Key Highlights:

- Super Micro Computer Inc (SMCI, Financial) has seen an impressive 829% stock increase over the past three years.

- The company projects $24 billion in revenue for FY2025, aiming for $50 per share, potentially yielding a 40% return.

- Wall Street remains cautious, with the average analyst rating indicating a "Hold" status.

Super Micro Computer (SMCI) has been on a remarkable growth trajectory, with its stock price skyrocketing by 829% over the past three years. This surge has been fueled by increased demand in AI, cloud, and IT sectors. Despite encountering some accounting challenges in the past, the company sets its sights on ambitious targets for the future. With an anticipated revenue of $24 billion for the fiscal year 2025 and a goal of achieving $50 per share, investors could see potential returns of 40%. However, the sentiment remains cautiously optimistic as stakeholders evaluate these projections with careful scrutiny.

Wall Street Analysts' Projections

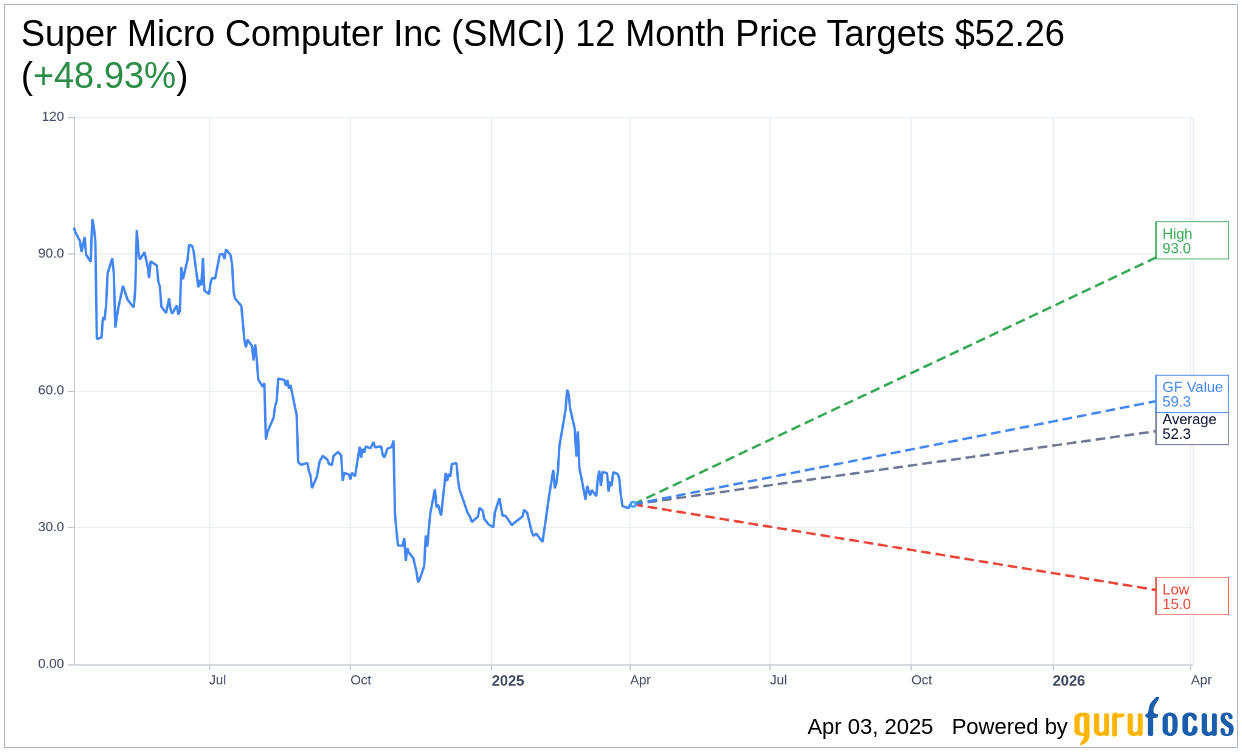

According to predictions from 12 analysts, Super Micro Computer Inc (SMCI, Financial) has an average one-year price target of $52.26. This target spans from a high estimate of $93.00 to a low estimate of $15.00. The average target suggests a promising upside of 48.93% from the current stock price of $35.09. For more detailed projections, visit the Super Micro Computer Inc (SMCI) Forecast page.

Furthermore, 14 brokerage firms have provided a consensus recommendation of 2.8 for SMCI, aligning it with a "Hold" status. This rating falls on a scale from 1 to 5, where 1 indicates a Strong Buy and 5 signifies a Sell recommendation.

GuruFocus Valuation Insights

According to GuruFocus, the estimated GF Value for Super Micro Computer Inc (SMCI, Financial) in one year is pegged at $59.31. This valuation suggests a notable upside of 69.02% from the current market price of $35.09. The GF Value represents GuruFocus's assessment of the fair trading value of the stock, calculated from historical trading multiples, alongside past business growth and future performance forecasts. Detailed data can be accessed on the Super Micro Computer Inc (SMCI) Summary page.