- Ford's Q1 vehicle sales dropped, but electric and hybrid models saw significant growth.

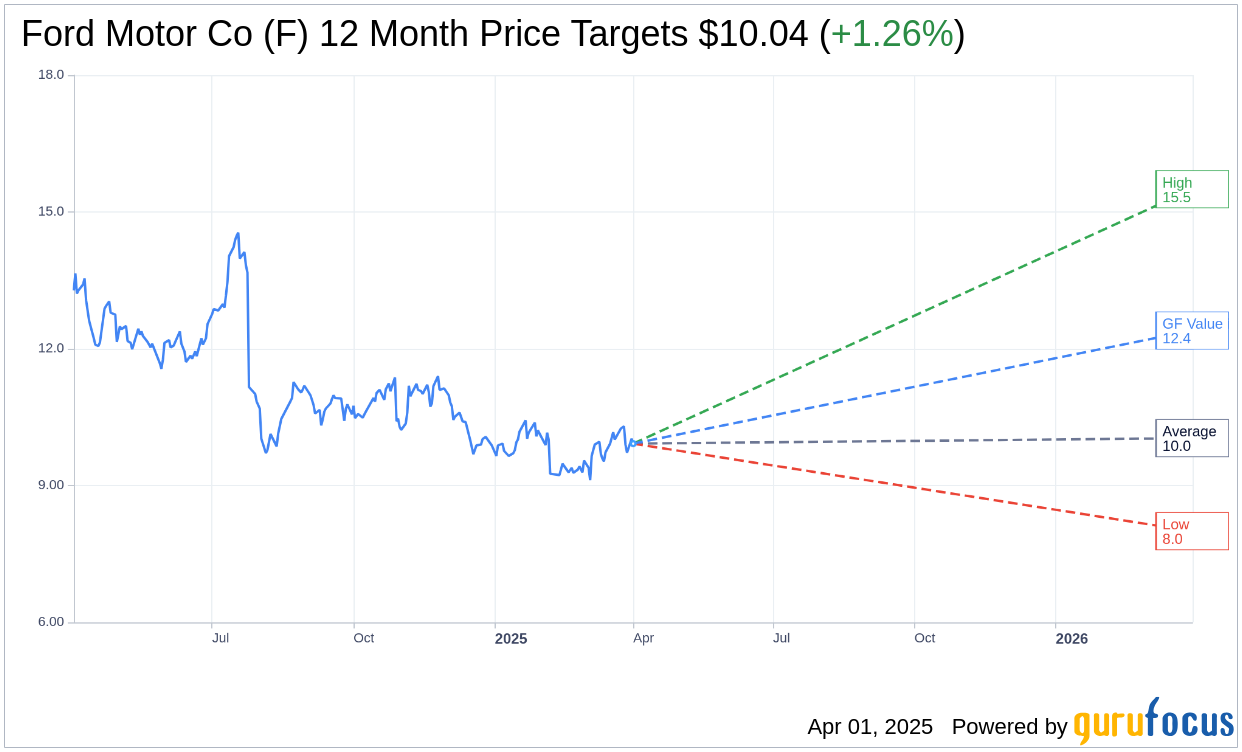

- Analysts set an average one-year price target of $10.04 for Ford's stock.

- GuruFocus estimates a substantial upside potential with a GF Value of $12.40.

Ford Motor Co. (F, Financial) recently released its U.S. vehicle sales figures for the first quarter, showing a 1.3% decrease in total units sold, reaching 501,291. While sales for internal combustion vehicles faced a 4.8% decline to 427,668 units, there was notable growth in other segments. Electric vehicles increased sales by 11.5%, and hybrids surged by 32.9%. Despite these developments, Ford's shares experienced a 0.9% drop in midday trading.

Wall Street Analysts Forecast

The market outlook for Ford Motor Co (F, Financial), as forecasted by 25 analysts, presents an average one-year price target of $10.04. Price targets range from a high estimate of $15.50 to a low of $8.00. This average target suggests a potential upside of 1.26% from the current trading price of $9.92. For further details, investors can visit the Ford Motor Co (F) Forecast page.

Brokerage Firm Recommendations

Ford's current average brokerage recommendation stands at 3.0, based on consensus from 27 brokerage firms, indicating a "Hold" status. The recommendation scale spans from 1 (Strong Buy) to 5 (Sell).

GF Value Outlook

GuruFocus provides an insightful estimate on Ford's potential with a GF Value of $12.40 in the coming year, reflecting a significant upside potential of 25% from the current price of $9.92. The GF Value represents an estimate of the fair trading value of the stock, derived from historical trading multiples, past growth trends, and forward-looking business performance estimates. More comprehensive insights are available on the Ford Motor Co (F, Financial) Summary page.