Key Takeaways:

- TTEC Holdings (TTEC, Financial) shares jumped 34.9% due to CEO Kenneth Tuchman's buyout proposal.

- Grifols (GRFS) increased by 12.5% as Brookfield reignited takeover discussions.

- nCino (NCNO) fell 31.7% following disappointing earnings and guidance.

TTEC Holdings Surge: Analyzing the Buyout Buzz

On Wednesday, shares of TTEC Holdings (NASDAQ: TTEC) surged 34.9% as excitement brewed over ongoing discussions with CEO Kenneth Tuchman. The CEO has proposed acquiring the remaining shares at a price of $6.85 each, stirring interest among investors. This move indicates confidence in the company's future prospects and has generated significant market interest.

Grifols Rallies as Brookfield Reopens Talks

Meanwhile, Grifols (NASDAQ: GRFS) saw its shares climb 12.5%. This uptick followed the news that Brookfield Asset Management has revived takeover talks with a sizable €7 billion bid. The potential acquisition by such a prominent firm suggests confidence in Grifols’ market position and future growth potential.

nCino's Decline: Weighing Disappointing Guidance

In contrast, nCino (NASDAQ: NCNO) experienced a significant 31.7% drop. The decline came after the company released lower-than-expected guidance for its Q1 and FY2026 performance. Despite announcing a $100 million stock repurchase program, the market reacted negatively to nCino's underwhelming Q4 results, leading to a sharp decline in share value.

Wall Street Expectations for TTEC Holdings

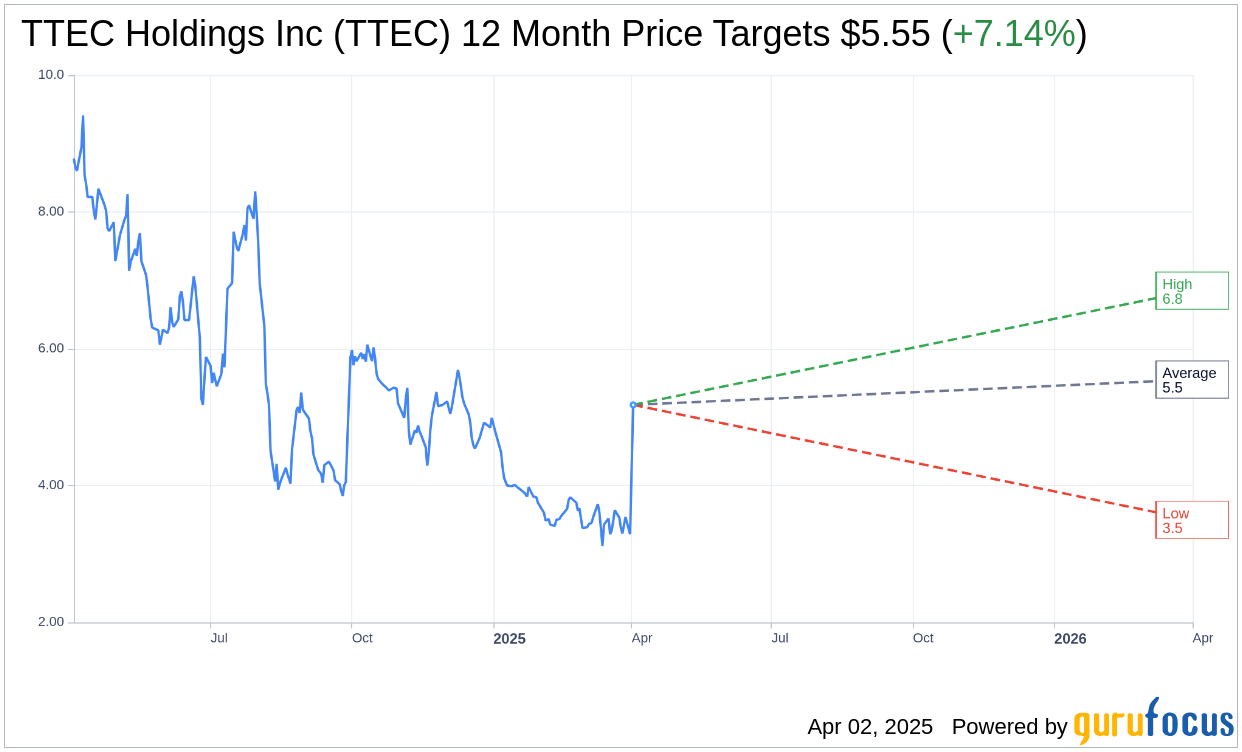

According to the consensus of four Wall Street analysts, the average price target for TTEC Holdings Inc (TTEC, Financial) over the next year is $5.55. This reflects a range with a high of $6.85 and a low of $3.50, suggesting a potential upside of 7.14% from the current market price of $5.18. Investors looking for more detailed data can explore the TTEC Holdings Inc (TTEC) Forecast page.

Brokerage Recommendations and GuruFocus Insights

Based on insights from six brokerage firms, TTEC Holdings Inc garners an average recommendation rating of 2.3, placing it in the "Outperform" category. The rating scale runs from 1 (Strong Buy) to 5 (Sell), indicating bullish sentiment.

From a valuation standpoint, GuruFocus's estimated GF Value for TTEC Holdings Inc predicts a stock value of $23.63 in one year. This estimation signals a substantial upside of 356.18% from the current price of $5.18. This GF Value estimate takes into account the stock's historical trading multiples, past business growth, and future performance expectations. For a comprehensive analysis, visit the TTEC Holdings Inc (TTEC, Financial) Summary page.