- Amazon introduces "Buy for Me," enhancing user shopping experience with seamless third-party transactions.

- Analysts predict a 48.51% upside in Amazon's stock price, with a high target of $306.00.

- GuruFocus' GF Value estimates an additional 3.58% growth potential.

Amazon (AMZN, Financial) is revolutionizing the way we shop with the introduction of a new feature, "Buy for Me." This beta feature enhances convenience by allowing users to make purchases from third-party websites directly through the Amazon app. Streamlining transactions within its interface, this feature is currently available to select users in the U.S., promising a more simplified shopping journey.

Wall Street Analysts Forecast

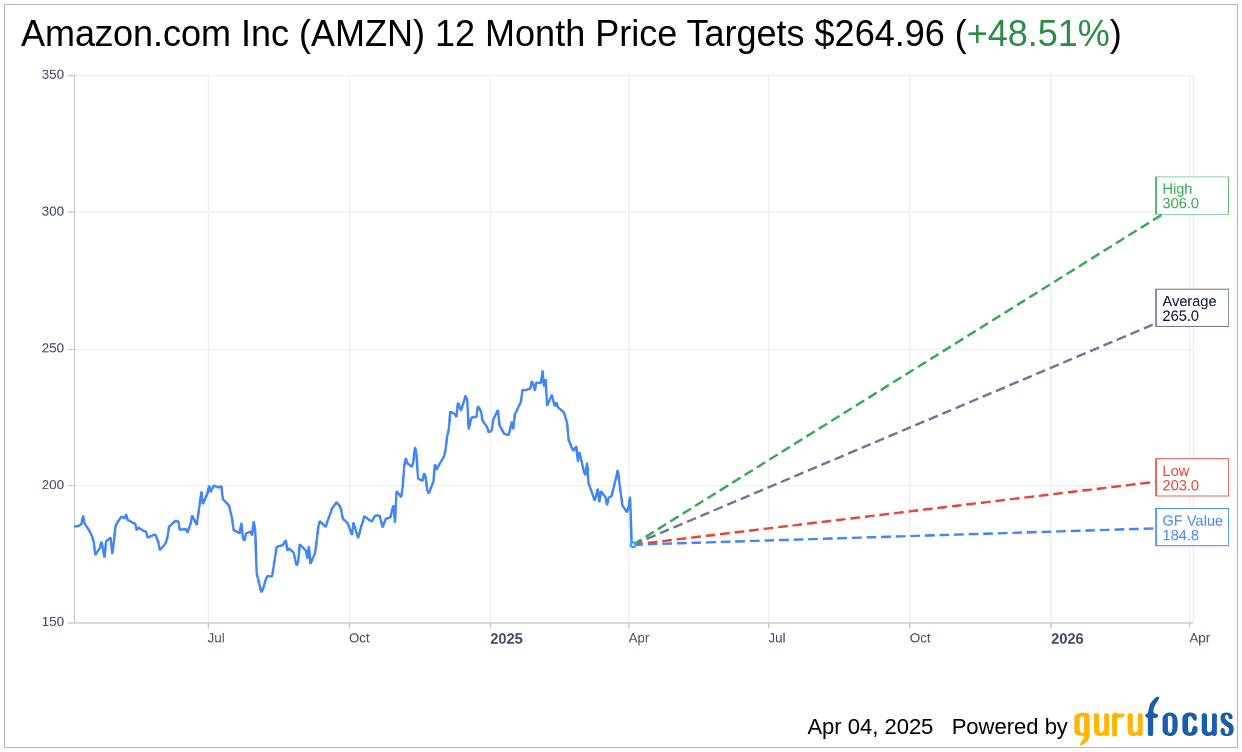

With the insights of 67 analysts, Amazon.com Inc (AMZN, Financial) is expected to see promising growth ahead. Analysts have set an average price target of $264.96, with projections ranging from a high of $306.00 to a low of $203.00. At its current market price of $178.41, the average target indicates a potential upside of 48.51%. For a more detailed insight into these projections, visit the Amazon.com Inc (AMZN) Forecast page.

Further adding to investor confidence, the consensus from 73 brokerage firms rates Amazon with an average recommendation of 1.8, equating to "Outperform." This rating is part of a scale ranging from 1 (Strong Buy) to 5 (Sell), underscoring the company's solid standing in the market.

The GF Value, a GuruFocus proprietary metric, estimates Amazon.com Inc (AMZN, Financial) to reach a value of $184.80 in one year. This suggests a modest upside of 3.58% from its current price. The GF Value assessment is grounded in the company's historical trading multiples, past growth patterns, and future business performance forecasts. For a comprehensive overview of these estimates, visit the Amazon.com Inc (AMZN) Summary page.