- AGNC Investment (AGNC, Financial) offers a notable 14% dividend yield but may underperform compared to industrial property REITs like Prologis and Rexford.

- Prologis and Rexford are positioned for growth with strategic expansions and lease renewals.

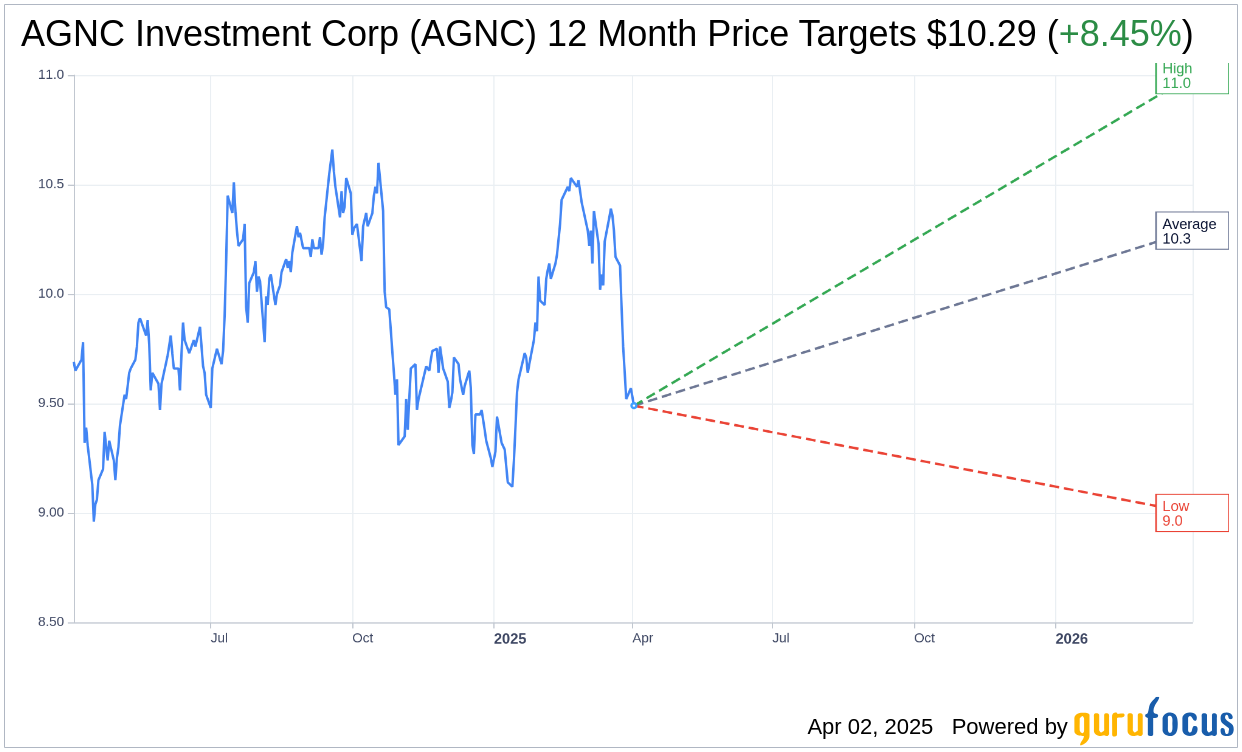

- Analyst forecasts suggest an 8.45% upside potential for AGNC, yet growth remains a challenge.

AGNC Investment Corp. (AGNC) stands out in the mortgage REIT sector, primarily due to its substantial dividend yield of 14%. However, investors should be aware that despite this attractive yield, AGNC might lag behind property-focused REITs such as Prologis and Rexford over the coming decade. Both Prologis and Rexford focus on industrial properties and are strategically expanding and renewing leases, which positions them for promising growth, even with dividend yields lower than AGNC's.

Wall Street Analysts Forecast

According to the latest data from 12 analysts, the average price target for AGNC Investment Corp. (AGNC, Financial) is set at $10.29. This estimate encompasses a high forecast of $11.00 and a low forecast of $9.00. The average price target indicates a potential upside of 8.45% from the current trading price of $9.49. For a more in-depth analysis, investors can explore further details on the AGNC Investment Corp (AGNC) Forecast page.

The consensus recommendation from 15 brokerage firms places AGNC Investment Corp. (AGNC, Financial) with an average brokerage recommendation of 2.2, categorizing it as "Outperform." This rating scale ranges from 1 to 5, where a rating of 1 suggests a Strong Buy, while a rating of 5 indicates a Sell. Investors monitoring AGNC should consider these recommendations when evaluating their investment strategies.