Summary:

- Jefferies downgrades airline stocks amid declining consumer confidence and revenue growth.

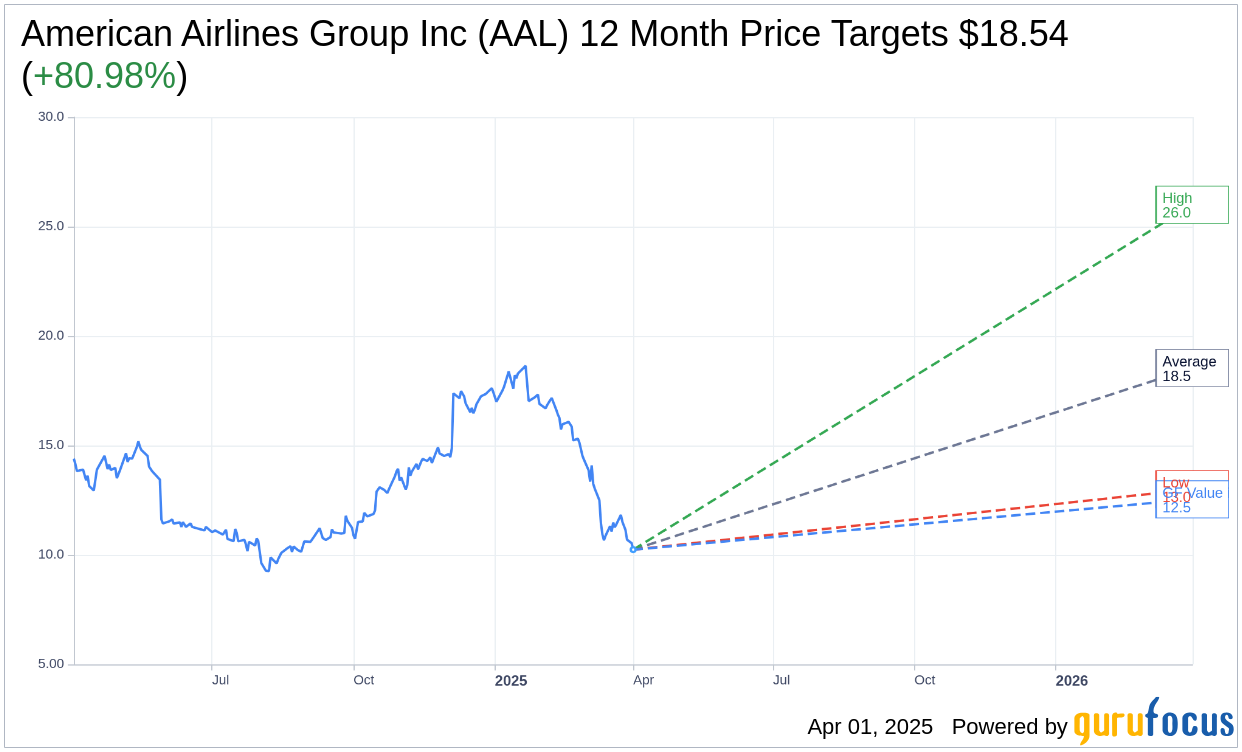

- American Airlines (AAL, Financial) shows potential with an 80.98% upside, according to analyst targets.

- United Airlines remains the only Buy-rated stock, with promising prospects post-2025.

Jefferies Signals Caution in Airline Stocks

Jefferies has issued a cautionary note on several major airline stocks. American Airlines (AAL) and Delta Air Lines (DAL) have faced downgrades to "Hold" due to waning consumer confidence and a deceleration in revenue growth. Meanwhile, Air Canada and Southwest Airlines are pegged as "Underperform." Despite these industry hurdles, United Airlines stands out as the sole Buy-rated stock, with bullish expectations reaching beyond 2025. The firm's analysis indicates a downturn in domestic travel, stressing that any revenue decline could sharply impact future earnings per share (EPS) projections.

Wall Street Analysts Forecast

Turning to price predictions, a collective of 19 analysts has set a one-year price target for American Airlines Group Inc (AAL, Financial) at $18.54. This target ranges from a high estimate of $26.00 to a low of $13.00, suggesting a potential rise of 80.98% from its current trading price of $10.25. For a deeper dive into these projections, investors can refer to the American Airlines Group Inc (AAL) Forecast page.

Furthermore, consensus from 23 brokerage firms rates American Airlines Group Inc's (AAL, Financial) average brokerage recommendation at 2.2, denoting an "Outperform" status. This rating scale spans from 1, indicating a Strong Buy, to 5, suggesting a Sell.

According to GuruFocus metrics, the projected GF Value for American Airlines Group Inc (AAL, Financial) in the next year is $12.54. This value implies an upside of 22.4% from the present price of $10.245. The GF Value signifies GuruFocus' calculated fair market value for the stock, derived from historical trading multiples, past business growth, and future business performance estimates. For further detailed insights, visit the American Airlines Group Inc (AAL) Summary page.