Key Highlights:

- Taiwan Semiconductor Manufacturing (TSM, Financial) experiences a remarkable 37% revenue growth in Q4, primarily fueled by the surging demand for AI chips.

- Wall Street analysts project substantial upside potential, with an average target price suggesting a 45.10% increase from current levels.

- TSM earns an "Outperform" rating, spotlighting its promising market position and growth expectations.

Taiwan Semiconductor Manufacturing (TSM), the leading global chip producer, witnessed a significant boost in its quarterly financials, reporting a 37% surge in revenue to $26.9 billion for the fourth quarter. This impressive growth is largely attributed to the soaring demand for AI chips, of which TSM manufactures an astounding 90% globally. Despite the tech sector's recent volatility, resulting in a broader sell-off, TSM's stock is trading at a price-to-earnings (P/E) ratio of 24.1.

Wall Street Analysts' Forecast

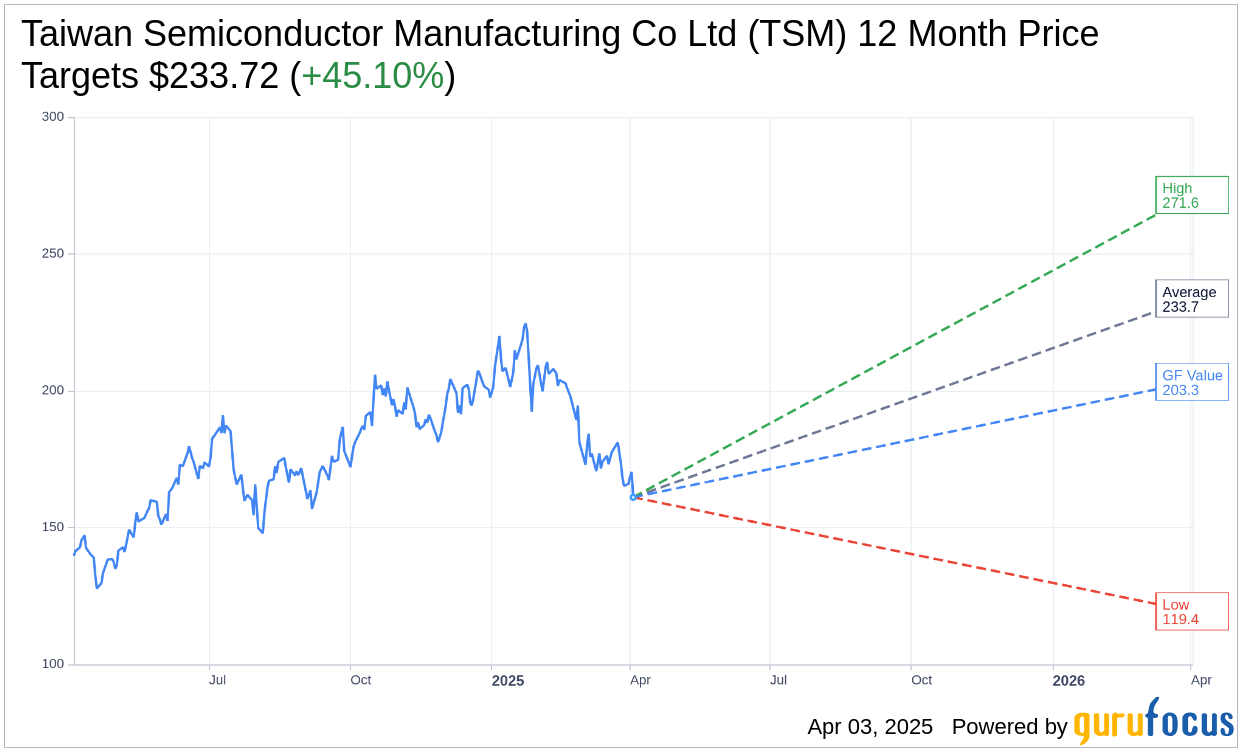

According to the one-year price targets provided by 16 analysts, the average target price for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) is set at $233.72. The price estimates range from a high of $271.55 to a low of $119.37. This average target price implies a significant upside potential of 45.10% from the current trading price of $161.08. For those interested in delving deeper into the estimates, more information is available on the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Forecast page.

The consensus recommendation from 18 brokerage firms positions Taiwan Semiconductor Manufacturing Co Ltd's (TSM, Financial) average brokerage recommendation at 1.6, categorizing it as "Outperform." The recommendation scale spans from 1 to 5, where 1 represents a Strong Buy, and 5 indicates a Sell.

In terms of valuation, the GF Value for Taiwan Semiconductor Manufacturing Co Ltd (TSM, Financial) is projected to be $203.28 in one year. This projection points to an attractive upside of 26.2% from the current stock price of $161.08. The GF Value represents GuruFocus' assessment of the stock's fair trading value, derived from historical trading multiples, past business performance, and future growth estimates. For a comprehensive analysis, please refer to the Taiwan Semiconductor Manufacturing Co Ltd (TSM) Summary page.