- Spotify introduces the Spotify Ads Exchange (SAX) to elevate its advertising platform with the power of AI.

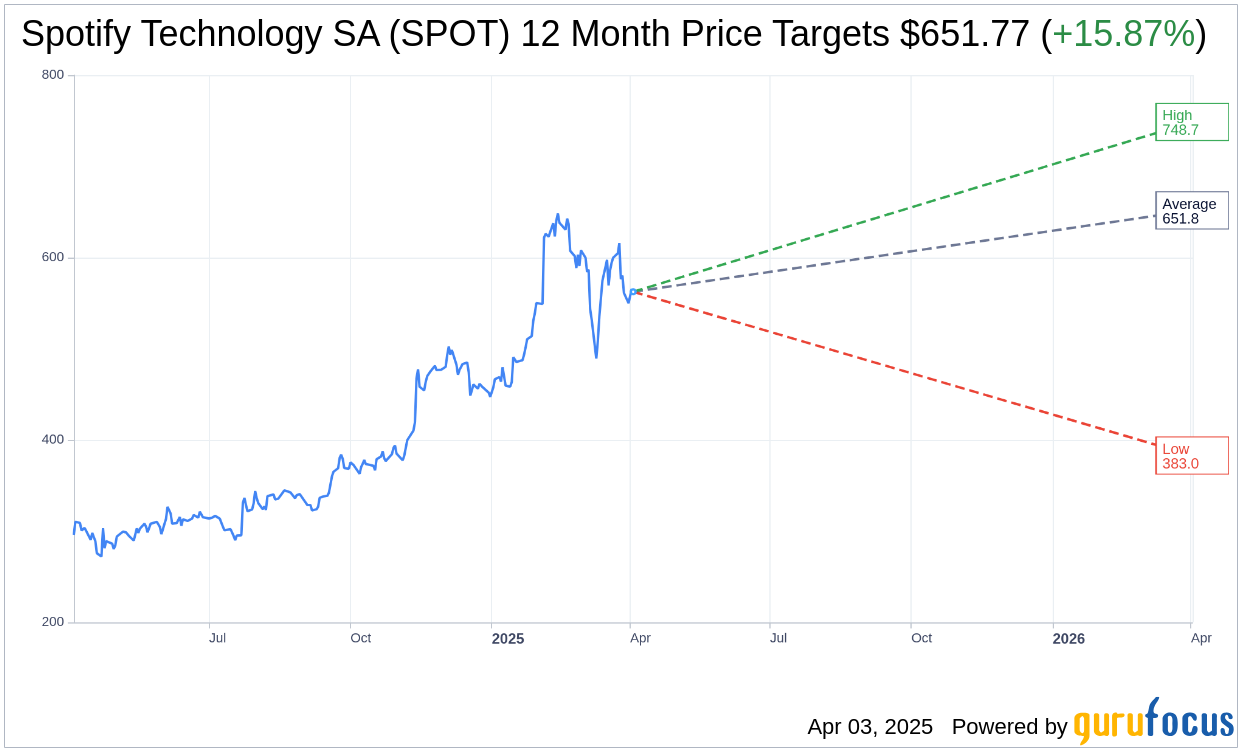

- Wall Street analysts see potential for a 15.87% upside on Spotify's stock, with an average price target of $651.77.

- GuruFocus metrics present a contrasting view with a GF Value suggesting a potential downside of 57.09%.

Spotify (NYSE: SPOT) is making strategic moves in the advertising sector by partnering with tech giants Google, Magnite, and The Trade Desk. Their collaboration has culminated in the creation of the Spotify Ads Exchange (SAX). This newly minted platform aims to bolster Spotify's market position, especially by integrating AI-driven tools that streamline ad creation. SAX is already active in several key markets, including the U.S. and Canada.

Analyst Expectations for Spotify's Stock Performance

According to projections from 35 industry analysts, Spotify Technology SA (SPOT, Financial) can anticipate an average target price of $651.77. This forecast ranges from a high of $748.70 to a low of $382.97, implying a potential upside of 15.87% relative to the current trading price of $562.49. For more comprehensive analyst data, visit the Spotify Technology SA (SPOT) Forecast page.

Brokerage Insights on Spotify's Market Position

The collective sentiment from 39 brokerage firms positions Spotify Technology SA (SPOT, Financial) at an average recommendation score of 2.2, translating to an "Outperform" status. This rating utilizes a scale from 1 to 5, where 1 equates to a Strong Buy and 5 to a Sell.

Evaluating Spotify's Intrinsic Value Using GuruFocus Metrics

Despite optimistic forecasts from Wall Street, GuruFocus offers a more conservative outlook with its estimated GF Value for Spotify Technology SA (SPOT, Financial) at $241.39. This estimation indicates a possible downside of 57.09% from the prevailing price of $562.49. The GF Value is determined through a combination of historical trading multiples, past growth trends, and future performance estimates. Detailed data is accessible via the Spotify Technology SA (SPOT) Summary page.