Key Highlights:

- Taiwan Semiconductor Manufacturing Company (TSM, Financial) projects a significant boost in AI-related revenues by 2025.

- The company's capital spending is expected to increase substantially, indicating future growth potential.

- TSMC shares have declined, presenting a potentially attractive entry point for investors.

Taiwan Semiconductor Manufacturing Company (TSM) is on the cusp of remarkable growth in AI revenue. The firm anticipates a threefold increase in 2024, followed by a doubling in 2025. In alignment with this growth, TSMC plans to augment its capital expenditures by an impressive 41%, reaching a total of $40 billion. Amid these developments, TSMC shares have seen a 24% drop from their peak, potentially offering an enticing opportunity for value-minded investors.

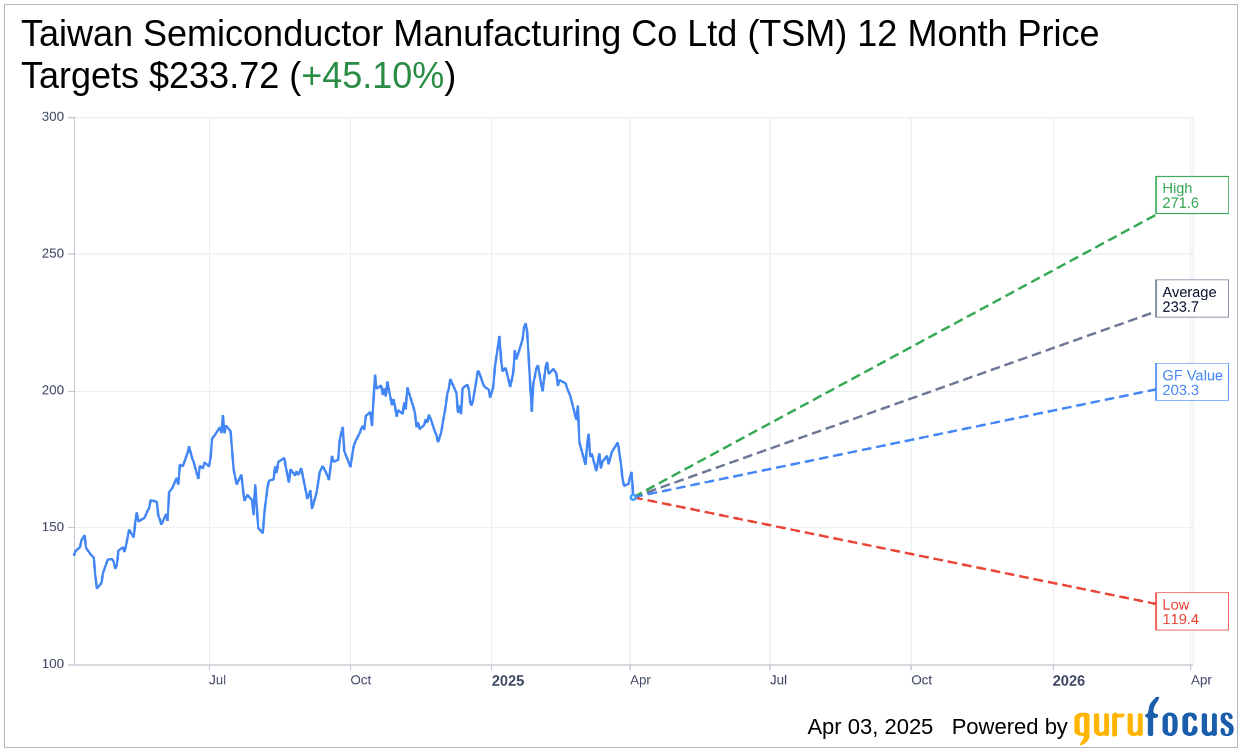

Wall Street Analysts Forecast

Wall Street analysts remain optimistic about Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial), positing an average one-year price target of $233.72. This projection is based on assessments from 16 analysts, with estimates ranging between a high of $271.55 and a low of $119.37. The average price target suggests a potential upside of 45.10% from TSM's current trading price of $161.08. For further details, investors can refer to the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

In addition, consensus from 18 brokerage firms rates TSM with an average recommendation of 1.6, denoting an "Outperform" status. This rating falls within a scale where 1 equates to a Strong Buy and 5 signifies a Sell.

Analyzing further, GuruFocus estimates posit the GF Value for TSM in one year at $203.28, indicating a 26.2% upside potential from $161.08. The GF Value is an estimation of the fair market value based on historical stock multiples, business growth patterns, and future performance forecasts. Investors seeking comprehensive insights can visit the Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) Summary page.