Key Takeaways:

- Jefferies initiates coverage of CenterPoint Energy (CNP, Financial) with a "Buy" rating and a $42 price target.

- The company's substantial growth is bolstered by a massive $47.5 billion capital expenditure plan.

- Analysts have a mixed outlook, with some predicting slight downsides from current stock prices.

Jefferies Analyst Coverage on CenterPoint Energy

CenterPoint Energy (NYSE: CNP) finds itself in the spotlight as Jefferies launches coverage with an optimistic "Buy" rating and a robust price target of $42. This confidence stems from CenterPoint's consistent earnings record and the promising economic growth in Houston, particularly in energy refining and export sectors. The company's strong capital expenditure initiative, valued at $47.5 billion over the next ten years, along with its advancements in system resiliency post-Hurricane Beryl, positions it favorably for growth.

Wall Street Analysts' Forecasts

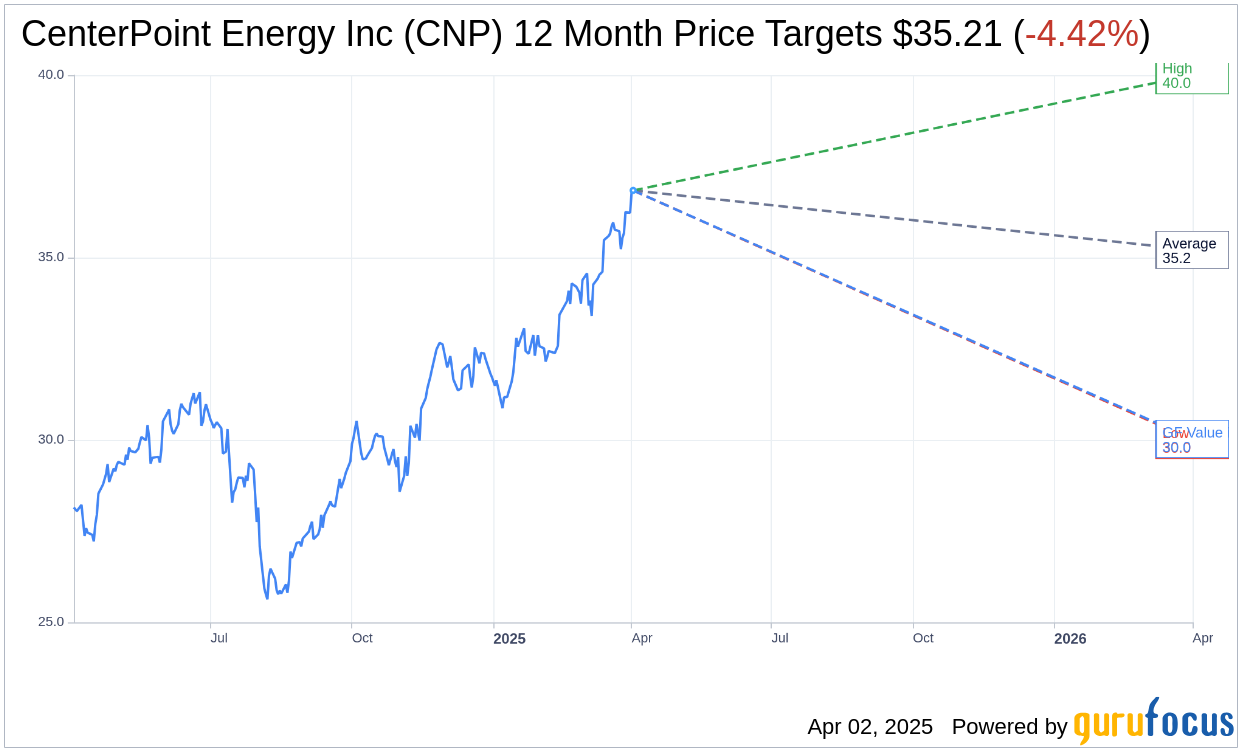

Among 14 analysts covering CenterPoint Energy Inc (CNP, Financial), the average price target is set at $35.21, with potential estimates ranging from a high of $40.00 to a low of $30.00. This average projection implies a potential downside of 4.54% from the current trading price of $36.89. Investors can explore more detailed estimates on the CenterPoint Energy Inc (CNP) Forecast page for deeper insights.

Brokerage Recommendations

The brokerage community remains cautious, with 18 firms assigning CenterPoint Energy Inc (CNP, Financial) an average recommendation of 2.6, characterizing it as a "Hold." This rating falls within a scale where 1 indicates a Strong Buy while 5 signifies a Sell.

GuruFocus GF Value Estimate

According to GuruFocus metrics, the projected GF Value for CenterPoint Energy Inc (CNP, Financial) is estimated at $30.03 in a year's time, representing a downside of 18.58% from the current price of $36.885. The GF Value metric provides a fair valuation benchmark based on historical trading multiples, business growth trends, and future performance projections. For more comprehensive data, visit the CenterPoint Energy Inc (CNP) Summary page for further analysis.