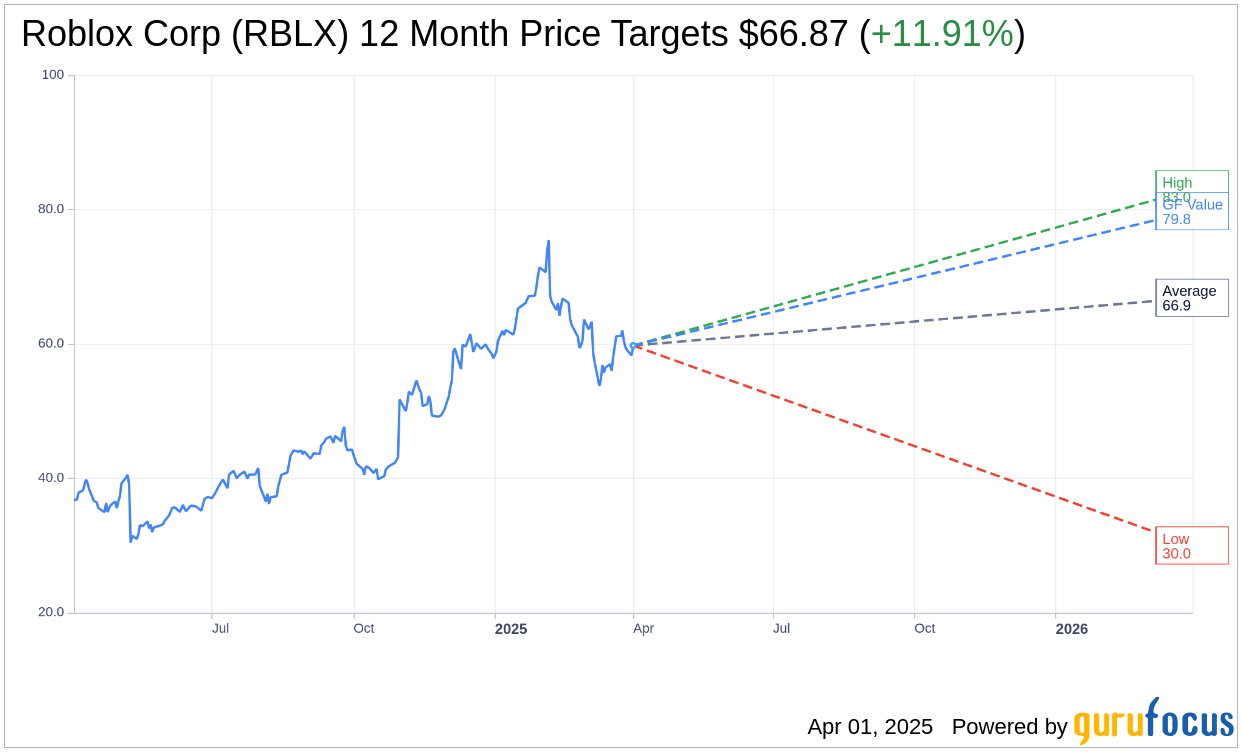

- Analysts see an upside potential of 11.91% for Roblox, with a GF Value suggesting a 33.47% increase.

Sands Capital's Select Growth Fund showcased a robust performance in the fourth quarter of 2024, achieving an 8.8% return, which outperformed the Russell 1000 Growth Index's 7.1%. A standout contributor to this success is Roblox Corporation (RBLX), a company renowned for its dynamic and interactive platform. Roblox reported an impressive 32% increase in revenue year-over-year, reaching a remarkable $988 million, thus exceeding analysts' projections. Despite a minor 6.97% decline in one-month returns, Roblox's shares surged by 58.57% over the past year, culminating in a closing price of $58.29 on March 31, 2025, with a market capitalization of $38.9 billion.

Wall Street Analysts Forecast

In the arena of Wall Street projections, 29 analysts have set their one-year price target for Roblox Corp (RBLX, Financial) at an average of $66.87. Estimates vary widely, with the highest target at $83.00 and the lowest at $30.00, presenting an average potential upside of 11.91% from its current trading value of $59.75. Further details on these projections are available on the Roblox Corp (RBLX) Forecast page.

Brokerage Recommendations & GF Value

Consensus from 33 brokerage firms positions Roblox Corp (RBLX, Financial) with an average recommendation of 2.4, translating to an "Outperform" rating. This brokerage rating scale ranges from 1 to 5, with 1 being a Strong Buy and 5 being a Sell.

Delving into GuruFocus insights, the estimated GF Value for Roblox Corp (RBLX, Financial) is pegged at $79.75 for the next year, indicating a promising upside of 33.47% from its existing price of $59.75. The GF Value represents GuruFocus' calculated fair value for the stock, based on historical trading multiples, past business growth, and forecasts for future business performance. For deeper analysis, visit the Roblox Corp (RBLX) Summary page.