Quick Takeaways:

- Hesai Group (HSAI, Financial) has released its comprehensive annual report for the fiscal year ending December 31, 2024.

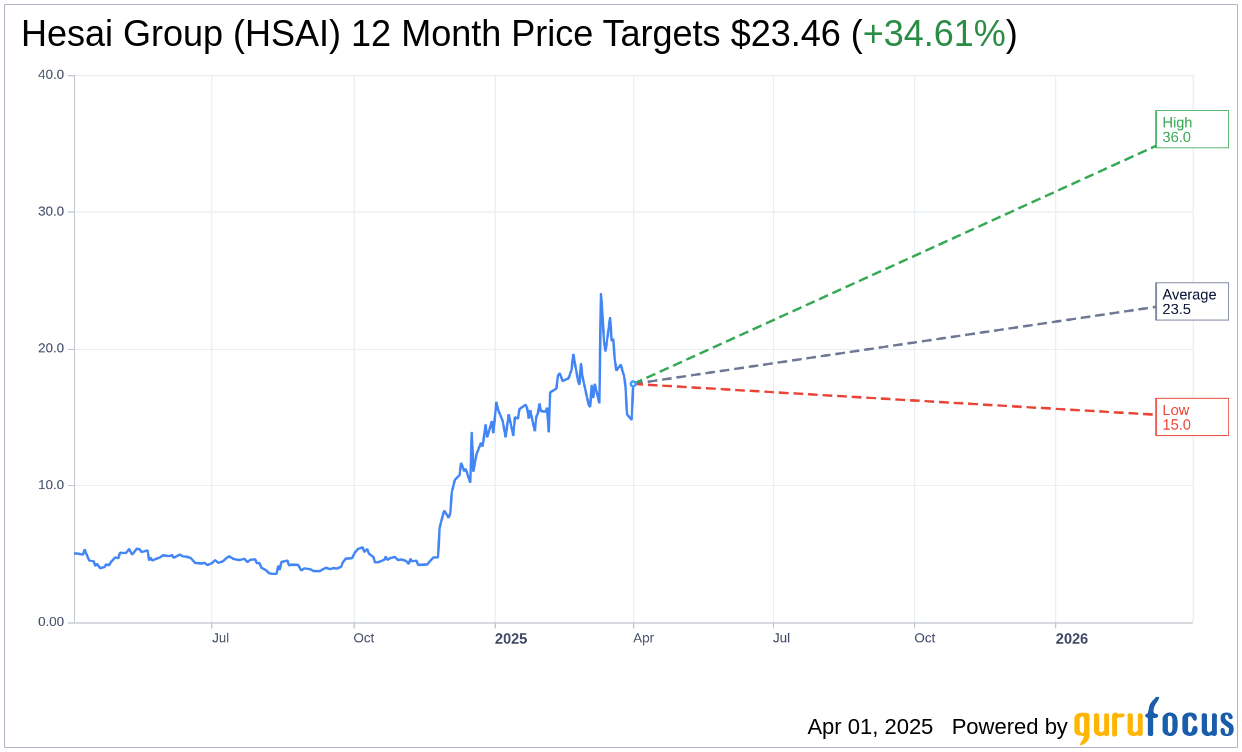

- Analysts have set an average price target of $23.46, suggesting significant upside potential.

- The company maintains an "Outperform" consensus amongst brokerage firms.

Hesai Group's Annual Report Highlights

Hesai Group (HSAI), a leader in lidar technology, has recently submitted its annual report for the fiscal year concluding on December 31, 2024, to the U.S. Securities and Exchange Commission. This crucial document, brimming with audited financial statements, is accessible via both the SEC's and Hesai's investor relations websites. The company also extends the convenience of providing complimentary printed copies of the report to shareholders and American depositary share holders upon request, ensuring transparency and accessibility.

Wall Street Analysts' Price Predictions

Delving into Wall Street's perspective, 11 reputable analysts have projected a one-year average price target for Hesai Group (HSAI, Financial) at $23.46. This projection ranges from a high estimate of $36.05 to a low of $15.02, indicating a promising upside potential of 34.61% from the current trading price of $17.43. Investors seeking more detailed predictions and analysis can refer to the Hesai Group (HSAI) Forecast page.

Brokerage Firms' Consensus

Hesai Group's (HSAI, Financial) market performance is bolstered by a consensus recommendation from 13 brokerage firms, resulting in an average brokerage recommendation of 1.7. This positions Hesai in the "Outperform" category. The rating scale spans from 1 to 5, with 1 reflecting a Strong Buy and 5 a Sell recommendation, underscoring the positive sentiment surrounding Hesai's stock potential.

Hesai Group’s strategic positioning within the lidar technology sector, combined with robust analyst support, paints a promising picture for potential investors looking to capitalize on growth opportunities. As the company continues to innovate and expand its market presence, maintaining close surveillance on analyst forecasts and market conditions will be essential for making informed investment decisions.