Summary:

- Berkshire Hathaway's investment in Jefferies Financial Group stands at $34 million.

- Jefferies is bullish on Bitcoin, investing $85 million in iShares Bitcoin Trust ETF.

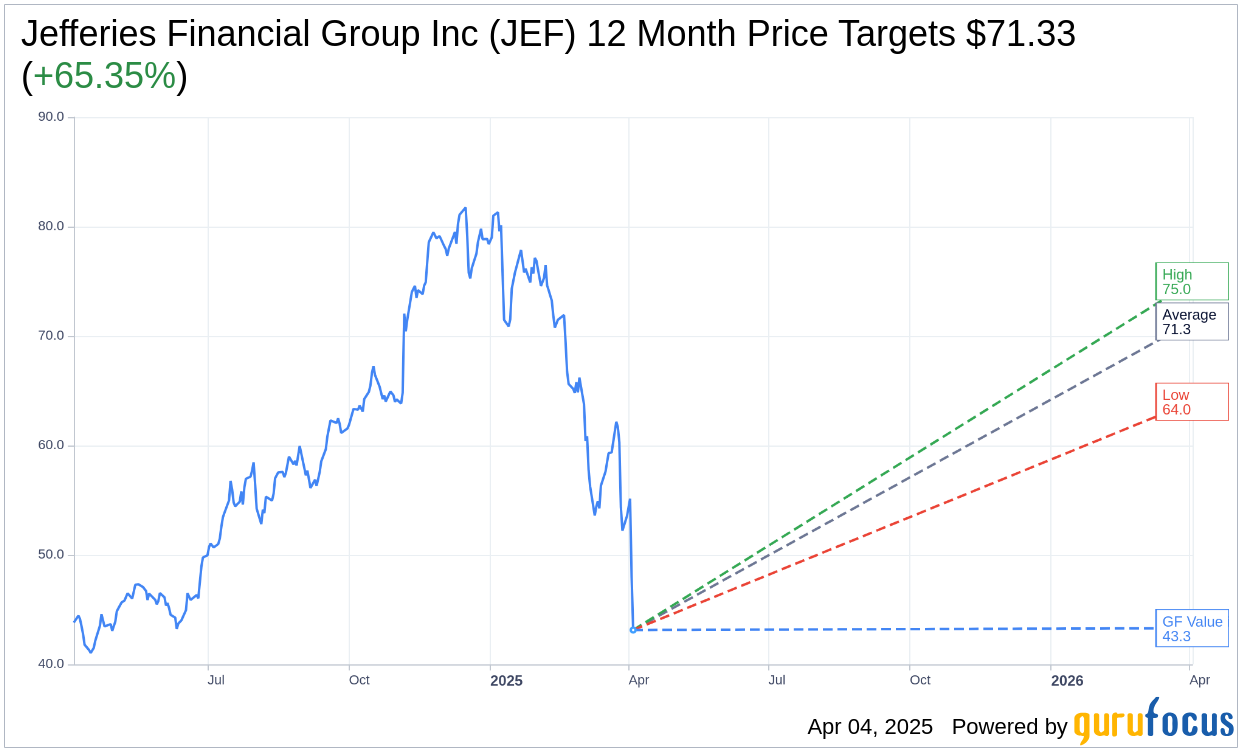

- Analysts forecast a potential 65.35% increase in Jefferies' stock price within a year.

Berkshire Hathaway Inc. (BRK) has taken a noteworthy position in Jefferies Financial Group Inc. (JEF, Financial), with its investment valued at approximately $34 million. Despite Warren Buffett (Trades, Portfolio)'s well-documented skepticism towards cryptocurrencies, Jefferies is actively promoting Bitcoin as a hedge against inflation by investing $85 million in the iShares Bitcoin Trust ETF (IBIT).

Analyst Price Target Projections

Three analysts have provided their one-year price targets for Jefferies Financial Group Inc. (JEF, Financial), presenting an average target price of $71.33. Projections vary between a high of $75.00 and a low of $64.00. This average target represents a potential upside of 65.35% from the current trading price of $43.14. For more detailed projections, visit the Jefferies Financial Group Inc (JEF) Forecast page.

Brokerage Recommendations

Consensus from five brokerage firms rates Jefferies Financial Group Inc. (JEF, Financial) with an average brokerage recommendation of 2.2, interpreted as "Outperform." The rating scale runs from 1 to 5, with 1 indicating a Strong Buy and 5 indicating a Sell.

GF Value Estimation

According to GuruFocus estimates, the projected GF Value for Jefferies Financial Group Inc. (JEF, Financial) in one year is pegged at $43.31. This suggests a marginal upside of 0.39% from its current share price of $43.14. The GF Value represents GuruFocus' fair value estimate, calculated with regard to historical stock trading multiples, past business growth trajectories, and future business performance predictions. For further detailed data, consult the Jefferies Financial Group Inc (JEF) Summary page.