Battalion Oil Corp (BATL, Financial) released its 8-K filing on March 31, 2025, detailing its financial and operational performance for the fourth quarter of 2024. Battalion Oil Corp is an independent oil and gas producer operating exclusively in the Delaware Basin, focusing on the acquisition, production, exploration, and development of onshore liquids-rich oil and natural gas assets in the United States.

Performance Overview

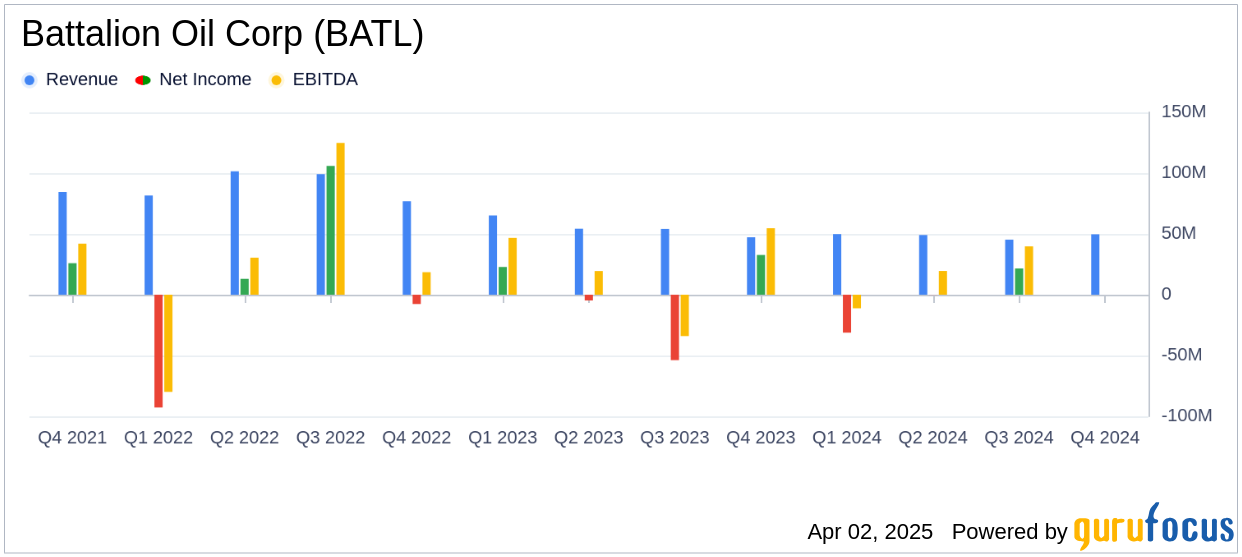

The company reported average daily net production of 12,750 barrels of oil equivalent per day (Boe/d), with 55% of this production being oil. This marks an increase from the 12,022 Boe/d (46% oil) reported in the fourth quarter of 2023. Total operating revenue for the quarter was $49.7 million, up from $47.2 million in the same period the previous year. The revenue increase was primarily driven by higher production volumes, despite a $0.22 decrease in average realized prices.

Financial Achievements and Challenges

One of the significant achievements for Battalion Oil Corp was the completion of its refinancing of the term loan on favorable terms, which enhanced liquidity. The company also successfully reduced capital expenditure per well, outperforming AFE estimates. However, the company reported a net loss available to common stockholders of $30.9 million, translating to a net loss of $1.88 per share. After adjustments, the diluted net loss was $0.04 per share.

Operational Highlights

The company completed its 2024 six-well campaign ahead of schedule and under budget, with wells producing ahead of type curve expectations. The acid gas injection (AGI) facility treated approximately 20 MMcf/d of gas, returning 16 MMcf/d of sweet gas for sales, resulting in substantial savings compared to alternative treatments.

Income Statement and Balance Sheet Insights

Lease operating and workover expenses decreased to $11.26 per Boe from $11.87 per Boe year-over-year, attributed to increased production. Gathering and other expenses also saw a reduction to $10.45 per Boe from $13.31 per Boe, primarily due to the AGI facility's startup. General and administrative expenses rose to $6.04 per Boe, mainly due to increased audit, legal, and transaction costs related to a terminated merger.

Liquidity and Debt Management

As of December 31, 2024, Battalion Oil Corp had $162.1 million in outstanding debt, with total liquidity of $19.7 million. The company incurred additional term loans amounting to $63.0 million in January 2025, increasing liquidity by $61.3 million. The refinancing of the term loan agreement is expected to provide financial stability and flexibility moving forward.

Conclusion

Battalion Oil Corp's fourth quarter results reflect a strategic focus on increasing production efficiency and managing costs effectively. Despite the reported net loss, the company's operational achievements and improved liquidity position it well for future growth in the competitive oil and gas industry.

Explore the complete 8-K earnings release (here) from Battalion Oil Corp for further details.