- Adobe Inc. (ADBE, Financial) is a major player in the enterprise software market, leveraging a strong subscription base amid competitive pressures from AI advancements.

- Analyst consensus puts Adobe's stock on an "Outperform" path with significant upside potential based on current price targets.

- GuruFocus estimates indicate a substantial valuation growth potential for Adobe Inc. in the coming year.

Jim Cramer recently turned the spotlight on Adobe Inc. (ADBE), recognizing it as a powerhouse in the enterprise software arena. However, Adobe faces stiff competition from rising generative AI tools. Despite this competitive landscape, Cramer points out that Adobe's expansive user base and its steady stream of enterprise subscriptions provide a solid revenue foundation.

Wall Street's Take on Adobe

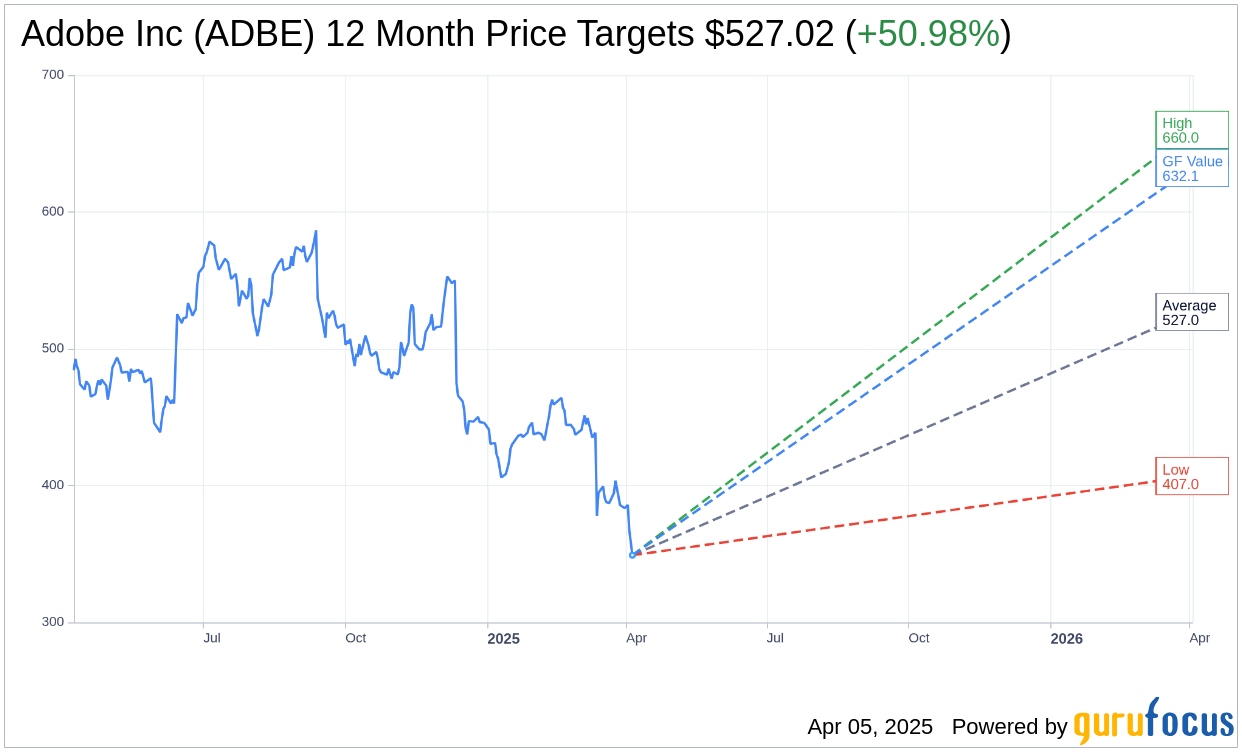

Adobe Inc. (ADBE, Financial) has caught the attention of 33 analysts, who have set a one-year average target price at $527.02. Their high estimate reaches $660.00, while the low is set at $407.00. This suggests a promising upside of 50.98% from the present stock price of $349.07. Investors seeking more detailed forecast data can explore the Adobe Inc (ADBE) Forecast page.

Across 41 brokerage firms, the consensus classifies Adobe Inc's (ADBE, Financial) average brokerage recommendation as 2.0, which translates to an "Outperform" rating. This rating system spans from 1 (Strong Buy) to 5 (Sell), positioning Adobe favorably in the analysts' evaluations.

GuruFocus Valuation Insights

According to GuruFocus estimates, Adobe Inc's (ADBE, Financial) expected GF Value for the upcoming year is pegged at $632.13. This estimate suggests a striking upside potential of 81.09% from its current trading price of $349.07. The GF Value represents GuruFocus' assessment of the stock's fair trading value, derived from historical trading multiples, past business growth, and projected future performance. For more comprehensive insights, visit the Adobe Inc (ADBE) Summary page.