Key Highlights:

- Maxeon Solar Technologies (MAXN, Financial) sees a strategic shift with a focus on the U.S. market after selling non-U.S. assets for approximately $94 million.

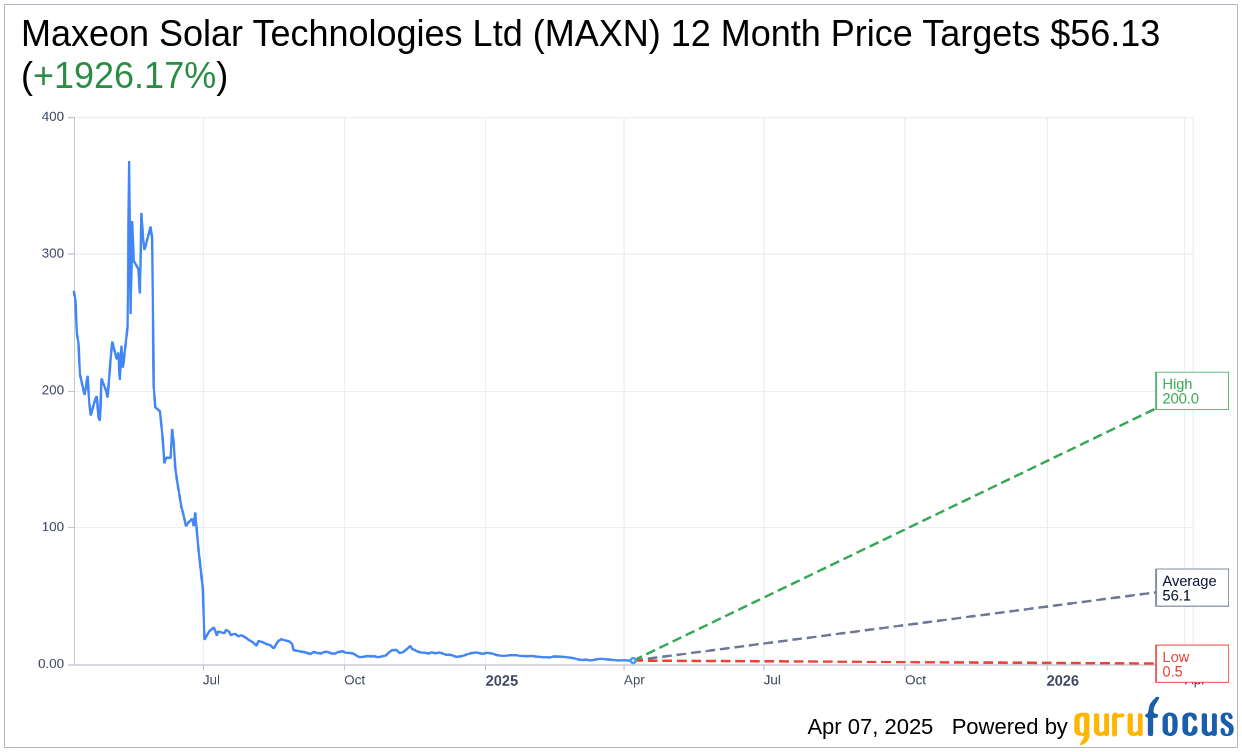

- Wall Street analysts project significant potential upside, with an average price target suggesting a 1,926.17% increase from current levels.

- GuruFocus estimates a remarkable 2,166.06% upside based on GF Value calculations.

Maxeon's Strategic Shift Amid Tariff Impacts

Maxeon Solar Technologies (NASDAQ: MAXN) is taking decisive steps to restructure its manufacturing and supply chains in response to the tariffs imposed during the Trump administration. This bold move includes the sale of non-U.S. assets, generating approximately $94 million, thereby sharpening the company's focus on maximizing its presence and operations in the U.S. market. Despite facing various challenges, Maxeon is determined to bolster its supply chain's resilience and operational efficiency.

Wall Street's Vision for Maxeon Solar

According to forecasts by four analysts, Maxeon Solar Technologies Ltd (MAXN, Financial) holds an average one-year price target of $56.13. Projections range significantly, with a high target of $200.00 and a low of $0.50. The average target suggests an impressive potential upside of 1,926.17% from its current trading price of $2.77. For more in-depth estimates, visit the detailed Maxeon Solar Technologies Ltd (MAXN) Forecast page.

Analyst Recommendations

The consensus recommendation from three brokerage firms places Maxeon Solar Technologies Ltd (MAXN, Financial) at a 3.3 rating, indicating a "Hold" status. The rating scale ranges from 1, which signifies a Strong Buy, to 5, denoting a Sell.

GuruFocus Insights on Maxeon's Future Value

At GuruFocus, the estimated GF Value for Maxeon Solar Technologies Ltd (MAXN, Financial) in one year stands at $62.77. This estimate represents an astounding potential upside of 2,166.06% from the current price of $2.77. The GF Value is a proprietary metric that calculates a stock's fair trading value. This calculation is grounded in historical trading multiples, past business growth, and future performance projections. For a deeper dive into the data, explore the Maxeon Solar Technologies Ltd (MAXN) Summary page.