- GigaCloud Technology (GCT, Financial) expands its share buyback program to $62 million.

- Analysts predict a potential 153.73% increase in GCT stock value.

- GCT holds an "Outperform" rating from major brokerage firms.

GigaCloud Technology (GCT) has strategically enhanced its share repurchase program by adding an additional $16 million, elevating the total authorization to an impressive $62 million. This bolstered program will remain active until August 28, 2025, providing the company with a prolonged window to repurchase more shares of its Class A ordinary stock.

Analyst Projections & Insights

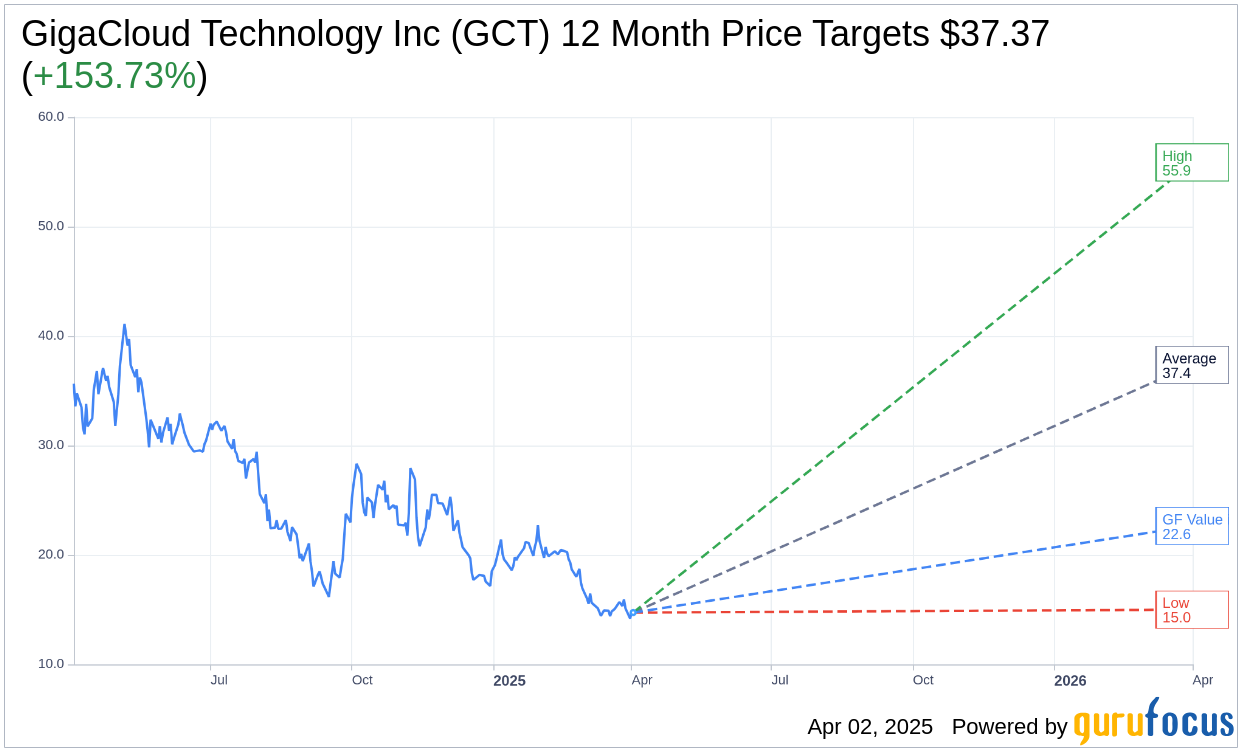

In a detailed analysis by 5 seasoned analysts, the average target price for GigaCloud Technology Inc (GCT, Financial) over the next year is projected at $37.37. Predictions range from a high of $55.87 to a lower estimate of $15.00. This average price target suggests a significant upside of 153.73% from the current trading price of $14.73. For a comprehensive view of these estimates, visit the GigaCloud Technology Inc (GCT) Forecast page.

Brokerage Firm Recommendations

GigaCloud Technology Inc's (GCT, Financial) shares are attracting positive attention, with an average brokerage recommendation score of 2.3, indicating an "Outperform" status. This rating falls within a scale where 1 denotes a Strong Buy and 5 represents a Sell recommendation, reflecting the stock's favorable outlook among 4 major brokerage firms.

Valuation Estimates

GuruFocus provides an insightful estimate of GigaCloud Technology Inc's (GCT, Financial) future value. The projected GF Value for the company in one year is pegged at $22.65. This assumption translates to a promising upside of 53.77% from the current price of $14.73. The GF Value is derived from an analysis of historical trading multiples, prior business growth metrics, and future performance forecasts. Investors can explore further data on the GigaCloud Technology Inc (GCT) Summary page.

This strategic move by GigaCloud Technology not only expands its financial flexibility but also paints a positive outlook as affirmed by analyst forecasts and brokerage firm recommendations. Investors should closely monitor these developments for future opportunities.