Advanced Micro Devices, Inc. (AMD, Financial) is demonstrating resilience with a 4.16% gain over the past month despite a challenging year with a 37.91% decline. As of April 2, 2025, AMD’s stock ended the trading session at $102.96, giving the company a market capitalization of approximately $167 billion.

Key Highlights

- AMD experienced a recent one-month gain of 4.16%, though it posted a 37.91% decline over the past year.

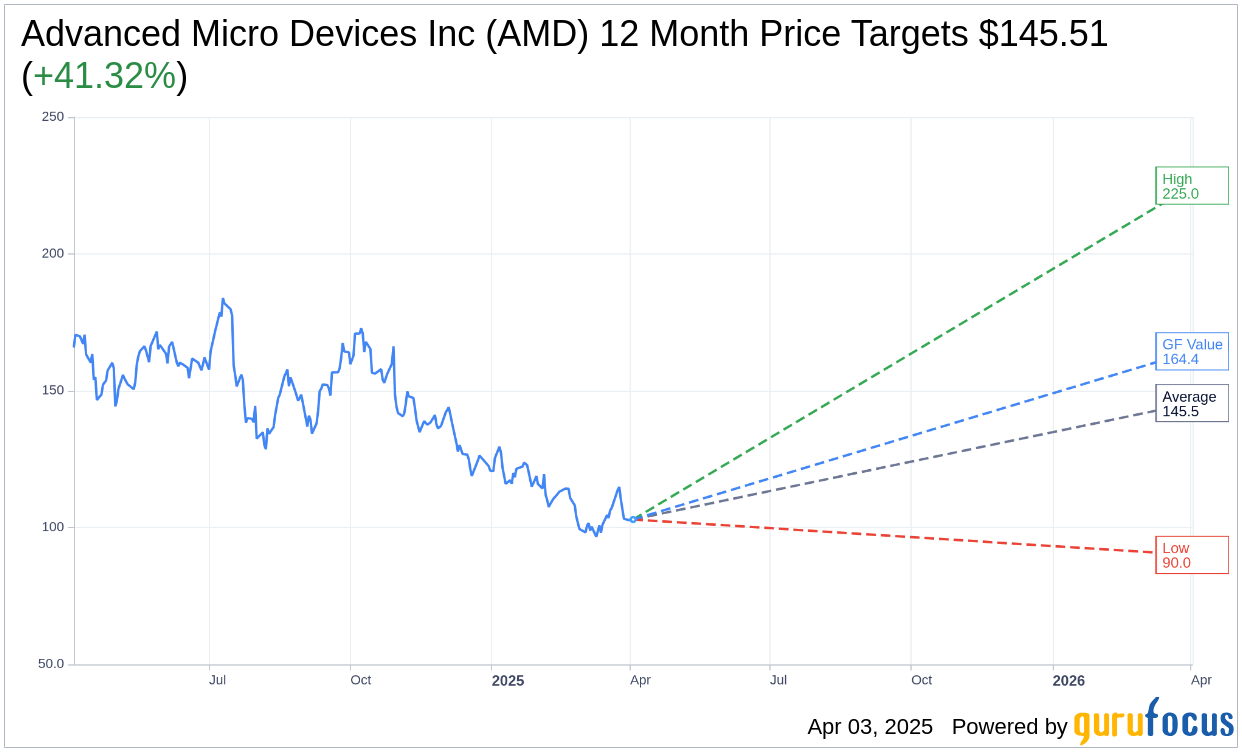

- Average analyst price target suggests a potential 41.32% upside.

- The GF Value estimate indicates a possible 59.7% increase from the current stock price.

Wall Street Analysts Forecast

According to projections from 41 analysts, the average price target for AMD is set at $145.51. This forecast includes a high target of $225.00 and a low target of $90.00. This average target suggests a 41.32% upside potential from the current trading price of $102.96. For more in-depth analysis, visit the Advanced Micro Devices Inc (AMD, Financial) Forecast page.

Brokerage Recommendations

Consensus among 50 brokerage firms positions AMD at an average recommendation of 2.2, representing an "Outperform" status. The recommendation scale spans from 1, indicating a Strong Buy, to 5, indicating a Sell.

GF Value Insights

According to GuruFocus's GF Value calculations, AMD is projected to reach an estimated value of $164.43 in one year. This reflects a substantial potential upside of 59.7% from its current price of $102.96. The GF Value metric helps gauge the fair value of a stock based on historical trading multiples, past business growth, and future performance projections. For a comprehensive overview, refer to the Advanced Micro Devices Inc (AMD, Financial) Summary page.