Summary:

- Progress Software (PRGS, Financial) reports a strong fiscal 2025 Q1 performance, leading to an 8% stock rise.

- Despite positive results, the stock has seen a 15% decline in 2025.

- Wall Street analysts and GuruFocus metrics point to significant potential upside.

Impressive Quarterly Earnings Propel Stock Growth

Progress Software (PRGS) experienced an 8% boost in its stock price following the release of its notable fiscal 2025 first-quarter results. The company reported an adjusted earnings per share (EPS) of $1.31, coupled with revenues of $238 million. These figures were a significant beat against analysts' projections, which forecasted an EPS of $1.06 and revenues of $235.9 million. The company's confidence in its future performance is also reflected in the revised full-year EPS forecast, now estimated to be between $5.25 and $5.37. Despite this positive momentum, PRGS shares have seen a decline of nearly 15% so far in 2025.

Forecasting Future Performance

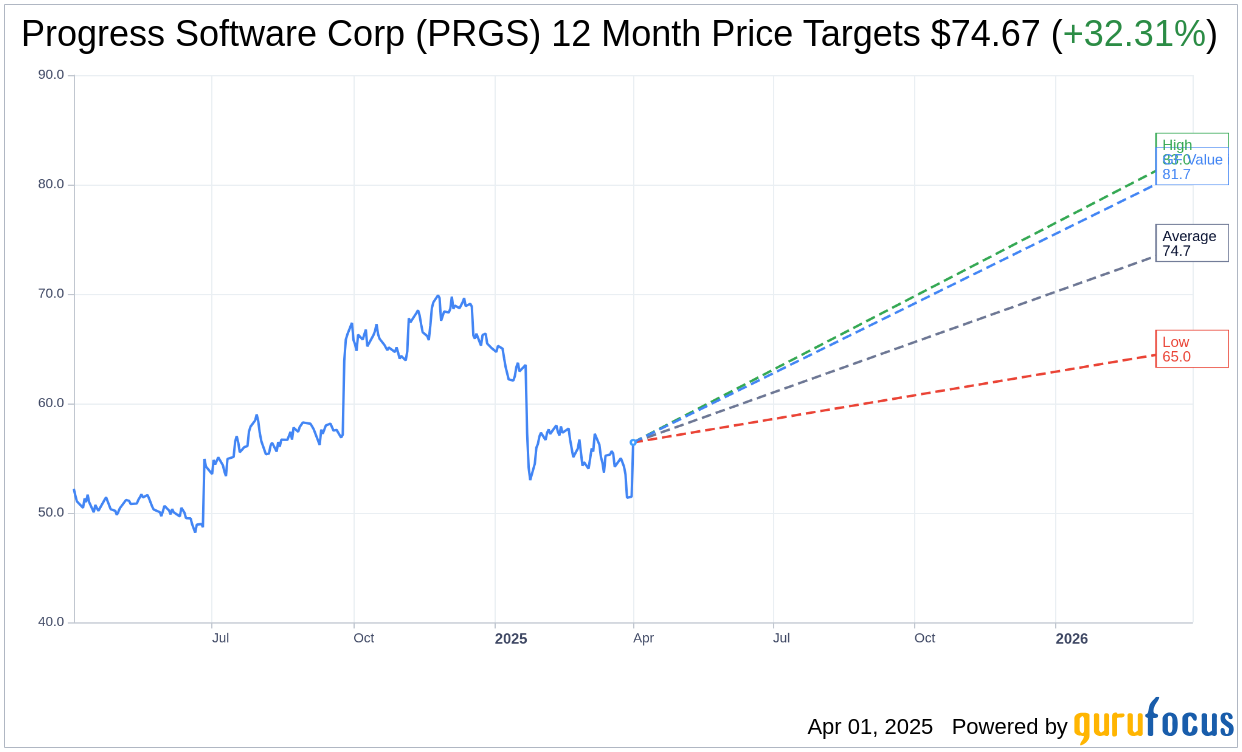

Wall Street analysts have set their sights on Progress Software Corp (PRGS, Financial) with a one-year average price target of $74.67. This analysis includes a range varying from a high of $83.00 to a low of $65.00. With the current stock price at $56.60, the average target suggests a potential upside of 31.92%. For a more comprehensive breakdown, visit the Progress Software Corp (PRGS) Forecast page.

Analysts' Recommendations

Progress Software Corp (PRGS, Financial) enjoys an "Outperform" status based on the consensus from seven brokerage firms, resulting in an average brokerage recommendation of 1.9. This rating indicates a strong confidence in the stock, with the rating scale spanning from 1 (Strong Buy) to 5 (Sell).

GuruFocus Estimates and Value Projections

According to estimates from GuruFocus, the estimated GF Value for Progress Software Corp (PRGS, Financial) over the next year stands at $81.68. This projection presents a notable 44.31% upside from the current stock price of $56.60. The GF Value reflects GuruFocus' determination of a stock's fair trading value, calculated considering historical trading multiples, previous business growth, and future performance projections. For further insights, explore the Progress Software Corp (PRGS) Summary page.