Summary:

- PVH Corp's stock surged 18.10% following an optimistic full-year 2025 outlook.

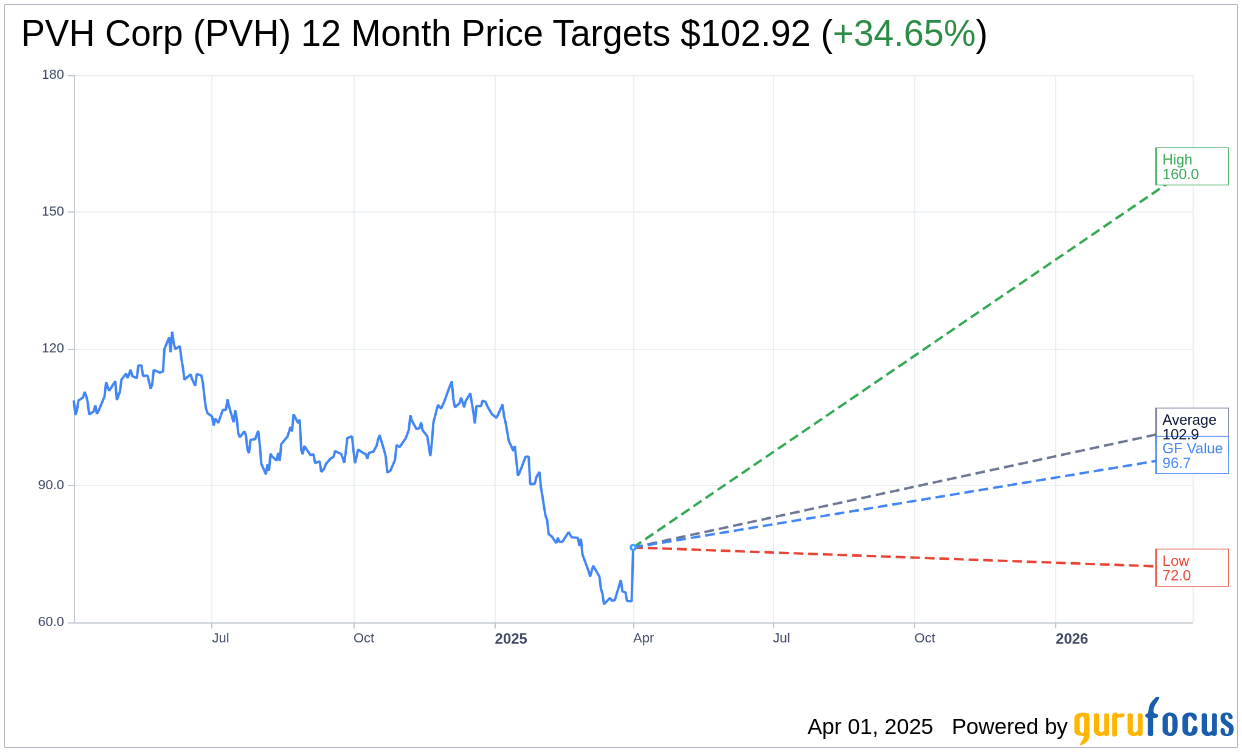

- Analysts project a potential 34.65% upside, with average price targets significantly higher than the current value.

- Despite challenges, PVH's strategic initiatives in cost control and licensing are seen as pivotal growth drivers.

PVH Corp (PVH, Financial) experienced a significant boost as its stock climbed 18.10%, closing at $76.34. This marks its highest level in the past month, fueled by a promising full-year 2025 forecast. Investors are optimistic despite certain hurdles, such as a dip in fourth-quarter sales and concerns surrounding Calvin Klein's profit margins. CEO Stefan Larsson emphasized the importance of stringent cost control measures and the progressing global licensing initiatives as pillars for future growth, even amidst geopolitical tensions in China.

Wall Street Analysts Forecast

According to data from 12 analysts, the average one-year price target for PVH Corp (PVH, Financial) stands at $102.92. Estimates range from a high of $160.00 to a low of $72.00, suggesting a potential upside of 34.65% from the current share price of $76.34. Investors can explore more detailed estimates on the PVH Corp (PVH) Forecast page.

The average brokerage recommendation, derived from 14 firms, rates PVH Corp (PVH, Financial) at 2.4, which corresponds to an "Outperform" status. This rating uses a scale from 1 to 5, where 1 indicates a Strong Buy, and 5 suggests a Sell recommendation.

In terms of valuation metrics, GuruFocus estimates that PVH Corp (PVH, Financial)'s GF Value for the upcoming year is $96.72. This indicates a forecasted upside of 26.55% from the current price point of $76.43. The GF Value represents GuruFocus' fair value estimation, calculated using historical trading multiples, past business growth, and future performance projections. For a more comprehensive analysis, visit the PVH Corp (PVH) Summary page.