Investment Highlights:

- Cytokinetics (CYTK, Financial) surges nearly 10% in premarket amid competitor's trial results.

- Edgewise Therapeutics (EWTX) shares plummet despite promising results.

- Cytokinetics' leading drug, aficamten, awaits critical FDA decision by September 2025.

Cytokinetics (CYTK) experienced a significant surge of nearly 10% in premarket trading. This uptick follows Edgewise Therapeutics' (EWTX) release of mixed Phase 2 trial results for its HCM therapy, EDG-7500. While Edgewise demonstrated notable improvements in patients suffering from obstructive HCM, its stock took a hit, plummeting 25% due to the trial conclusion and an immediate $200 million fundraising initiative. Investors now turn their attention to Cytokinetics, which is waiting on a pivotal FDA decision regarding its leading HCM drug, aficamten, anticipated by September 2025.

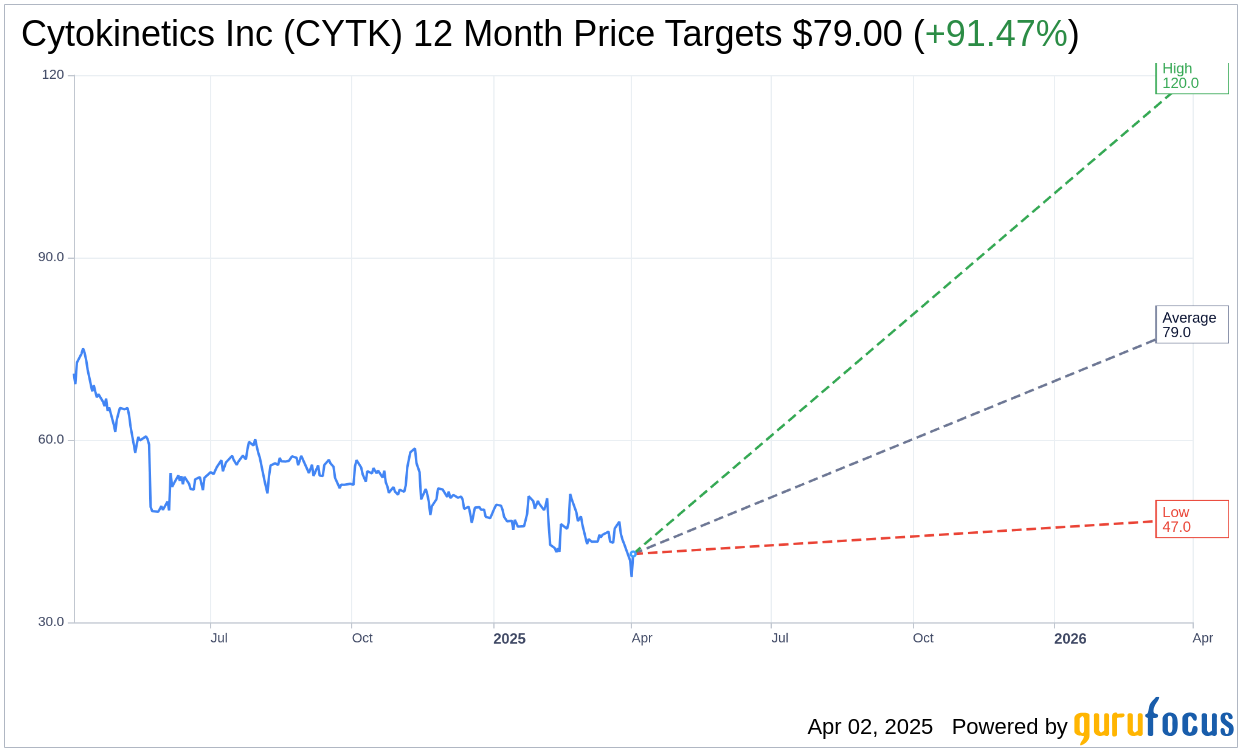

Wall Street Analysts' Forecast

The one-year price targets from 19 analysts suggest an average target price for Cytokinetics Inc (CYTK, Financial) at $79.00, with projections ranging from a high of $120.00 to a low of $47.00. This average implies a potential upside of 91.47% from the current price of $41.26. For a more comprehensive analysis, visit the Cytokinetics Inc (CYTK) Forecast page.

Consensus from 21 brokerage firms indicates that Cytokinetics Inc's (CYTK, Financial) average brokerage recommendation stands at 1.9, indicating an "Outperform" status. This rating scale ranges from 1 to 5, with 1 representing a Strong Buy and 5 indicating a Sell.

GuruFocus Perspective on GF Value

According to GuruFocus estimates, the GF Value for Cytokinetics Inc (CYTK, Financial) in one year is predicted to be $217.59. This suggests a remarkable upside of 427.36% from the current price of $41.26. The GF Value reflects GuruFocus' evaluation of the fair market price at which the stock should trade, calculated based on historical trading multiples, past business growth, and projected future performance. For further insights, explore the Cytokinetics Inc (CYTK) Summary page.