Summary:

- Amazon (AMZN, Financial) is potentially a strong buy following its recent stock pullback.

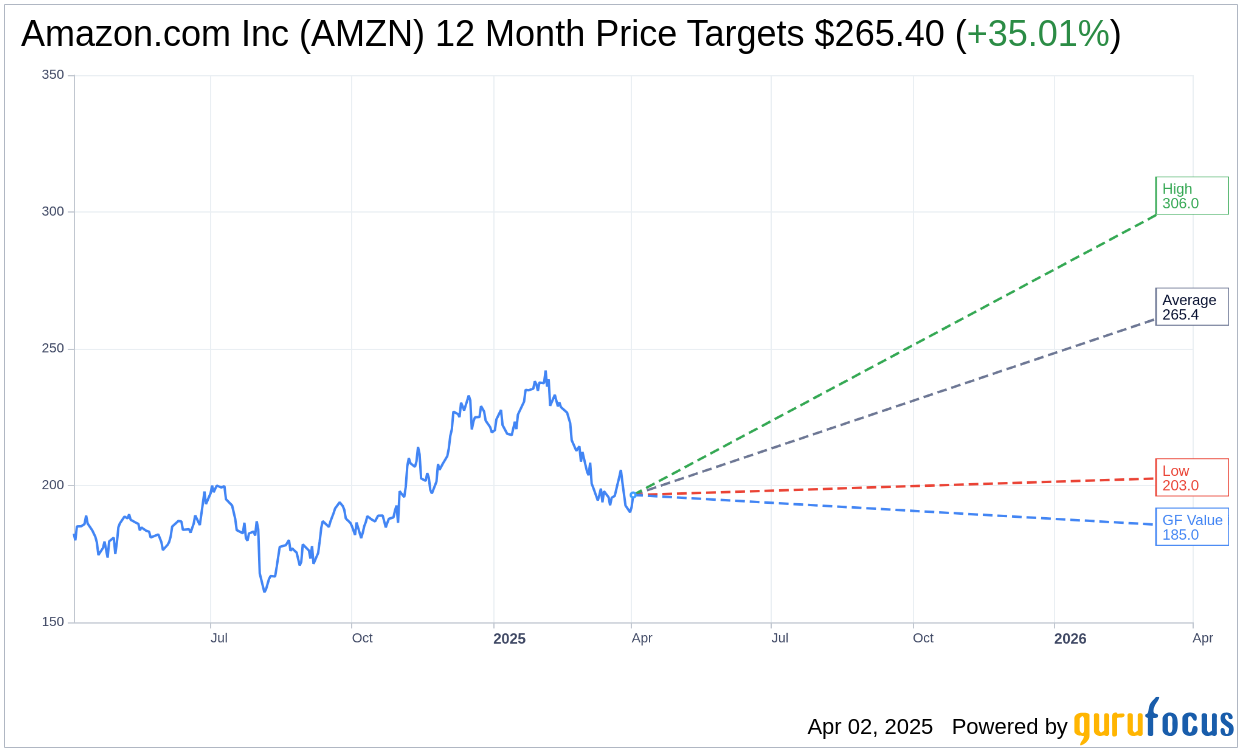

- Analysts see robust upside potential with a 35.01% increase from the current price.

- Despite challenges, Amazon's strategic strengths keep it competitive in the e-commerce space.

Amazon (AMZN) stock has recently caught the attention of investors, as its price pullback makes it a potentially lucrative buy. The company’s recent Spring Sale has reportedly garnered significant consumer interest, which could positively impact its first-quarter results. While Amazon's e-commerce division has encountered some hurdles in gaining momentum, the company remains a formidable player, thanks in part to its Prime program and swift delivery services. Although it has faced minor setbacks, Amazon's execution has improved, helping it maintain a strong market position.

Wall Street Analysts' Price Outlook

Amazon.com Inc (AMZN, Financial) is anticipated to see substantial growth according to 67 Wall Street analysts. They have set an average one-year price target of $265.40, with estimates ranging from a high of $306.00 to a low of $203.00. This average prediction suggests a potential upside of 35.01% from the current price of $196.58. For a deeper look into Amazon's projected stock movement, visit the Amazon.com Inc (AMZN) Forecast page.

Analyst Recommendations and GF Value Metrics

Amazon.com Inc (AMZN, Financial) holds an "Outperform" average brokerage recommendation of 1.8 based on the consensus from 72 brokerage firms. This rating falls on a scale from 1 to 5, where 1 represents a Strong Buy, and 5 signifies a Sell. This indicates confidence from analysts in Amazon’s potential to perform well in the market.

In terms of valuation, the GF Value suggests a one-year estimate of $184.96 for Amazon.com Inc (AMZN, Financial), implying a downside potential of 5.91% from the current trading price of $196.58. The GF Value is GuruFocus' assessment of the stock's fair trading value, based on its historical trading multiples, past business growth, and future performance estimates. For comprehensive data, refer to the Amazon.com Inc (AMZN) Summary page.