EQT Corp (EQT, Financial), a long-standing player in the Oil & Gas industry, has built a solid reputation over the years. Recently, the company experienced a daily gain of 1.48% and a three-month change of 15.81%. However, fresh insights from the GF Score suggest potential challenges ahead. The company's lower rankings in financial strength, growth, and valuation indicate that it may not sustain its historical performance. In this article, we delve into these critical metrics to understand the evolving narrative of EQT Corp.

Understanding the GF Score

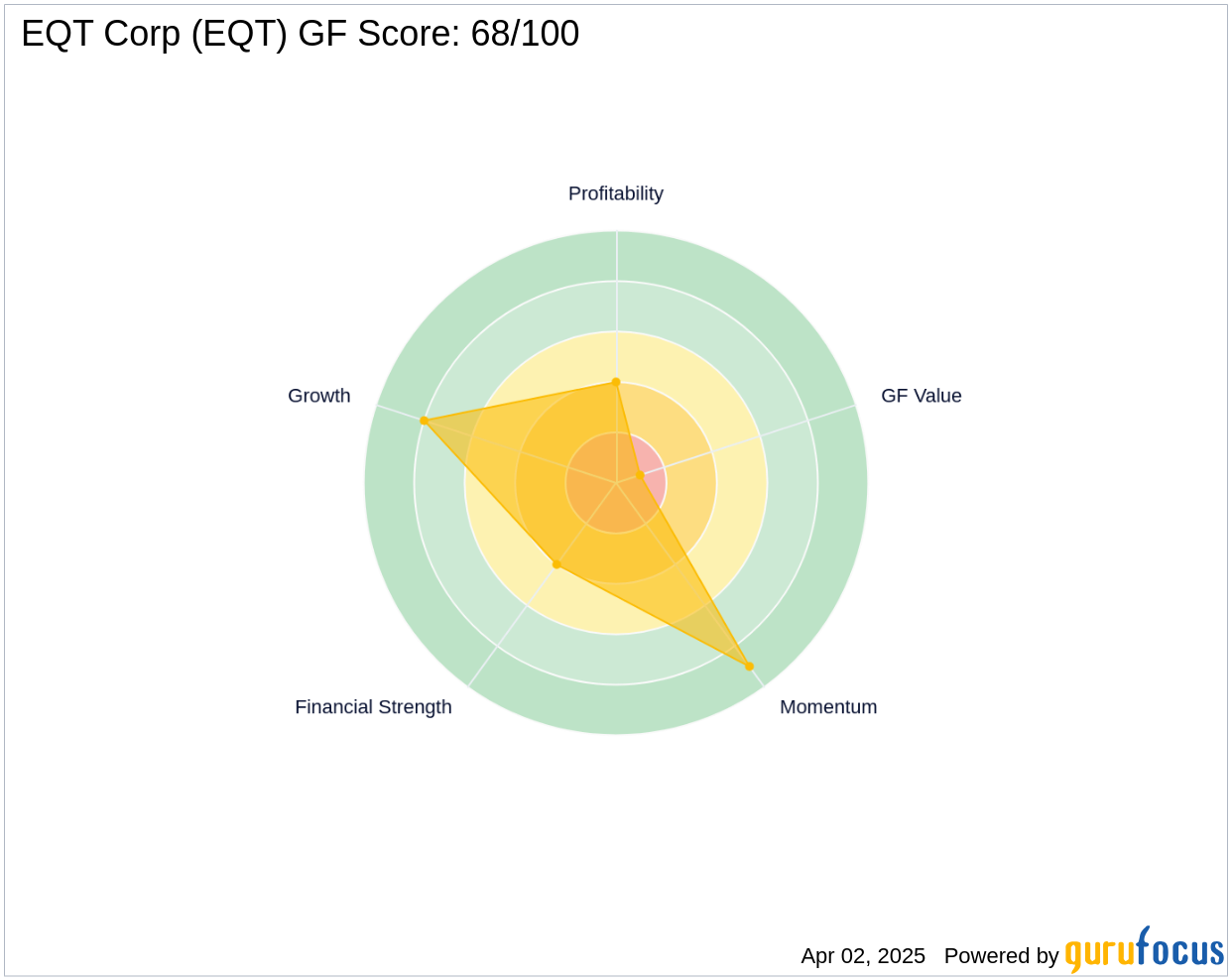

The GF Score is a stock performance ranking system developed by GuruFocus, which evaluates five aspects of valuation. This system has shown a strong correlation with long-term stock performance, as evidenced by backtesting from 2006 to 2021. Stocks with higher GF Scores tend to generate better returns than those with lower scores. The GF Score ranges from 0 to 100, with 100 being the highest rank. For EQT Corp, the GF Score is 68 out of 100, indicating a potential for underperformance in the future.

- Financial strength rank: 4/10

- Profitability rank: 4/10

- Growth rank: 8/10

- GF Value rank: 1/10

- Momentum rank: 9/10

Company Overview

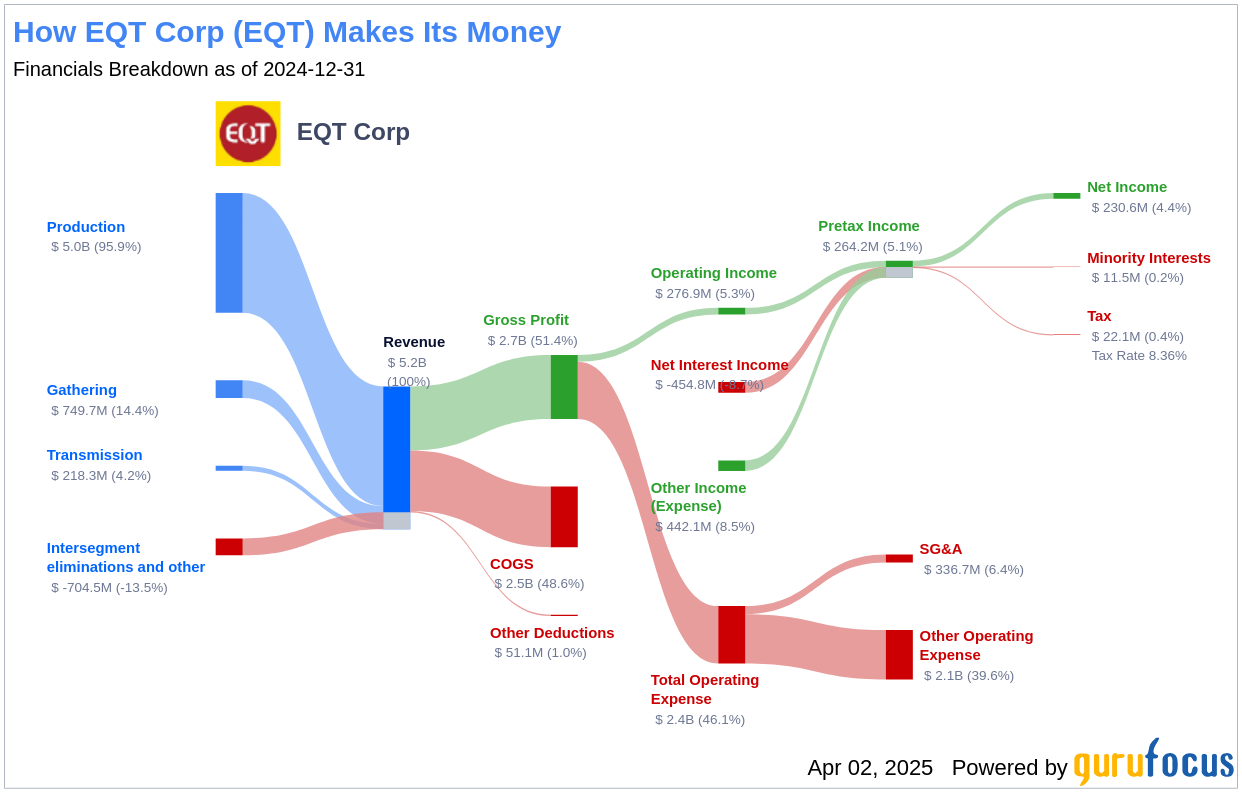

EQT Corp is an independent natural gas production company with a market capitalization of $32.665 billion and sales of $5.222 billion. The company operates primarily in the Marcellus and Utica shales within the Appalachian Basin in the Eastern United States. Its main customers include marketers, utilities, and industrial operators in the region. EQT Corp's operations are divided into three segments: production, gathering, and transmission, the latter being a joint venture with Blackstone. The company's operating margin stands at 5.3%, with all revenue generated in the U.S., primarily from the Marcellus Shale field.

Financial Strength Analysis

EQT Corp's financial strength indicators reveal some concerns regarding the company's balance sheet health. The interest coverage ratio of 0.61 places EQT Corp worse than 96.25% of 720 companies in the Oil & Gas industry, indicating potential difficulties in managing interest expenses on outstanding debt. Benjamin Graham, a renowned investor, typically preferred companies with an interest coverage ratio of at least five. Additionally, the company's Altman Z-Score of 1.5 falls below the distress zone of 1.81, suggesting possible financial distress in the coming years. The low cash-to-debt ratio of 0.02 further highlights challenges in managing existing debt levels.

Profitability Concerns

EQT Corp's low Profitability rank of 4/10 raises additional warning signals. This rank reflects the company's struggles in generating consistent profits, which could impact its ability to reinvest in growth opportunities and maintain competitive advantages. Investors should closely monitor the company's profitability metrics to assess its long-term viability and potential for improvement.

Conclusion

In conclusion, EQT Corp's financial strength, profitability, and growth metrics, as highlighted by the GF Score, suggest a challenging road ahead. The company's low rankings in key areas indicate potential underperformance, making it crucial for investors to consider these factors when evaluating EQT Corp's future prospects. For those seeking companies with strong GF Scores, GuruFocus Premium members can explore more options using the GF Score Screen.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.